Reserve requirements are regulations that mandate banks to hold a certain percentage of their deposits as reserves, either in cash or at the central bank, to ensure financial stability and liquidity. These requirements influence the money supply and lending capacity, directly impacting your ability to access loans and credit. Learn how reserve requirements shape the banking system and affect your financial decisions in the rest of this article.

Table of Comparison

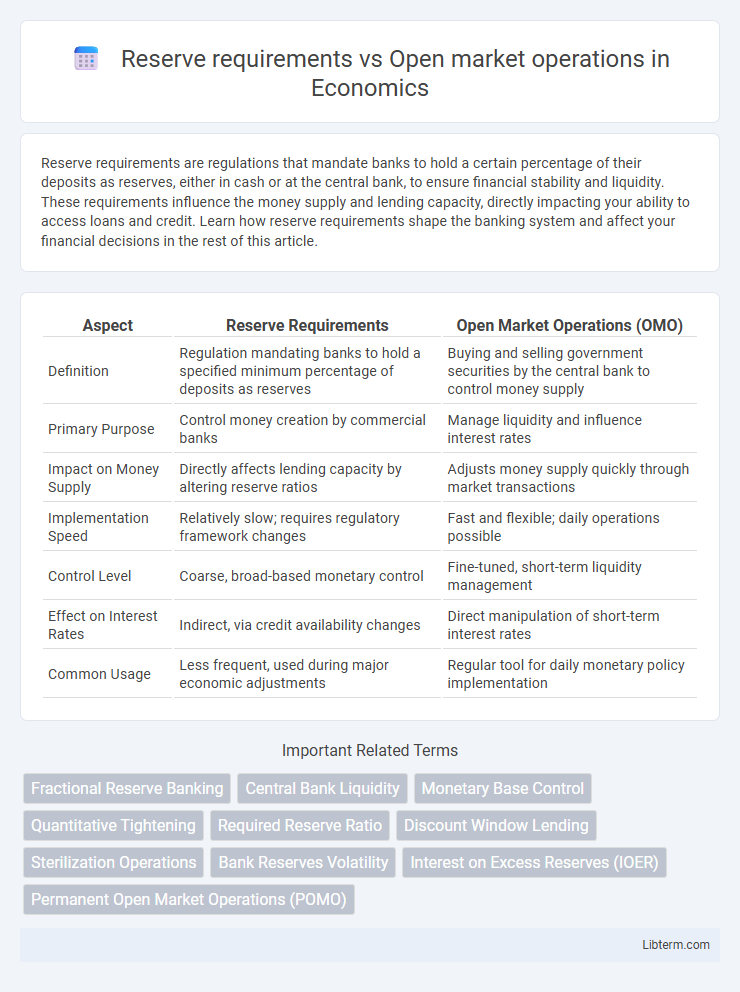

| Aspect | Reserve Requirements | Open Market Operations (OMO) |

|---|---|---|

| Definition | Regulation mandating banks to hold a specified minimum percentage of deposits as reserves | Buying and selling government securities by the central bank to control money supply |

| Primary Purpose | Control money creation by commercial banks | Manage liquidity and influence interest rates |

| Impact on Money Supply | Directly affects lending capacity by altering reserve ratios | Adjusts money supply quickly through market transactions |

| Implementation Speed | Relatively slow; requires regulatory framework changes | Fast and flexible; daily operations possible |

| Control Level | Coarse, broad-based monetary control | Fine-tuned, short-term liquidity management |

| Effect on Interest Rates | Indirect, via credit availability changes | Direct manipulation of short-term interest rates |

| Common Usage | Less frequent, used during major economic adjustments | Regular tool for daily monetary policy implementation |

Introduction to Monetary Policy Tools

Reserve requirements dictate the minimum reserves banks must hold, directly impacting their ability to lend and influence money supply. Open market operations involve the purchase and sale of government securities by the central bank to regulate liquidity and control short-term interest rates. Both tools serve as primary instruments in monetary policy for managing inflation and stabilizing the economy.

