Open credit refers to a flexible borrowing arrangement where you can access funds up to a predetermined limit and repay the balance over time, commonly seen in credit cards and lines of credit. This type of credit provides ongoing access to funds without needing to reapply after each use, offering convenience and adaptability for managing expenses. Explore the full article to understand how open credit can benefit your financial strategy.

Table of Comparison

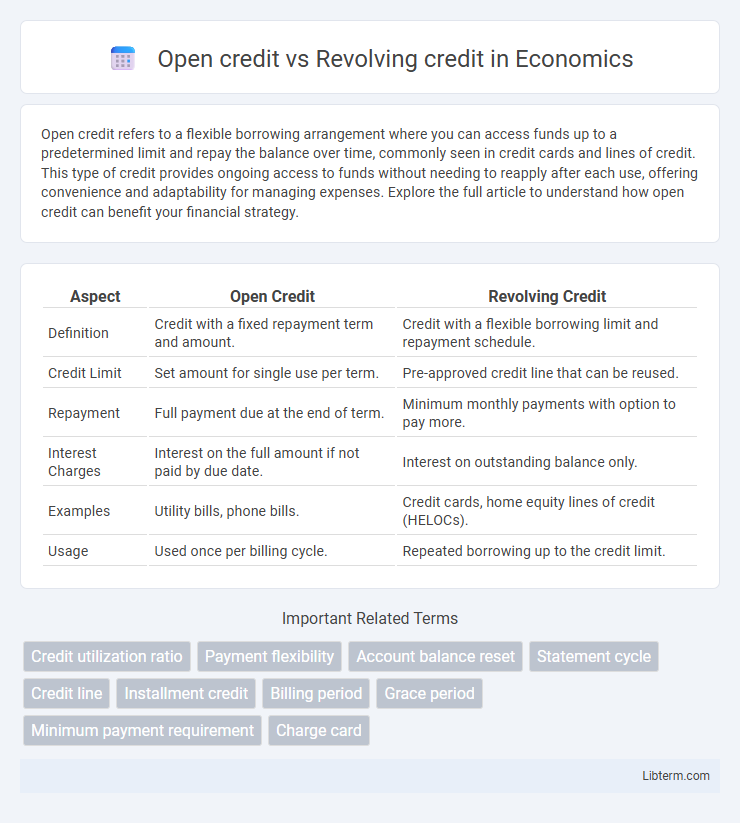

| Aspect | Open Credit | Revolving Credit |

|---|---|---|

| Definition | Credit with a fixed repayment term and amount. | Credit with a flexible borrowing limit and repayment schedule. |

| Credit Limit | Set amount for single use per term. | Pre-approved credit line that can be reused. |

| Repayment | Full payment due at the end of term. | Minimum monthly payments with option to pay more. |

| Interest Charges | Interest on the full amount if not paid by due date. | Interest on outstanding balance only. |

| Examples | Utility bills, phone bills. | Credit cards, home equity lines of credit (HELOCs). |

| Usage | Used once per billing cycle. | Repeated borrowing up to the credit limit. |

Understanding Open Credit: Definition and Features

Open credit, also known as a charge account, allows borrowers to make purchases up to a predetermined limit with full payment required at the end of each billing cycle, often seen in charge cards. Unlike revolving credit, which permits carrying balances and paying interest over time, open credit requires the account balance to be paid in full, promoting disciplined financial management. Key features include no interest charges if paid on time, predefined credit limits, and strict payment schedules ensuring timely debt settlement.

What is Revolving Credit? Key Characteristics

Revolving credit is a type of credit that allows borrowers to access funds up to a pre-approved limit and repay over time, with the flexibility to borrow again as payments are made. Key characteristics include an ongoing credit line, variable interest rates based on outstanding balances, and minimum monthly payments that cover interest and principal. Unlike open credit, revolving credit does not require the full balance to be paid at each billing cycle, enabling continuous borrowing and repayment.

Key Differences Between Open Credit and Revolving Credit

Open credit requires full payment of the balance by the due date, preventing interest charges, whereas revolving credit allows carrying a balance with minimum monthly payments and accrues interest on unpaid amounts. Open credit is typically seen in charge cards that must be cleared monthly, while revolving credit is common in credit cards and lines of credit with flexible borrowing limits. The key difference lies in payment structure and interest application, impacting credit usage and financial management strategies.

Common Examples of Open Credit Accounts

Common examples of open credit accounts include utility bills, rent payments, and charge cards that require full payment each month. These accounts differ from revolving credit, such as credit cards or lines of credit, which allow users to carry a balance and make minimum payments. Open credit typically has a fixed payment schedule and no minimum balance requirement, promoting consistent repayment.

Typical Uses of Revolving Credit

Revolving credit is typically used for ongoing expenses such as credit card purchases, home improvements, or managing cash flow fluctuations in small businesses. Unlike open credit, which requires full repayment after each billing cycle, revolving credit allows borrowers to carry a balance and make minimum payments while accessing a preset credit limit repeatedly. This flexibility makes it ideal for covering variable or unpredictable costs over time.

Impact on Credit Scores: Open Credit vs Revolving Credit

Open credit accounts, such as installment loans, typically have fixed payment schedules that show consistent repayment behavior, positively impacting credit scores when paid on time. Revolving credit, like credit cards, influences credit utilization ratios, with lower balances relative to limits enhancing credit scores and high utilization potentially lowering them. Both credit types affect payment history, but revolving credit's fluctuating balances make credit management crucial for maintaining or improving credit scores.

Interest Rates and Fees: Comparing Open and Revolving Credit

Interest rates on open credit typically remain fixed for the loan term, often lower than revolving credit rates, which can fluctuate based on credit card issuers' variable APRs. Fees associated with open credit usually include origination or application costs, while revolving credit may involve annual fees, late payment fees, and cash advance charges. Comparing open and revolving credit, consumers often find open credit more cost-effective for predictable expenses, whereas revolving credit offers flexibility but potentially higher financial charges.

Pros and Cons of Open Credit

Open credit offers the advantage of fixed payment amounts and clear payoff timelines, which aids in budgeting and reduces the risk of escalating debt. However, its rigid repayment structure might lack flexibility compared to revolving credit, potentially causing financial strain if unexpected expenses arise. The predictability of open credit lowers interest costs over time, but insufficient adaptability can limit its suitability for fluctuating cash flow needs.

Pros and Cons of Revolving Credit

Revolving credit offers flexibility by allowing borrowers to spend up to a credit limit and repay over time, which helps manage cash flow and cover unexpected expenses. However, it often comes with higher interest rates and the risk of accumulating debt if payments are missed or only minimum payments are made. Compared to open credit, revolving credit demands disciplined financial management to avoid long-term costly debt.

Choosing the Right Credit Option for Your Financial Needs

Open credit offers a fixed amount and a set repayment schedule, making it ideal for predictable expenses and structured budgeting. Revolving credit provides flexibility with a credit limit that replenishes as you repay, suitable for ongoing or variable spending needs. Assess your financial habits and payment discipline to select the credit type that aligns with your cash flow and long-term financial goals.

Open credit Infographic

libterm.com

libterm.com