Installment credit allows you to borrow a fixed amount of money and repay it over time through scheduled payments, often with interest. This form of credit is common for large purchases like cars, homes, or appliances, providing manageable monthly expenses. Discover how understanding installment credit can improve your financial decisions by reading the rest of the article.

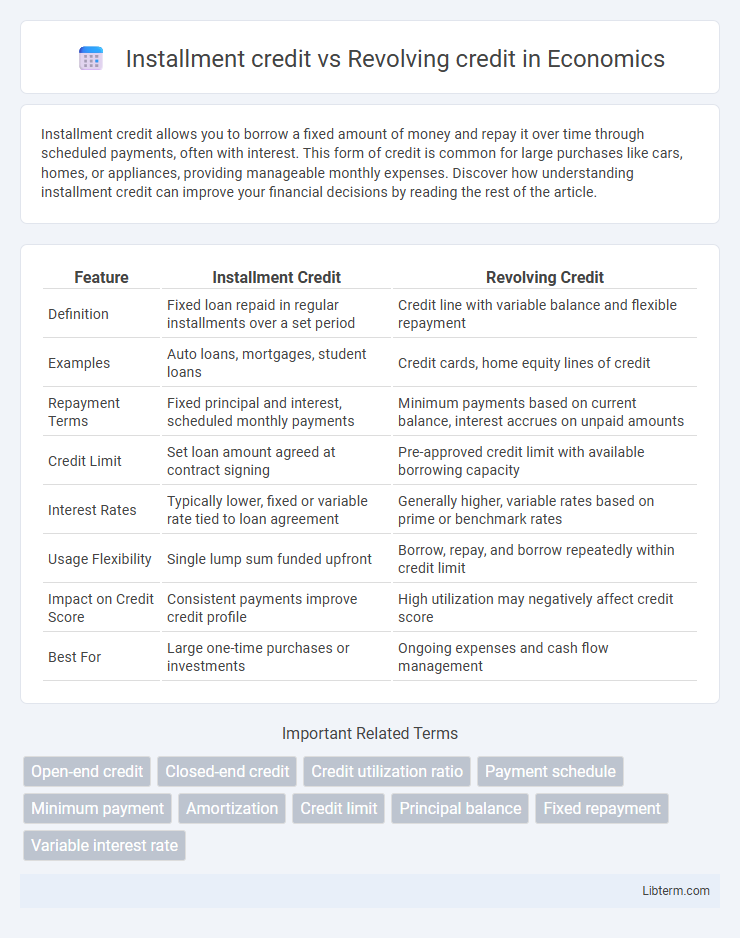

Table of Comparison

| Feature | Installment Credit | Revolving Credit |

|---|---|---|

| Definition | Fixed loan repaid in regular installments over a set period | Credit line with variable balance and flexible repayment |

| Examples | Auto loans, mortgages, student loans | Credit cards, home equity lines of credit |

| Repayment Terms | Fixed principal and interest, scheduled monthly payments | Minimum payments based on current balance, interest accrues on unpaid amounts |

| Credit Limit | Set loan amount agreed at contract signing | Pre-approved credit limit with available borrowing capacity |

| Interest Rates | Typically lower, fixed or variable rate tied to loan agreement | Generally higher, variable rates based on prime or benchmark rates |

| Usage Flexibility | Single lump sum funded upfront | Borrow, repay, and borrow repeatedly within credit limit |

| Impact on Credit Score | Consistent payments improve credit profile | High utilization may negatively affect credit score |

| Best For | Large one-time purchases or investments | Ongoing expenses and cash flow management |

Introduction to Installment and Revolving Credit

Installment credit involves borrowing a fixed amount of money and repaying it in equal monthly payments over a predetermined period, such as car loans or mortgages. Revolving credit offers a flexible borrowing limit that users can repeatedly draw from and repay, as seen with credit cards and lines of credit. Understanding these credit types helps consumers manage debt and optimize financial planning by matching borrowing needs to repayment capabilities.

