Market risk refers to the potential for financial loss due to fluctuations in market prices, including stocks, bonds, commodities, and currencies. It encompasses systematic risk factors such as economic downturns, interest rate changes, and geopolitical events that impact overall market performance. Explore the rest of the article to understand how to identify, manage, and mitigate market risk effectively for your investments.

Table of Comparison

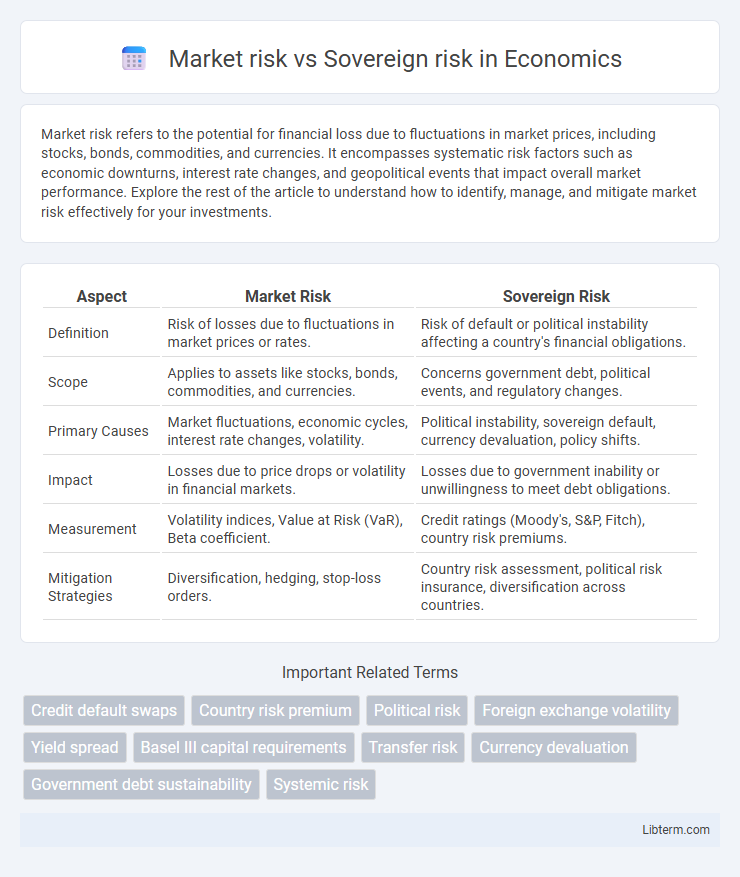

| Aspect | Market Risk | Sovereign Risk |

|---|---|---|

| Definition | Risk of losses due to fluctuations in market prices or rates. | Risk of default or political instability affecting a country's financial obligations. |

| Scope | Applies to assets like stocks, bonds, commodities, and currencies. | Concerns government debt, political events, and regulatory changes. |

| Primary Causes | Market fluctuations, economic cycles, interest rate changes, volatility. | Political instability, sovereign default, currency devaluation, policy shifts. |

| Impact | Losses due to price drops or volatility in financial markets. | Losses due to government inability or unwillingness to meet debt obligations. |

| Measurement | Volatility indices, Value at Risk (VaR), Beta coefficient. | Credit ratings (Moody's, S&P, Fitch), country risk premiums. |

| Mitigation Strategies | Diversification, hedging, stop-loss orders. | Country risk assessment, political risk insurance, diversification across countries. |

Introduction to Market Risk and Sovereign Risk

Market risk involves the potential for losses due to fluctuations in asset prices, interest rates, or exchange rates in financial markets, affecting equities, bonds, commodities, and currencies. Sovereign risk refers to the possibility that a government might default on its debt obligations, impacting international investors and global financial stability. Both risks require distinct assessment strategies, with market risk driven by economic conditions and market sentiment, while sovereign risk depends on a country's political stability, fiscal health, and monetary policies.

