Accrual basis accounting records revenues and expenses when they are earned or incurred, regardless of cash flow timing, providing a more accurate financial picture. This method helps businesses match income with related expenses during the same period, improving financial reporting and decision-making. Discover how adopting accrual basis accounting can enhance your company's financial clarity by reading the full article.

Table of Comparison

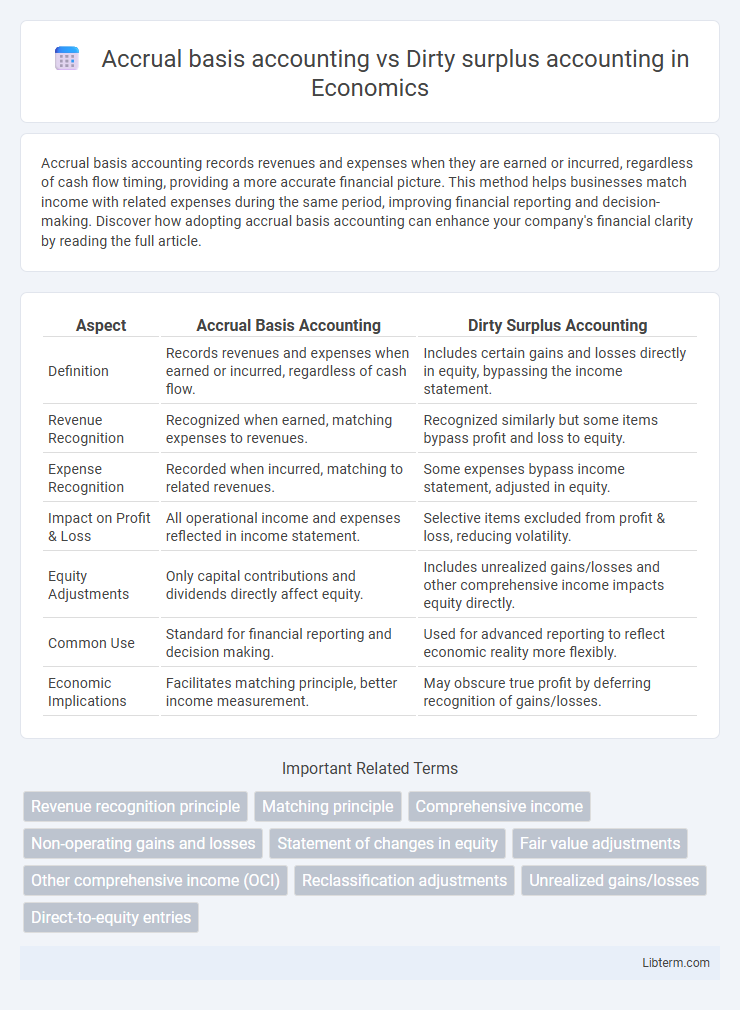

| Aspect | Accrual Basis Accounting | Dirty Surplus Accounting |

|---|---|---|

| Definition | Records revenues and expenses when earned or incurred, regardless of cash flow. | Includes certain gains and losses directly in equity, bypassing the income statement. |

| Revenue Recognition | Recognized when earned, matching expenses to revenues. | Recognized similarly but some items bypass profit and loss to equity. |

| Expense Recognition | Recorded when incurred, matching to related revenues. | Some expenses bypass income statement, adjusted in equity. |

| Impact on Profit & Loss | All operational income and expenses reflected in income statement. | Selective items excluded from profit & loss, reducing volatility. |

| Equity Adjustments | Only capital contributions and dividends directly affect equity. | Includes unrealized gains/losses and other comprehensive income impacts equity directly. |

| Common Use | Standard for financial reporting and decision making. | Used for advanced reporting to reflect economic reality more flexibly. |

| Economic Implications | Facilitates matching principle, better income measurement. | May obscure true profit by deferring recognition of gains/losses. |

Introduction to Accrual Basis Accounting

Accrual basis accounting records revenues and expenses when they are earned or incurred, regardless of cash transactions, providing a comprehensive view of a company's financial performance and position. This method aligns revenues with the expenses incurred to generate them, enhancing the accuracy of financial statements compared to cash basis accounting. Unlike dirty surplus accounting, which includes all changes in equity not captured in net income, accrual accounting ensures that financial results reflect economic activities during the reporting period.

