Monetarism emphasizes the role of government control over the money supply to manage economic stability and inflation. This economic theory argues that variations in the money supply have major influences on national output in the short run and the price level over longer periods. Discover how monetarism can impact your understanding of economic policies and financial decisions by reading the full article.

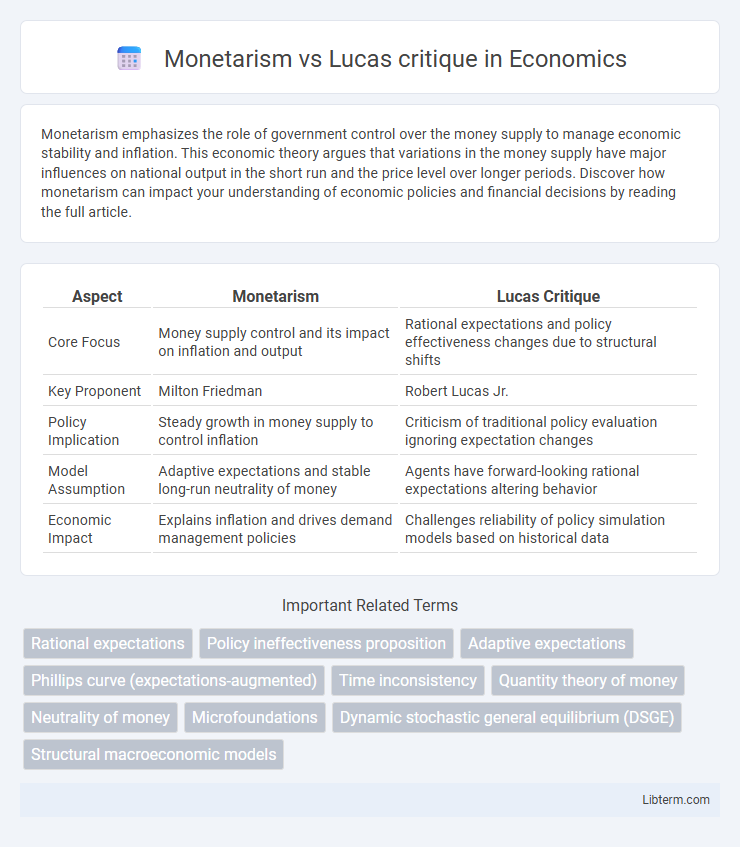

Table of Comparison

| Aspect | Monetarism | Lucas Critique |

|---|---|---|

| Core Focus | Money supply control and its impact on inflation and output | Rational expectations and policy effectiveness changes due to structural shifts |

| Key Proponent | Milton Friedman | Robert Lucas Jr. |

| Policy Implication | Steady growth in money supply to control inflation | Criticism of traditional policy evaluation ignoring expectation changes |

| Model Assumption | Adaptive expectations and stable long-run neutrality of money | Agents have forward-looking rational expectations altering behavior |

| Economic Impact | Explains inflation and drives demand management policies | Challenges reliability of policy simulation models based on historical data |

Introduction to Monetarism and the Lucas Critique

Monetarism, pioneered by Milton Friedman, emphasizes the role of government in controlling the money supply to regulate economic stability and inflation. The Lucas Critique, formulated by Robert Lucas, challenges traditional macroeconomic models by arguing that policy evaluations fail to account for changes in agents' expectations and behavior in response to policy shifts. Understanding the limitations exposed by the Lucas Critique led to the development of new macroeconomic frameworks that incorporate rational expectations, refining Monetarist policy applications.

Historical Background and Theoretical Foundations

Monetarism, developed by Milton Friedman in the 1950s, emphasizes the role of stable money supply growth in controlling inflation and influencing economic output, grounded in the Quantity Theory of Money. The Lucas critique, proposed by Robert Lucas in the 1970s, challenges traditional macroeconomic models by highlighting the inconsistency of policy evaluation when agents adjust their expectations based on rational expectations theory. Both frameworks fundamentally reshape macroeconomic policy analysis by integrating expectations and institutional behavior, with monetarism focusing on predictable monetary rules and the Lucas critique advocating for micro-founded models reflecting individual decision-making processes.

