Income elasticity measures how the demand for a good changes in response to a change in consumer income, reflecting the sensitivity of consumption patterns. It helps businesses and economists predict shifts in market demand as incomes rise or fall, differentiating between normal goods, inferior goods, and luxury items. Explore the rest of the article to understand how income elasticity affects your purchasing behavior and economic decision-making.

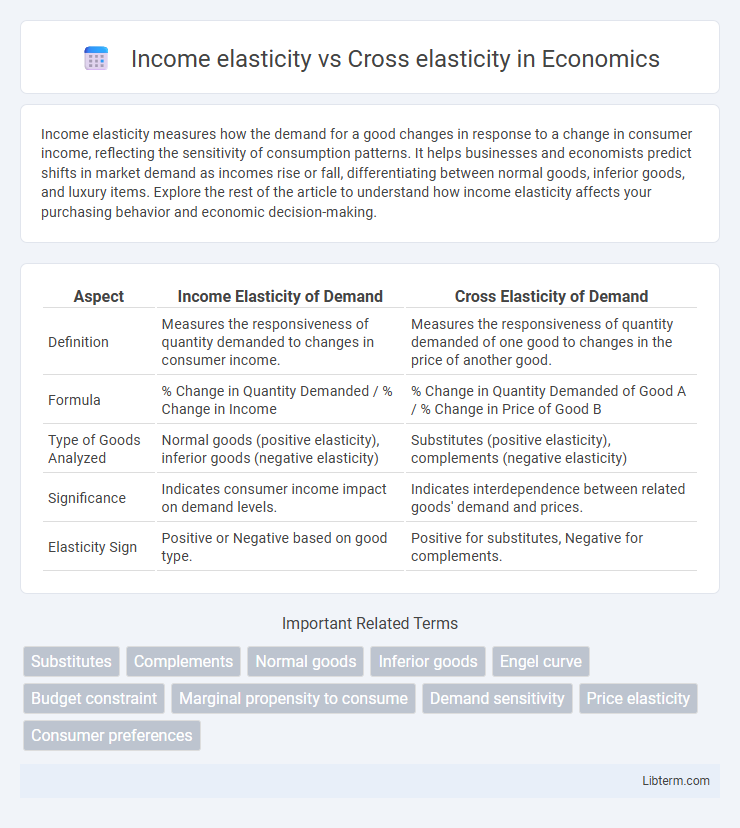

Table of Comparison

| Aspect | Income Elasticity of Demand | Cross Elasticity of Demand |

|---|---|---|

| Definition | Measures the responsiveness of quantity demanded to changes in consumer income. | Measures the responsiveness of quantity demanded of one good to changes in the price of another good. |

| Formula | % Change in Quantity Demanded / % Change in Income | % Change in Quantity Demanded of Good A / % Change in Price of Good B |

| Type of Goods Analyzed | Normal goods (positive elasticity), inferior goods (negative elasticity) | Substitutes (positive elasticity), complements (negative elasticity) |

| Significance | Indicates consumer income impact on demand levels. | Indicates interdependence between related goods' demand and prices. |

| Elasticity Sign | Positive or Negative based on good type. | Positive for substitutes, Negative for complements. |

Introduction to Elasticity in Economics

Income elasticity measures the responsiveness of demand for a good when there is a change in consumer income, indicating whether a product is a necessity or luxury. Cross elasticity captures the change in demand for one good in response to a price change of another good, revealing substitute or complementary relationships. Both elasticities are key components in understanding market behavior, consumer preferences, and pricing strategies within microeconomic analysis.

Defining Income Elasticity of Demand

Income elasticity of demand measures the responsiveness of the quantity demanded of a good to changes in consumer income, indicating whether a product is a normal or inferior good. It is calculated as the percentage change in quantity demanded divided by the percentage change in income. Cross elasticity of demand, in contrast, assesses the responsiveness of demand for one good to changes in the price of another, distinguishing between substitutes and complements.

Understanding Cross Elasticity of Demand

Cross elasticity of demand measures the responsiveness of the quantity demanded for one good when the price of a related good changes, indicating whether goods are substitutes or complements. A positive cross elasticity suggests substitute goods, while a negative value indicates complementary goods. Understanding cross elasticity helps businesses and economists predict market dynamics and consumer behavior in response to price fluctuations across related products.

Key Differences Between Income and Cross Elasticity

Income elasticity of demand measures how quantity demanded changes in response to changes in consumer income, indicating whether a good is normal or inferior. Cross elasticity of demand assesses the responsiveness of the quantity demanded for one good when the price of another good changes, reflecting substitute or complementary relationships. Key differences include the variables involved--income versus price of another good--and the interpretative focus on income effect versus inter-product price effect.

Types of Goods Based on Income Elasticity

Income elasticity measures how the demand for goods changes with consumer income variations, categorizing goods into normal, inferior, and luxury types based on elasticity values. Normal goods have positive income elasticity, indicating higher demand as income rises, while inferior goods exhibit negative income elasticity, with demand decreasing as income increases. Luxury goods show income elasticity greater than one, reflecting a proportionally larger increase in demand with rising incomes, crucial for businesses targeting different market segments.

Classification of Goods by Cross Elasticity

Cross elasticity of demand measures the responsiveness of quantity demanded for one good when the price of another good changes, classifying goods as substitutes or complements. Positive cross elasticity indicates substitute goods, where an increase in the price of one leads to higher demand for the other. Negative cross elasticity characterizes complementary goods, showing a decrease in demand when the price of the related good rises.

Mathematical Calculation: Income vs Cross Elasticity

Income elasticity of demand measures the percentage change in quantity demanded divided by the percentage change in consumer income, calculated as (DQ/Q) / (DI/I). Cross elasticity of demand assesses the responsiveness of quantity demanded for one good to a change in the price of another good, expressed mathematically as (DQx/Qx) / (DPy/Py). Both elasticities use percentage changes but differ in variables: income elasticity relates demand to income shifts, while cross elasticity relates demand to price changes of related goods.

Real-World Examples: Income and Cross Elasticity

Income elasticity of demand measures how consumer demand changes with income variations, such as increased demand for luxury cars when incomes rise. Cross elasticity of demand evaluates how the price change of one product affects the demand for another, exemplified by rising coffee prices boosting tea sales. Real-world analysis reveals that income elasticity guides marketers in luxury sectors, while cross elasticity informs competitive strategies in substitute goods markets.

Importance in Business and Policy Decision-Making

Income elasticity measures consumer demand responsiveness to income changes, guiding businesses in forecasting sales during economic shifts. Cross elasticity assesses demand changes between related goods, crucial for competitive pricing strategies and market entry decisions. Policymakers use both elasticities to predict consumer behavior impacts from fiscal policies and to design effective taxation and subsidy programs.

Summary: Choosing the Right Elasticity Measure

Income elasticity measures the responsiveness of demand to changes in consumer income, essential for understanding normal and inferior goods. Cross elasticity gauges how the demand for one product reacts to price changes of a related good, indicating substitutes or complements. Selecting the appropriate elasticity depends on whether the analysis targets consumer purchasing power effects or inter-product price relationships.

Income elasticity Infographic

libterm.com

libterm.com