The Efficient Market Hypothesis (EMH) asserts that financial markets fully reflect all available information, making it impossible to consistently outperform the market through stock picking or market timing. This theory implies that investors should focus on long-term strategies rather than attempting to exploit short-term market inefficiencies. Discover how understanding EMH can reshape your investment approach by reading the full article.

Table of Comparison

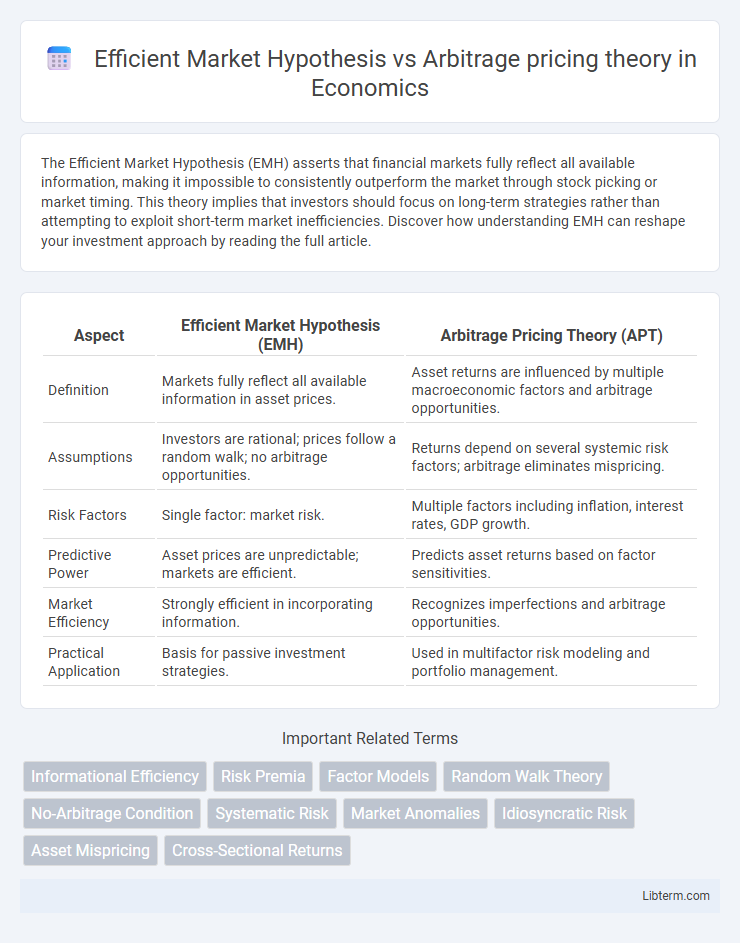

| Aspect | Efficient Market Hypothesis (EMH) | Arbitrage Pricing Theory (APT) |

|---|---|---|

| Definition | Markets fully reflect all available information in asset prices. | Asset returns are influenced by multiple macroeconomic factors and arbitrage opportunities. |

| Assumptions | Investors are rational; prices follow a random walk; no arbitrage opportunities. | Returns depend on several systemic risk factors; arbitrage eliminates mispricing. |

| Risk Factors | Single factor: market risk. | Multiple factors including inflation, interest rates, GDP growth. |

| Predictive Power | Asset prices are unpredictable; markets are efficient. | Predicts asset returns based on factor sensitivities. |

| Market Efficiency | Strongly efficient in incorporating information. | Recognizes imperfections and arbitrage opportunities. |

| Practical Application | Basis for passive investment strategies. | Used in multifactor risk modeling and portfolio management. |

Introduction to Efficient Market Hypothesis (EMH)

Efficient Market Hypothesis (EMH) asserts that financial markets fully incorporate and reflect all available information in asset prices, making it impossible to consistently achieve higher-than-average returns through stock selection or market timing. EMH is categorized into three forms: weak, semi-strong, and strong, each differing by the level of information reflected in prices, ranging from historical data to all public and private data. This theory contrasts with Arbitrage Pricing Theory (APT), which explains asset prices through multiple macroeconomic factors, allowing for potential mispricing that can be exploited.

Fundamentals of Arbitrage Pricing Theory (APT)

Arbitrage Pricing Theory (APT) explains asset returns through multiple macroeconomic factors such as inflation, GDP growth, and interest rates, contrasting with the Efficient Market Hypothesis (EMH), which posits that prices fully reflect all available information. APT assumes that arbitrage opportunities are quickly exploited and eliminated by rational investors, ensuring that asset prices adjust to reflect systematic risks rather than idiosyncratic risks. The theory relies on a linear factor model, where asset returns are decomposed into factor sensitivities and risk premiums associated with each underlying economic factor.