What Is Installment Credit?

Installment credit refers to a type of loan that requires fixed monthly payments over a set period until the full balance is paid off. Common examples include auto loans, mortgages, and personal loans where borrowers repay principal and interest in equal installments. Unlike revolving credit, installment credit has a predetermined payoff date and structured repayment schedule, which helps borrowers manage debt predictably.

What Is Revolving Credit?

Revolving credit is a type of loan that allows borrowers to access a predetermined credit limit, repay it, and borrow again without reapplying. Common examples include credit cards and lines of credit, where the balance fluctuates based on usage and payments. Unlike installment credit, which involves fixed payments over a set period, revolving credit offers flexibility in repayment amounts and timelines.

Key Differences Between Installment and Revolving Credit

Installment credit involves borrowing a fixed amount and repaying it over a set period with consistent monthly payments, commonly seen in mortgages or auto loans. Revolving credit, such as credit cards, provides a credit limit that borrowers can use repeatedly, paying off balances partially or in full each billing cycle. Key differences include repayment structure, credit limit flexibility, and interest calculation, with installment credit focusing on fixed payments and revolving credit emphasizing variable usage and payments.

Pros and Cons of Installment Credit

Installment credit offers fixed monthly payments and a clear payoff schedule, making budgeting easier and encouraging disciplined repayment, but it limits flexibility since you cannot borrow additional funds without reapplying. It often provides lower interest rates compared to revolving credit, which can reduce overall borrowing costs; however, missing payments can severely impact credit scores and may lead to penalties or accelerated repayment. While installment credit is ideal for large purchases like vehicles or home improvements, it lacks the convenience of ongoing access to credit lines found in revolving credit accounts.

Pros and Cons of Revolving Credit

Revolving credit offers flexibility by allowing borrowers to use and repay funds repeatedly up to a credit limit, making it ideal for managing fluctuating expenses. Its main advantages include convenience and ongoing access to credit, while disadvantages involve potentially high-interest rates and the risk of accumulating debt if not managed responsibly. Unlike installment credit, revolving credit requires minimum monthly payments rather than fixed amounts, which can lead to prolonged repayment periods and increased interest costs.

Impact on Credit Score: Installment vs Revolving Credit

Installment credit, such as auto loans or mortgages, typically has a positive impact on credit scores by showing consistent, on-time payments over a fixed term. Revolving credit, like credit cards, can significantly influence credit scores through credit utilization rates and payment history, with high balances or late payments potentially lowering scores. Both types contribute to credit mix, which accounts for about 10% of credit scoring models, highlighting the importance of responsibly managing both installment and revolving credit to maintain or improve creditworthiness.

Which Credit Type Is Best for You?

Installment credit, such as auto loans or mortgages, offers fixed payments over a set period, making it ideal for borrowers seeking predictable expenses and structured debt repayment. Revolving credit, like credit cards or lines of credit, provides flexible borrowing limits with variable payments, suited for those needing ongoing access to funds and managing fluctuating expenses. Choosing the best credit type depends on your financial goals, repayment discipline, and cash flow stability.

Common Examples of Installment and Revolving Credit

Installment credit commonly includes mortgages, auto loans, and personal loans, where borrowers repay fixed amounts over a set period. Revolving credit primarily involves credit cards and home equity lines of credit (HELOCs), allowing users to borrow up to a credit limit and carry balances month to month. Understanding these examples highlights the difference in repayment structure and credit flexibility between installment and revolving credit types.

Tips for Managing Both Installment and Revolving Credit

Establish a budget that prioritizes timely payments for both installment credit, such as car loans and mortgages, and revolving credit like credit cards, to maintain a healthy credit score. Monitor credit utilization ratios closely, keeping revolving credit balances below 30% of the credit limit to optimize creditworthiness. Regularly review statements and automate payments to avoid late fees and reduce debt systematically across both credit types.

Installment credit Infographic

libterm.com

libterm.com