Structural policy focuses on long-term economic and social reforms that enhance productivity, competitiveness, and sustainable growth. It addresses fundamental issues such as labor market efficiency, innovation, infrastructure development, and regulatory frameworks to create a resilient economic environment. Explore the rest of the article to understand how structural policy can shape Your economic future.

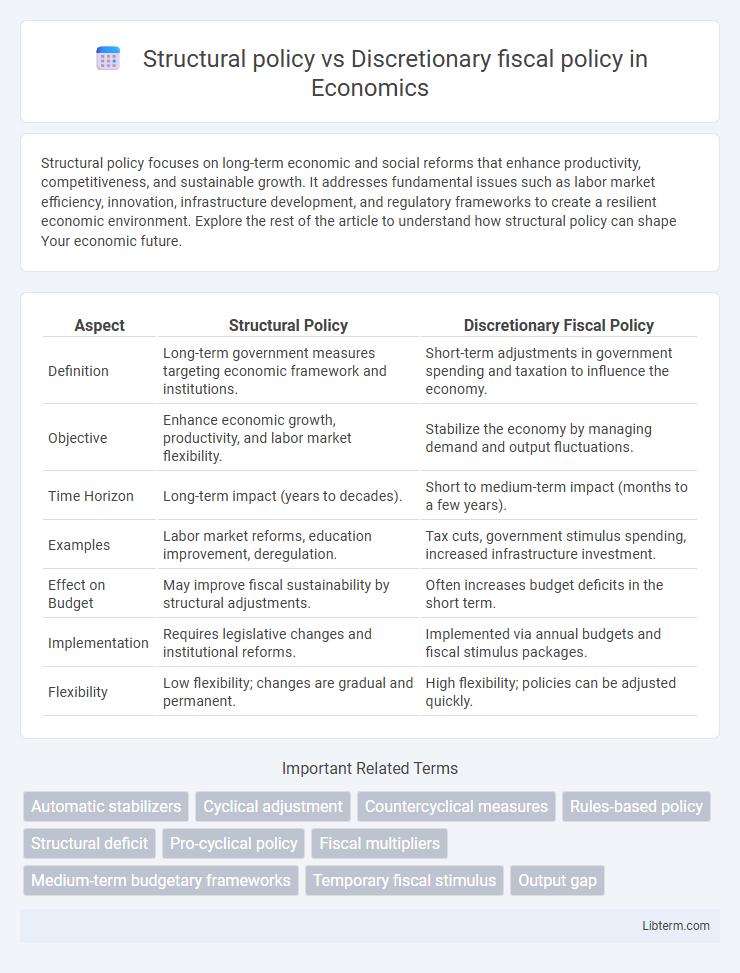

Table of Comparison

| Aspect | Structural Policy | Discretionary Fiscal Policy |

|---|---|---|

| Definition | Long-term government measures targeting economic framework and institutions. | Short-term adjustments in government spending and taxation to influence the economy. |

| Objective | Enhance economic growth, productivity, and labor market flexibility. | Stabilize the economy by managing demand and output fluctuations. |

| Time Horizon | Long-term impact (years to decades). | Short to medium-term impact (months to a few years). |

| Examples | Labor market reforms, education improvement, deregulation. | Tax cuts, government stimulus spending, increased infrastructure investment. |

| Effect on Budget | May improve fiscal sustainability by structural adjustments. | Often increases budget deficits in the short term. |

| Implementation | Requires legislative changes and institutional reforms. | Implemented via annual budgets and fiscal stimulus packages. |

| Flexibility | Low flexibility; changes are gradual and permanent. | High flexibility; policies can be adjusted quickly. |

Introduction to Economic Policies

Structural policy targets long-term economic fundamentals by reforming institutions, labor markets, and regulatory frameworks to enhance growth potential and competitiveness. Discretionary fiscal policy involves deliberate government interventions, such as altering tax rates or public spending, to stabilize economic fluctuations and influence aggregate demand in the short run. Both policies play critical roles in shaping economic stability, growth, and the effectiveness of monetary policy.