Key Principles of Monetarism

Monetarism emphasizes the control of money supply as the primary tool for managing economic stability, advocating that inflation is always a monetary phenomenon. The theory posits that markets are efficient and that monetary policy should follow predictable rules to avoid destabilizing expectations. Unlike the Lucas critique, which highlights the failure of traditional policy evaluation due to changing expectations, Monetarism stresses consistent, rule-based monetary interventions to guide long-term economic growth.

The Emergence of the Lucas Critique

The emergence of the Lucas critique marked a fundamental shift in macroeconomic modeling by challenging the predictive accuracy of traditional monetarist frameworks, which often failed to account for changes in policy behavior. Robert Lucas argued that policy evaluations must incorporate rational expectations and structural parameter changes, as agents adjust their behavior in response to anticipated policy shifts. This critique led to the development of new dynamic stochastic general equilibrium (DSGE) models, emphasizing microfoundations and the endogeneity of policy effects.

Monetarist Policy Recommendations

Monetarist policy recommendations emphasize controlling the money supply to manage inflation and stabilize the economy, advocating for predictable, rule-based changes rather than discretionary fiscal actions. Monetarists argue that price levels and output respond primarily to changes in money supply growth, promoting steady, moderate increases aligned with economic potential. These policies contrast with insights from the Lucas critique, which warns that economic agents adjust expectations based on policy changes, potentially undermining the effectiveness of traditional Keynesian fiscal interventions.

The Mechanisms of the Lucas Critique

The Lucas Critique challenges traditional monetarist models by emphasizing the instability of policy-economy relationships when agents adjust expectations based on anticipated policy changes. It argues that monetary policy impacts economic outcomes not solely through direct channels but also via changes in agents' decision rules, rendering historical econometric parameters unreliable for predicting future effects. This mechanism highlights the necessity of incorporating microfoundations and rational expectations into macroeconomic models to accurately assess policy effectiveness.

Policy Ineffectiveness Debate: Monetarists vs Lucas

Monetarists argue that controlling money supply directly influences economic output and inflation, emphasizing policy rules over discretion for stability. The Lucas critique challenges this by asserting that traditional policy evaluations fail to account for changes in agents' expectations caused by policy shifts, rendering naive econometric models unreliable. This debate underscores the tension between fixed monetary rules advocated by Monetarists and the dynamic, expectation-driven framework highlighted by Lucas to explain policy ineffectiveness.

Empirical Evidence and Real-World Applications

Empirical evidence shows Monetarism emphasizes the role of controlling money supply to manage inflation and output, with historical data supporting its effectiveness during the 1970s. The Lucas critique challenges traditional policy evaluation by highlighting that economic agents adjust their expectations based on policy changes, rendering past empirical relationships unreliable. Real-world applications incorporate Lucas's insight by developing models with rational expectations, improving policy design to anticipate behavioral adjustments and enhance macroeconomic stability.

Lasting Impacts on Macroeconomic Policy

Monetarism emphasized the importance of controlling money supply to manage inflation, influencing central banks to adopt rules-based monetary policies. The Lucas critique challenged traditional policy evaluation by highlighting how changes in policy alter expectations and economic behavior, prompting the integration of rational expectations into macroeconomic models. These insights led to more robust policy frameworks that account for dynamic responses, improving the effectiveness of monetary interventions.

Conclusion: Integrating Monetarism and the Lucas Critique

Integrating Monetarism and the Lucas Critique enhances macroeconomic policy by emphasizing the importance of stable monetary rules while accounting for changes in expectations and behavior. Monetarism's focus on controlling money supply growth complements the Lucas Critique's insight that economic agents adjust their expectations in response to policy shifts, negating static policy effects. This integration leads to more effective, forward-looking policies that recognize the dynamic interaction between monetary policy and rational expectations.

Monetarism Infographic

libterm.com

libterm.com