Defining Market Risk

Market risk refers to the potential financial loss resulting from fluctuations in asset prices, interest rates, currency exchange rates, and equity markets. It encompasses systematic risks affecting entire markets or segments, driven by economic, political, or environmental factors. Unlike sovereign risk, which relates to a government's ability or willingness to meet debt obligations, market risk focuses on market-driven volatility impacting investments.

Understanding Sovereign Risk

Sovereign risk refers to the potential for a government to default on its debt or implement policies that negatively affect investors, distinguishing it from broader market risk which encompasses overall financial market fluctuations. Understanding sovereign risk involves evaluating a country's political stability, economic health, and fiscal policies to assess the likelihood of default or adverse regulatory changes. Key indicators include debt-to-GDP ratio, credit ratings by agencies like Moody's and S&P, and geopolitical factors impacting a nation's ability to meet its financial obligations.

Key Differences Between Market and Sovereign Risk

Market risk refers to the potential for losses due to fluctuations in financial markets, including equity prices, interest rates, and currency exchange rates, affecting investors and institutions. Sovereign risk specifically involves the possibility that a government may default on its debt obligations or implement policies adversely affecting bondholders and foreign investors. Key differences include market risk's exposure to market volatility and liquidity changes, whereas sovereign risk centers on political, economic stability, and government creditworthiness factors unique to a country's financial environment.

Major Factors Influencing Market Risk

Market risk is driven primarily by factors such as interest rate fluctuations, equity price volatility, and currency exchange rate movements, which affect the overall financial markets and asset values. Sovereign risk relates to a country's ability to meet its debt obligations and is influenced by political stability, economic performance, and fiscal policies. Understanding these distinctions is crucial for investors assessing exposure to market-specific uncertainties versus country-specific default risks.

Primary Drivers of Sovereign Risk

Sovereign risk primarily stems from a country's fiscal health, political stability, and external debt levels, which affect its ability to repay obligations. Unlike market risk, influenced by asset price volatility and investor sentiment, sovereign risk hinges on macroeconomic indicators such as GDP growth, inflation rates, and foreign exchange reserves. Understanding government policy decisions and geopolitical tensions provides critical insight into changes in sovereign creditworthiness and default probability.

Measuring and Assessing Market Risk

Measuring market risk involves quantifying potential losses due to fluctuations in asset prices, interest rates, or exchange rates using metrics such as Value at Risk (VaR), stress testing, and scenario analysis. These tools provide probabilistic estimates of maximum expected losses over a given time horizon under normal market conditions. In contrast, sovereign risk assessment focuses on evaluating a country's creditworthiness, political stability, and economic conditions that may affect its ability to meet debt obligations, relying heavily on sovereign credit ratings and macroeconomic indicators.

Evaluating Sovereign Risk Indicators

Evaluating sovereign risk indicators involves analyzing a country's credit ratings, debt-to-GDP ratio, political stability, and fiscal policies to assess its likelihood of defaulting on obligations. Market risk focuses on price volatility and exposure to market fluctuations, while sovereign risk specifically examines a nation's economic and political environment impacting its creditworthiness. Key indicators such as foreign exchange reserves, inflation rates, and external debt structure provide critical insights for investors gauging sovereign risk.

Impacts of Market and Sovereign Risk on Investments

Market risk affects investments through fluctuations in asset prices caused by economic changes, interest rate shifts, and political instability, leading to potential losses in portfolio value. Sovereign risk specifically impacts investments by increasing the chance of default on government bonds, currency devaluation, and capital controls, which can severely reduce returns and liquidity for international investors. Both risks influence investor confidence and can lead to heightened volatility and reduced capital flows in affected markets.

Strategies to Mitigate Market and Sovereign Risks

Diversifying investments across various asset classes and geographic regions reduces exposure to market risk and sovereign risk by minimizing the impact of localized economic downturns or political instability. Employing hedging techniques such as options, futures contracts, and currency swaps helps protect portfolios against adverse market fluctuations and currency devaluations linked to sovereign events. Monitoring macroeconomic indicators and political developments enables timely adjustments to investment strategies, enhancing resilience against market volatility and sovereign credit risk.

Market risk Infographic

libterm.com

libterm.com