Defining Structural Policy

Structural policy refers to government measures aimed at improving the long-term economic framework by addressing fundamental issues like labor market rigidities, regulatory inefficiencies, and institutional reforms. Unlike discretionary fiscal policy, which involves short-term adjustments to government spending and taxation to influence economic cycles, structural policy targets sustainable growth and competitiveness by altering the underlying economic infrastructure. Key examples include reforms to enhance productivity, innovation incentives, and improving the business environment.

Understanding Discretionary Fiscal Policy

Discretionary fiscal policy involves deliberate changes in government spending and taxation to influence economic activity, aiming to stabilize output and control inflation. Unlike structural policy, which targets long-term economic reforms, discretionary measures respond quickly to short-term economic fluctuations by adjusting budgetary components. Key examples include stimulus packages during recessions and tax cuts designed to boost consumer demand and aggregate spending.

Key Objectives of Structural Policy

Structural policy aims to enhance the long-term economic framework by improving labor market efficiency, promoting innovation, and ensuring sustainable fiscal balance. It targets fundamental issues such as reducing structural unemployment, increasing productivity, and fostering competitive markets to support steady economic growth. These policies complement discretionary fiscal measures by addressing underlying economic weaknesses rather than short-term demand fluctuations.

Main Goals of Discretionary Fiscal Policy

Discretionary fiscal policy primarily aims to stabilize the economy by managing aggregate demand through government spending and taxation adjustments. Key goals include reducing unemployment during recessions, controlling inflation in periods of economic overheating, and promoting sustainable economic growth. This policy allows targeted interventions to address cyclical fluctuations and enhance overall macroeconomic stability.

Tools and Instruments Used

Structural policy relies on long-term regulatory frameworks, such as labor market reforms, tax code adjustments, and investment in infrastructure to influence economic efficiency and growth potential. Discretionary fiscal policy employs short-term government actions like changes in taxation rates, government spending, and transfer payments to stabilize economic fluctuations and control demand. Tools for structural policy include legislative changes and institutional reforms, while discretionary fiscal policy utilizes budgetary measures and fiscal stimulus packages.

Short-term vs Long-term Economic Impact

Structural policy targets long-term economic growth by implementing reforms that improve market efficiency and productivity, such as labor market adjustments and regulatory changes. Discretionary fiscal policy focuses on short-term economic stabilization through government spending and taxation adjustments aimed at managing aggregate demand and countering economic fluctuations. While structural policies reshape the economic framework over years, discretionary fiscal measures provide immediate stimulus or restraint, affecting output and employment in the short run.

Advantages and Limitations of Each Policy

Structural policy offers long-term economic stability by addressing fundamental issues such as labor market inefficiencies and regulatory barriers, enhancing productivity and growth potential; however, its implementation often requires extensive time and political consensus, limiting immediate impact. Discretionary fiscal policy provides flexibility to respond quickly to economic fluctuations through targeted government spending and tax adjustments, effectively stabilizing demand during recessions but risks increasing public debt and potential inflation if mismanaged. Both policies are essential for balanced economic management, yet structural reforms focus on sustainable growth while discretionary measures prioritize short-term economic stabilization.

Case Studies and Real-World Examples

Structural policy targets long-term economic growth by reforming labor markets, tax codes, and regulatory frameworks, as seen in Germany's Hartz reforms boosting employment and productivity since the early 2000s. Discretionary fiscal policy involves short-term government spending or tax measures to stabilize the economy, exemplified by the U.S. American Recovery and Reinvestment Act of 2009, which injected $831 billion to counteract the Great Recession. Case studies reveal structural reforms foster sustainable growth, while discretionary policies provide necessary demand stimulus during economic downturns.

Comparative Analysis and Policy Recommendations

Structural policy targets long-term economic stability by reforming fundamental institutions such as labor markets and tax systems, promoting sustained growth and employment. Discretionary fiscal policy focuses on short-term economic fluctuations by adjusting government spending and taxation to manage aggregate demand during recessions or booms. Policy recommendations emphasize combining structural reforms to enhance economic flexibility with calibrated discretionary measures to stabilize business cycles effectively.

Structural policy Infographic

libterm.com

libterm.com