Historical Development: EMH vs APT

The Efficient Market Hypothesis (EMH), developed in the 1960s by Eugene Fama, posits that asset prices fully reflect all available information, making it impossible to consistently achieve higher returns than the market average. Arbitrage Pricing Theory (APT), introduced by Stephen Ross in 1976, expands on this by modeling asset returns through multiple macroeconomic factors, allowing for more nuanced risk pricing beyond the single-market factor used in EMH. The historical development of EMH established the foundation for market efficiency, while APT provided a multifactor framework addressing EMH's limitations in explaining asset price variations.

Key Assumptions of EMH and APT

The Efficient Market Hypothesis (EMH) assumes that all available information is fully reflected in asset prices, implying that markets are rational and investors cannot consistently achieve excess returns. Arbitrage Pricing Theory (APT) relies on the assumption that multiple risk factors systematically influence asset returns and that arbitrage opportunities will be exploited until prices adjust accordingly. While EMH emphasizes market efficiency and information symmetry, APT focuses on the multifactor structure of returns and the role of arbitrage in correcting mispricings.

Market Efficiency: EMH Perspective

The Efficient Market Hypothesis (EMH) posits that asset prices fully reflect all available information, making it impossible to consistently achieve excess returns through market timing or stock selection. EMH emphasizes three forms of market efficiency: weak, semi-strong, and strong, each varying by the scope of information incorporated into prices. Unlike Arbitrage Pricing Theory, which accounts for multiple factors influencing asset returns, EMH centers on the premise that markets are inherently efficient and arbitrage opportunities are quickly eliminated.

Risk Factors in Arbitrage Pricing Theory

The Arbitrage Pricing Theory (APT) identifies multiple systematic risk factors influencing asset returns, such as inflation rates, interest rates, and industrial production, allowing for a multifactor risk assessment beyond market risk. Unlike the Efficient Market Hypothesis (EMH), which assumes all securities are fairly priced reflecting all available information, APT models asset prices based on sensitivity to these diverse macroeconomic variables. The APT's emphasis on multiple risk factors provides a more flexible framework for pricing assets in markets with varying economic influences.

Strengths and Weaknesses: EMH and APT

Efficient Market Hypothesis (EMH) strengths include its strong foundation in market efficiency and its ability to explain broad market behavior through the assumption that asset prices reflect all available information. However, EMH's weakness lies in its inability to account for anomalies and investor irrationality, limiting its application in predicting short-term market movements. Arbitrage Pricing Theory (APT) offers a more flexible multi-factor model incorporating various macroeconomic factors, providing a nuanced asset pricing framework, yet its complexity and reliance on identifying relevant factors can reduce practical implementability and may introduce estimation errors.

Empirical Evidence and Real-World Applications

Empirical evidence on the Efficient Market Hypothesis (EMH) reveals mixed results, with strong support for weak-form efficiency but significant anomalies challenging strong and semi-strong forms, while Arbitrage Pricing Theory (APT) demonstrates effectiveness in capturing multifactor risks influencing asset returns. Real-world applications of EMH influence passive investment strategies and index fund development, whereas APT guides multifactor portfolio construction and risk management by identifying systematic risk factors beyond market beta. Both theories contribute to financial modeling, yet practitioners often prefer APT for its flexibility in incorporating diverse macroeconomic variables in asset pricing.

Comparative Analysis: EMH versus APT

The Efficient Market Hypothesis (EMH) asserts that asset prices fully reflect all available information, implying that consistent excess returns are unattainable, whereas Arbitrage Pricing Theory (APT) identifies multiple macroeconomic factors influencing asset returns, allowing for potential arbitrage opportunities. EMH predominantly relies on the notion of market efficiency and random price movements, while APT provides a multifactor model addressing systematic risk beyond the market portfolio considered in EMH. Comparative analysis reveals that EMH assumes pricing equilibrium and information symmetry, whereas APT offers a practical framework for explaining and exploiting mispricing based on diverse economic variables.

Conclusion: Implications for Investors and Financial Markets

Efficient Market Hypothesis (EMH) asserts that asset prices fully reflect all available information, implying that consistently outperforming the market is nearly impossible without taking additional risk. Arbitrage Pricing Theory (APT) suggests that multiple macroeconomic factors can explain asset returns, offering investors the potential to exploit mispriced securities through factor-based strategies. The divergence in assumptions between EMH and APT influences investment approaches, with EMH promoting passive investing and market efficiency, while APT supports active risk factor analysis and targeted arbitrage opportunities.

Efficient Market Hypothesis Infographic

libterm.com

libterm.com