Overview of Dirty Surplus Accounting

Dirty surplus accounting captures income and expense items bypassing the traditional profit and loss statement, directly adjusting equity instead. This approach includes unrealized gains and losses, revaluations, and other comprehensive income components not recognized in accrual basis accounting. It provides a broader view of financial performance by integrating changes in equity that are excluded from net income under standard accrual accounting methods.

Key Principles of Accrual Basis Accounting

Accrual basis accounting recognizes revenues and expenses when they are earned or incurred, regardless of cash flow timing, ensuring financial statements reflect the true economic activity of a business. Key principles include the matching principle, which aligns expenses with related revenues, and revenue recognition, which records income in the period it is earned. Unlike dirty surplus accounting, which bypasses some comprehensive income items by directly adjusting equity, accrual accounting provides a clearer, more detailed view of operational performance through systematic recognition of all income and expenses.

Core Concepts of Dirty Surplus Accounting

Dirty surplus accounting records comprehensive income changes outside the traditional income statement, incorporating gains and losses directly into equity without passing through profit or loss accounts. It challenges the accrual basis accounting core concept, which recognizes revenues and expenses when earned or incurred, by admitting adjustments such as revaluation reserves and actuarial gains that affect equity directly. This approach highlights the importance of transparency in equity changes and the limitations of accrual accounting in capturing all economic events impacting firm value.

Recognition of Revenues and Expenses

Accrual basis accounting recognizes revenues and expenses when earned or incurred, regardless of cash flow timing, ensuring accurate matching of income and related costs within the same period. Dirty surplus accounting allows certain gains and losses to bypass the income statement, directly affecting equity and altering recognized profits without corresponding expense or revenue adjustments. This distinction impacts financial reporting transparency and the assessment of true operating performance by stakeholders.

Treatment of Gains and Losses

Accrual basis accounting records gains and losses when they are earned or incurred, regardless of cash flow, ensuring revenues and expenses match the period they relate to. Dirty surplus accounting allows certain gains and losses bypassing the income statement and directly adjusting equity, often impacting comprehensive income rather than net income. This distinction affects financial transparency, with accrual basis providing a more immediate reflection of economic events, while dirty surplus may obscure the timing and nature of some gains and losses.

Impact on Financial Statements

Accrual basis accounting records revenues and expenses when they are earned or incurred, providing a comprehensive view of financial performance and ensuring that financial statements reflect the true economic activities during a period. Dirty surplus accounting, however, bypasses certain gains and losses from the income statement, instead recognizing them directly in equity changes, which can obscure the true operational results and reduce the transparency of the financial statements. This difference significantly impacts the accuracy of reported earnings, liquidity assessments, and stakeholders' ability to evaluate a company's ongoing profitability and financial health.

Transparency and Financial Reporting Quality

Accrual basis accounting enhances transparency by recognizing revenues and expenses when they are incurred, providing a more accurate reflection of a company's financial position and performance. Dirty surplus accounting allows certain gains and losses to bypass the income statement and directly adjust equity, which can obscure true performance and reduce financial reporting quality. Companies using accrual basis accounting typically deliver more reliable financial reports, fostering greater investor confidence and better decision-making.

Advantages and Disadvantages Comparison

Accrual basis accounting provides a comprehensive view of financial performance by recognizing revenues and expenses when they are incurred, enhancing accuracy in financial reporting and decision-making; however, it can be complex and require substantial judgment, potentially leading to inconsistencies. Dirty surplus accounting captures unrealized gains and losses outside the income statement, reflecting changes in equity that improve transparency for certain financial elements but may reduce comparability and complicate performance analysis. The choice between these methods depends on the prioritization of accounting precision versus comprehensive equity changes, with accrual basis favored for detailed income tracking and dirty surplus useful for capturing value fluctuations.

Practical Implications and Use Cases

Accrual basis accounting recognizes revenues and expenses when they are incurred, providing a comprehensive view of financial performance and facilitating accurate profitability analysis for businesses with complex transactions. Dirty surplus accounting tracks changes in equity not reflected in net income, such as revaluation reserves, offering valuable insights for financial institutions and firms with significant unrealized gains or losses. Understanding these methods helps stakeholders in sectors like banking and manufacturing choose the appropriate reporting framework to enhance transparency and decision-making.

Accrual basis accounting Infographic

libterm.com

libterm.com