Underleveraged companies have untapped potential to boost growth by optimizing their capital structure and accessing more debt financing. Increasing leverage strategically can improve return on equity and provide funds for expansion or innovation. Explore the rest of the article to learn how your business can effectively leverage debt to maximize value.

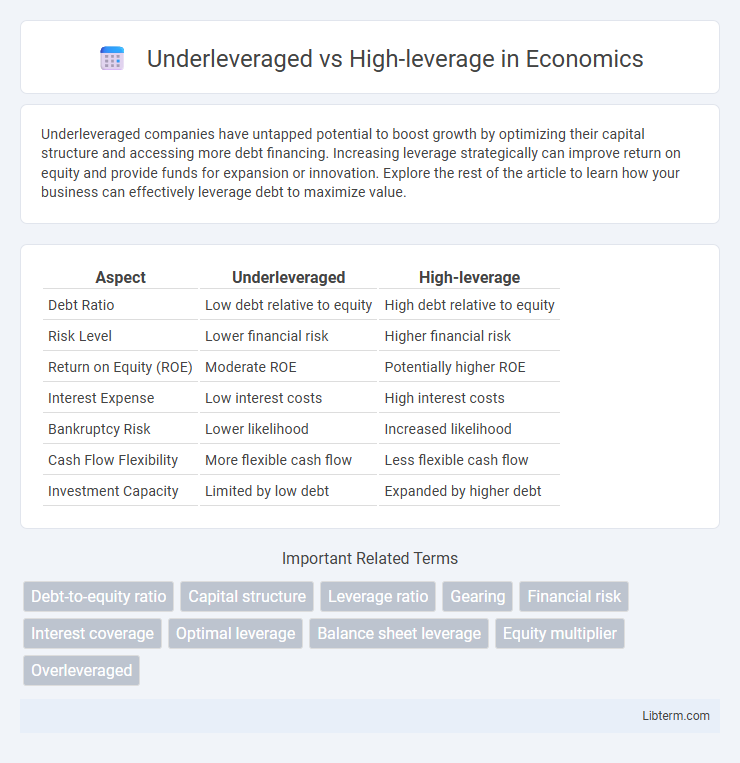

Table of Comparison

| Aspect | Underleveraged | High-leverage |

|---|---|---|

| Debt Ratio | Low debt relative to equity | High debt relative to equity |

| Risk Level | Lower financial risk | Higher financial risk |

| Return on Equity (ROE) | Moderate ROE | Potentially higher ROE |

| Interest Expense | Low interest costs | High interest costs |

| Bankruptcy Risk | Lower likelihood | Increased likelihood |

| Cash Flow Flexibility | More flexible cash flow | Less flexible cash flow |

| Investment Capacity | Limited by low debt | Expanded by higher debt |

Understanding Leverage in Finance

Understanding leverage in finance involves analyzing the ratio of borrowed capital to equity used to fund investments or operations; underleveraged companies utilize minimal debt, potentially missing growth opportunities, while high-leverage firms rely heavily on debt, increasing risk but enabling larger asset accumulation. Optimal leverage balances the cost of debt and the benefits of financial flexibility, influencing a company's return on equity and overall risk profile. Financial metrics such as debt-to-equity ratio, interest coverage ratio, and return on assets are critical to assessing leverage effectiveness and sustainability.

What Does Underleveraged Mean?

Underleveraged refers to a financial position where a company or individual uses less debt compared to its capacity, resulting in lower financial risk but potentially missing out on growth opportunities funded by borrowed capital. In contrast to high-leverage situations, underleveraged entities maintain conservative debt levels, preserving liquidity and reducing interest expenses. This cautious approach means underleveraged businesses may experience slower expansion due to limited use of debt-financed investments.

Defining High Leverage

High leverage refers to the use of significant borrowed capital to increase the potential return of an investment, amplifying both gains and risks. Underleveraged positions, by contrast, use minimal debt, emphasizing stability and reduced financial exposure. Understanding high leverage is crucial for investors seeking aggressive growth, as it involves higher volatility and potential for substantial financial strain.

Key Differences: Underleveraged vs High-Leverage

Underleveraged firms maintain low debt levels relative to their equity, minimizing financial risk but potentially limiting growth opportunities due to underutilized capital. High-leverage companies rely heavily on borrowed funds, increasing potential returns but also elevating default risk and financial distress during economic downturns. Key differences lie in risk tolerance, capital structure strategy, and impact on firm valuation and cash flow stability.

Advantages of Underleveraged Strategies

Underleveraged strategies offer significant risk reduction by minimizing exposure to volatile debt levels, which enhances financial stability and long-term resilience. These approaches promote sustainable growth through conservative capital allocation, preserving cash flow and improving creditworthiness. Investors benefit from lower default risk and better adaptability to market fluctuations, ensuring more consistent returns.

Risks and Rewards of High Leverage

High leverage amplifies potential returns by allowing greater exposure to assets with a smaller initial investment, but it also significantly increases the risk of substantial losses or margin calls if market movements are unfavorable. Investors using high leverage face amplified volatility, where even minor price fluctuations can lead to rapid equity depletion and forced liquidations. In contrast, underleveraged positions minimize risk exposure and preserve capital stability but may result in slower portfolio growth and missed opportunities for higher profits.

Impact of Leverage Levels on Business Growth

Underleveraged businesses often experience slower growth due to insufficient capital infusion, limiting opportunities for expansion and market penetration. High-leverage companies can accelerate growth by accessing significant external financing, but they face increased risk of insolvency if revenue fails to cover debt servicing. Optimal leverage levels balance debt and equity to maximize growth potential while maintaining financial stability and mitigating default risk.

Leverage Ratios: How to Measure and Compare

Leverage ratios, such as debt-to-equity and debt-to-assets, quantify financial risk by comparing borrowed funds relative to equity or total assets. Underleveraged companies maintain low leverage ratios, signaling conservative use of debt and lower financial risk, while high-leverage firms exhibit elevated ratios, indicating aggressive debt financing that can amplify returns but increase insolvency risk. Accurate measurement and comparison of these ratios help investors assess capital structure efficiency and the balance between risk and potential growth.

Best Practices for Managing Leverage

Best practices for managing leverage involve maintaining an optimal debt-to-equity ratio tailored to the specific industry and business model to avoid underleveraging or excessive high leverage risks. Regularly monitoring cash flow and debt servicing capacity ensures the company can meet financial obligations without jeopardizing operational stability. Strategic use of leverage includes balancing growth opportunities with risk management by setting clear limits on borrowing and employing stress testing frameworks to anticipate market fluctuations.

Choosing the Right Leverage for Your Financial Goals

Choosing the right leverage involves assessing your risk tolerance, investment horizon, and financial objectives to balance potential returns against possible losses. Underleveraged positions limit exposure and reduce risk, ideal for conservative investors prioritizing capital preservation, while high-leverage strategies amplify gains but increase susceptibility to market volatility and margin calls. Evaluating factors such as debt-to-equity ratio, interest costs, and market conditions ensures leverage aligns with your financial goals and risk appetite.

Underleveraged Infographic

libterm.com

libterm.com