Convenience yield represents the non-monetary benefits of holding physical inventory rather than futures contracts, often reflecting factors like immediate availability and reduced stock-out risk. This concept plays a crucial role in commodity markets by influencing the relationship between spot and futures prices. Explore the rest of the article to understand how convenience yield impacts your trading and investment strategies.

Table of Comparison

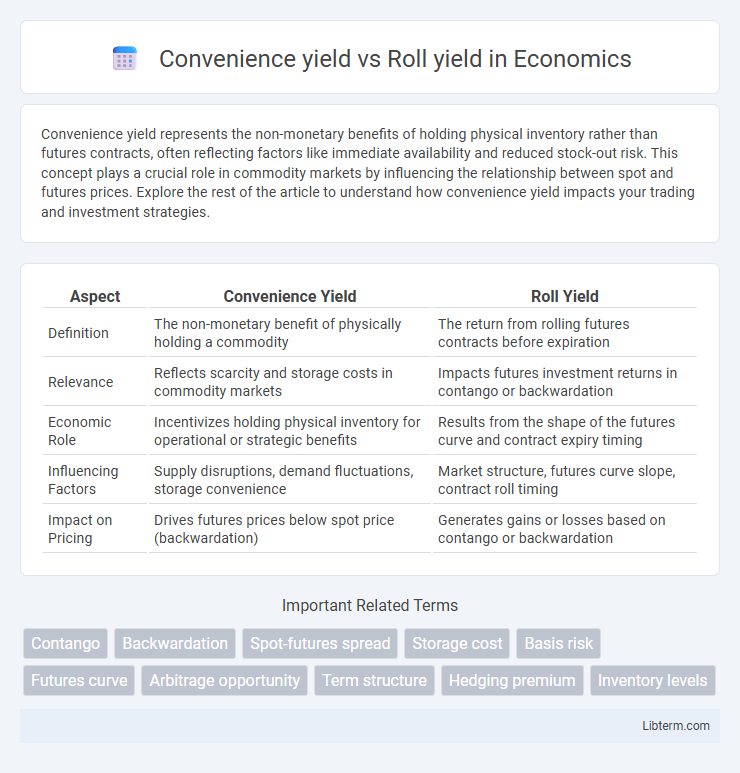

| Aspect | Convenience Yield | Roll Yield |

|---|---|---|

| Definition | The non-monetary benefit of physically holding a commodity | The return from rolling futures contracts before expiration |

| Relevance | Reflects scarcity and storage costs in commodity markets | Impacts futures investment returns in contango or backwardation |

| Economic Role | Incentivizes holding physical inventory for operational or strategic benefits | Results from the shape of the futures curve and contract expiry timing |

| Influencing Factors | Supply disruptions, demand fluctuations, storage convenience | Market structure, futures curve slope, contract roll timing |

| Impact on Pricing | Drives futures prices below spot price (backwardation) | Generates gains or losses based on contango or backwardation |

Introduction to Commodity Yields

Commodity yields represent crucial factors influencing futures pricing and investor returns, with convenience yield embodying the non-monetary benefits of holding physical commodities, such as storage availability and market supply assurance. Roll yield arises from the process of rolling over futures contracts, reflecting gains or losses due to the shape of the futures curve, typically contango or backwardation. Understanding the distinction between convenience yield and roll yield is essential for accurately assessing the cost and profitability of commodity investments.

Defining Convenience Yield

Convenience yield refers to the non-monetary benefits or advantages of physically holding a commodity, such as ensuring supply availability or avoiding production disruptions. This yield is a crucial factor in commodity markets as it influences the futures prices relative to spot prices, reflecting the value of immediate possession. Roll yield, on the other hand, arises from the process of rolling over futures contracts and is affected by the difference between spot and futures prices, but it does not capture the inherent benefits of physical ownership that convenience yield represents.

Understanding Roll Yield

Roll yield represents the gain or loss generated when futures contracts are periodically rolled over from a near-expiry contract to a longer-dated one, influenced by the shape of the futures curve such as contango or backwardation. Convenience yield reflects the non-monetary benefits of physically holding an asset, often resulting in futures prices being lower or higher than spot prices due to factors like storage costs or immediate availability. Understanding roll yield is crucial for investors in commodity futures, as it directly affects returns independently from spot price movements or convenience yield fluctuations.

Key Differences Between Convenience Yield and Roll Yield

Convenience yield represents the non-monetary benefit or premium investors gain from physically holding a commodity, reflecting supply-demand imbalances and storage advantages. Roll yield arises from the difference in futures contract prices during the process of rolling over expiring contracts, influenced by the shape of the futures curve, such as contango or backwardation. While convenience yield is intrinsic and tied to actual commodity possession, roll yield is a financial return or cost realized through futures trading strategies.

Factors Influencing Convenience Yield

Convenience yield is influenced by factors such as inventory levels, market demand, and storage costs, which determine the immediate benefits of holding a physical commodity. High convenience yield often occurs in periods of shortage or supply disruptions, increasing the value of possession relative to futures contracts. Roll yield, by contrast, derives from the price differences between expiring and new contracts, reflecting the cost or benefit of maintaining futures positions rather than spot asset advantages.

Factors Affecting Roll Yield

Roll yield is primarily influenced by the shape of the futures curve, such as contango or backwardation conditions, which dictate whether rolling contracts results in gains or losses. Market liquidity and the timing of roll periods also impact roll yield by affecting transaction costs and slippage during contract rollover. Storage costs, interest rates, and seasonal demand variations further modify roll yield by altering the relative futures prices and the ease of rolling positions.

Convenience Yield in Commodity Markets

Convenience yield in commodity markets represents the non-monetary benefits of physically holding a commodity, such as ensuring supply security and avoiding stockouts, which increases the asset's value beyond spot price. It influences the relationship between spot and futures prices, often causing futures prices to trade at a discount or premium depending on market conditions and inventory levels. Understanding convenience yield is crucial for commodity traders as it affects hedging strategies and the interpretation of futures price movements relative to underlying physical demand.

Roll Yield in Futures Trading

Roll yield in futures trading represents the profit or loss generated when a trader rolls over a futures contract approaching expiration into a longer-dated contract, capturing the price difference between the two contracts. It is influenced by the shape of the futures curve, with contango causing negative roll yield and backwardation contributing to positive roll yield. Understanding roll yield is crucial for investors in commodities futures, as it impacts total returns and reflects market conditions beyond spot price movements and convenience yield.

Practical Implications for Investors

Convenience yield reflects the non-monetary advantages of physically holding a commodity, such as ensuring supply during shortages, which can justify paying a premium over futures prices. Roll yield arises when investors continuously roll over futures contracts, capturing gains or losses depending on whether the market is in contango or backwardation, directly impacting portfolio returns. Understanding the interplay between convenience yield and roll yield enables investors to better assess storage costs, timing strategies, and potential arbitrage opportunities in commodity markets.

Conclusion: Strategic Considerations

Convenience yield represents the non-monetary benefits of physically holding a commodity, influencing inventory decisions and spot-futures price relationships. Roll yield arises from the impact of rolling futures contracts in contango or backwardation markets, affecting overall investment returns. Strategic considerations involve balancing convenience yield advantages against potential roll yield losses to optimize commodity investment performance and risk management.

Convenience yield Infographic

libterm.com

libterm.com