Income tax is a mandatory financial charge imposed by governments on individuals and businesses based on their earnings. It plays a crucial role in funding public services, infrastructure, and social programs that benefit society. Explore the rest of this article to understand how income tax impacts your financial planning and what strategies you can use to optimize your tax liabilities.

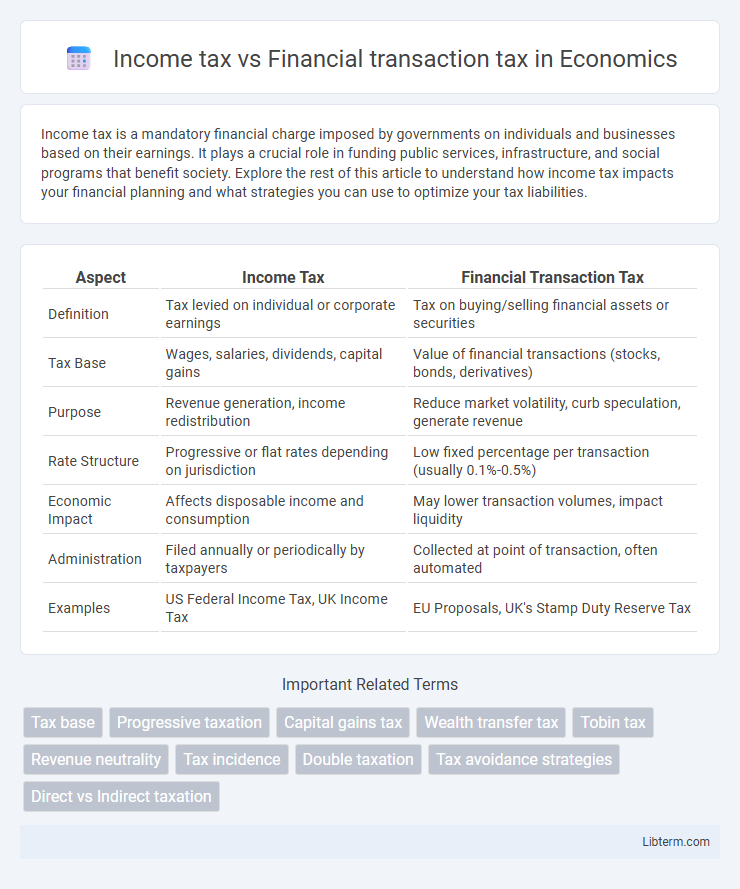

Table of Comparison

| Aspect | Income Tax | Financial Transaction Tax |

|---|---|---|

| Definition | Tax levied on individual or corporate earnings | Tax on buying/selling financial assets or securities |

| Tax Base | Wages, salaries, dividends, capital gains | Value of financial transactions (stocks, bonds, derivatives) |

| Purpose | Revenue generation, income redistribution | Reduce market volatility, curb speculation, generate revenue |

| Rate Structure | Progressive or flat rates depending on jurisdiction | Low fixed percentage per transaction (usually 0.1%-0.5%) |

| Economic Impact | Affects disposable income and consumption | May lower transaction volumes, impact liquidity |

| Administration | Filed annually or periodically by taxpayers | Collected at point of transaction, often automated |

| Examples | US Federal Income Tax, UK Income Tax | EU Proposals, UK's Stamp Duty Reserve Tax |

Introduction to Income Tax and Financial Transaction Tax

Income tax is a direct tax levied on an individual's or entity's earnings, including wages, salaries, and profits, based on specified tax brackets and rates set by the government. Financial Transaction Tax (FTT) is an indirect tax imposed on specific financial transactions such as the purchase and sale of stocks, bonds, or other financial instruments, aiming to reduce market volatility and generate revenue. While income tax targets overall earnings and wealth, FTT focuses solely on taxing the volume and value of transactions within financial markets.

Key Definitions and Concepts

Income tax is a direct tax levied on an individual's or corporation's earnings, including wages, salaries, and profits, calculated based on taxable income. Financial transaction tax (FTT) is an indirect tax imposed on specific types of financial transactions, such as the buying or selling of stocks, bonds, or derivatives, typically expressed as a percentage of the transaction value. The fundamental distinction lies in income tax targeting overall earnings, while FTT targets the volume of financial market activities.