Understanding Reserve Requirements

Reserve requirements mandate the minimum fraction of customer deposits that banks must hold as reserves, influencing liquidity and lending capacity. By adjusting reserve ratios, central banks control the money supply, ensuring financial stability while managing inflationary pressures. Understanding how reserve requirements limit or expand bank lending offers crucial insight into monetary policy implementation.

Exploring Open Market Operations

Open market operations involve the buying and selling of government securities by a central bank to regulate the money supply and influence interest rates, serving as a primary monetary policy tool. This mechanism allows for rapid adjustments in liquidity, directly impacting short-term interest rates and economic activity. Compared to reserve requirements, which set the minimum reserves banks must hold, open market operations provide more flexible and precise control over monetary conditions.

Historical Evolution of Reserve Requirements

Reserve requirements have evolved significantly since their formal adoption in the early 20th century, initially serving as a direct tool to control bank liquidity and credit supply. Historically, reserve ratios were rigidly set by central banks to ensure financial stability and prevent bank runs, but over time, many countries have shifted toward more flexible reserve requirements or eliminated them to grant monetary authorities greater maneuverability. Open market operations emerged as a more dynamic mechanism, allowing central banks to adjust money supply and influence interest rates more precisely without the rigid constraints posed by fixed reserve requirements.

Mechanisms of Open Market Operations

Open Market Operations involve the Federal Reserve buying or selling government securities to regulate the money supply and influence short-term interest rates. When the Fed purchases securities, it injects liquidity into the banking system, increasing reserves and encouraging lending. Conversely, selling securities withdraws funds from banks, reducing reserves and tightening monetary conditions to control inflation or cool economic activity.

Impact on Money Supply and Credit

Reserve requirements directly influence the amount of funds banks must hold, restricting the money available for lending and thereby contracting the money supply and credit creation when increased. Open market operations involve the central bank buying or selling government securities, which injects or withdraws liquidity from the banking system, leading to a more immediate and flexible impact on expanding or contracting the money supply and credit availability. While reserve requirements set a regulatory boundary on credit potential, open market operations serve as a primary tool for targeting short-term fluctuations in money supply and controlling credit flow.

Flexibility and Speed: A Comparative Analysis

Reserve requirements are rigid regulatory measures mandating banks to hold a fixed percentage of deposits, offering limited flexibility and slower responsiveness in monetary policy implementation. Open market operations enable central banks to buy or sell government securities with high flexibility and immediate impact on liquidity and interest rates. The speed and adaptability of open market operations make them the primary tool for fine-tuning monetary policy compared to the inflexible nature of reserve requirements.

Effectiveness During Economic Crises

Reserve requirements directly influence banks' lending capacity by mandating a minimum reserve ratio, effectively controlling money supply during economic crises but often with delayed implementation and limited flexibility. Open market operations provide central banks with a more immediate and precise tool to inject or withdraw liquidity, enabling swift responses to volatile financial conditions and stabilizing interest rates. Empirical evidence from past recessions highlights that open market operations yield more timely and targeted impacts on credit availability and economic recovery compared to rigid reserve requirement adjustments.

Challenges and Limitations of Each Tool

Reserve requirements face challenges in their rigidity, as sudden changes can disrupt bank liquidity and credit availability, limiting their flexibility in real-time monetary policy adjustments. Open market operations encounter limitations in effectiveness during periods of low interest rates or liquidity traps, where market participants' responses to asset purchases or sales are muted. Both tools struggle with timing and scale precision, complicating efforts to finely tune money supply and influence economic activity efficiently.

Conclusion: Choosing the Right Policy Instrument

Reserve requirements directly influence the amount of funds banks must hold, impacting liquidity and credit availability, while open market operations provide more flexibility by adjusting the money supply through buying or selling government securities. Central banks often prefer open market operations for fine-tuning short-term interest rates and responding quickly to economic changes without disrupting banking stability. Selecting the right policy instrument depends on the desired speed, precision, and scope of monetary control needed to maintain economic stability and promote growth.

Reserve requirements Infographic

libterm.com

libterm.com