Historical Background and Global Adoption

Income tax, rooted in ancient civilizations such as Egypt and Rome, gained formal structure during the 19th century, with modern systems established globally following World War I to fund government expenditures. Financial transaction tax (FTT) concepts date back to the 17th century in the Netherlands and Britain, primarily as stamp duties on stock trades, but widespread contemporary adoption remains limited; key implementations include the UK's Stamp Duty Reserve Tax and recent proposals in the European Union. While income tax enjoys near-universal implementation due to its role in progressive revenue generation, financial transaction taxes are selectively applied, often debated for their impact on market liquidity and financial stability.

Mechanisms of Income Tax Collection

Income tax collection relies primarily on periodic reporting of earnings by individuals and businesses through tax returns, which are then assessed by tax authorities for accuracy and compliance. Employers often implement withholding mechanisms to deduct income tax at the source before salary payment, ensuring regular revenue flow to the government. In contrast, financial transaction tax is collected automatically at the point of transaction, usually as a fixed percentage levied on the value of trades or transfers within financial markets.

How Financial Transaction Tax Works

Financial Transaction Tax (FTT) imposes a small levy on specific financial transactions such as stock trades, bond purchases, and currency exchanges, calculated as a percentage of the transaction value. Unlike Income Tax, which targets individual or corporate earnings, FTT generates revenue by taxing the volume and value of financial activities, potentially reducing market volatility and speculative trading. This tax typically applies at the point of transaction settlement, ensuring immediate collection and minimizing tax evasion opportunities.

Economic Impact Comparison

Income tax directly influences individual and corporate disposable income, affecting consumption, savings, and investment patterns essential for economic growth. Financial transaction tax (FTT) targets trading activities, potentially reducing market liquidity and increasing transaction costs, which may lead to lower trading volumes and volatility. Comparing their economic impact, income tax primarily shapes economic behavior through income redistribution and incentives, while FTT influences market efficiency and capital allocation.

Effects on Different Income Groups

Income tax imposes a progressive burden, with higher-income groups paying a larger percentage of their income, thereby directly affecting disposable income and consumption patterns across income brackets. Financial transaction tax (FTT) applies uniformly on trades, often impacting middle and lower-income investors disproportionately due to lower asset holdings and trading volumes. The combined effect of both taxes shapes economic behavior, where income tax influences earning incentives and FTT can reduce market liquidity and trading frequency among smaller investors.

Administrative Challenges and Compliance

Income tax administration requires detailed record-keeping, periodic filings, and comprehensive audits to ensure accurate reporting of income, which can be resource-intensive and prone to evasion. Financial transaction tax (FTT) faces challenges in monitoring high volumes of rapid transactions across multiple platforms, complicating enforcement and increasing compliance costs for financial institutions. Both taxes demand robust technological infrastructure and cross-jurisdictional cooperation to effectively address evasion and ensure adherence to regulations.

Revenue Generation Potential

Income tax generates substantial revenue by targeting individual and corporate earnings with progressive rates, ensuring a steady and predictable income stream for governments. Financial transaction tax (FTT) generates revenue by imposing small levies on trades of stocks, bonds, and derivatives, capturing value from high-frequency market activities. While income tax revenue tends to be more stable and significant, FTT revenue depends heavily on transaction volume and market activity levels, often resulting in a smaller but more volatile revenue source.

Policy Considerations and Future Trends

Income tax policies primarily target individual and corporate earnings, aiming to balance revenue generation with economic growth incentives, while financial transaction tax (FTT) proposals focus on curbing market volatility and speculative trading, potentially reducing systemic risk but raising concerns over liquidity and market efficiency. Future trends indicate growing interest in digital transaction taxes and harmonization of FTT across jurisdictions to prevent regulatory arbitrage, alongside ongoing debates about the equity and administrative feasibility of expanding income tax brackets or implementing progressive FTT rates. Policymakers must weigh the trade-offs between revenue stability, economic behavior influence, and compliance complexity when designing these tax frameworks.

Income tax Infographic

libterm.com

libterm.com