A Cournot competitor operates in a market where firms choose quantities simultaneously, each aiming to maximize profit given the quantities set by rivals. This strategic interaction shapes market prices and influences competition outcomes significantly. Discover how understanding Cournot competition can enhance your insight into market dynamics by reading the full article.

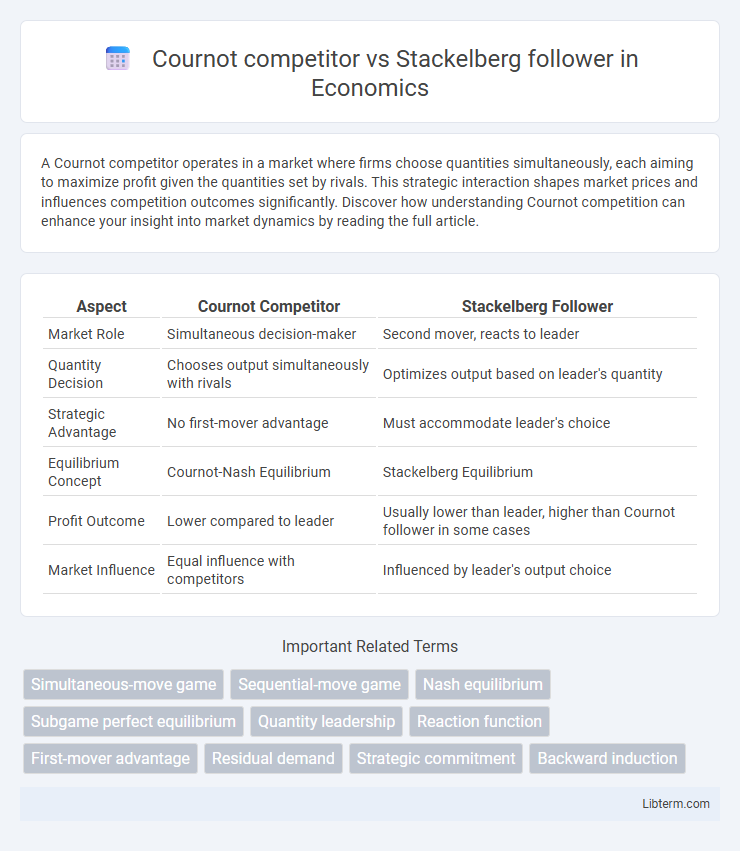

Table of Comparison

| Aspect | Cournot Competitor | Stackelberg Follower |

|---|---|---|

| Market Role | Simultaneous decision-maker | Second mover, reacts to leader |

| Quantity Decision | Chooses output simultaneously with rivals | Optimizes output based on leader's quantity |

| Strategic Advantage | No first-mover advantage | Must accommodate leader's choice |

| Equilibrium Concept | Cournot-Nash Equilibrium | Stackelberg Equilibrium |

| Profit Outcome | Lower compared to leader | Usually lower than leader, higher than Cournot follower in some cases |

| Market Influence | Equal influence with competitors | Influenced by leader's output choice |

Introduction to Cournot and Stackelberg Competition

Cournot competition models firms choosing quantities simultaneously, assuming competitors' outputs remain fixed, leading to a Nash equilibrium where each firm's output maximizes its profit given rivals' quantities. Stackelberg competition features a leader firm that commits to an output level first, while the follower firm reacts by optimizing its quantity based on the leader's decision, creating a sequential game with a strategic advantage for the leader. The difference in timing and information structure results in distinct equilibrium outcomes, with the Stackelberg leader typically earning higher profits compared to Cournot firms operating simultaneously.

Defining Cournot Competitor

A Cournot competitor is a firm in an oligopoly that chooses its output quantity simultaneously with rivals, aiming to maximize profit based on the expected quantities of competitors. The Cournot model assumes firms have market power but make decisions independently without knowing competitors' choices beforehand. In contrast, a Stackelberg follower observes the leader's output decision before optimizing its own production level, reacting strategically to the leader's quantity.

Understanding Stackelberg Follower

The Stackelberg follower observes the leader's output decision before choosing its own quantity, allowing the follower to optimize its response strategically. This sequential move advantage contrasts with the simultaneous decisions in Cournot competition, where firms choose quantities without knowing rivals' choices. Understanding the Stackelberg follower's role highlights how timing and information influence competitive dynamics and market equilibrium outcomes.

Key Differences: Cournot vs. Stackelberg Models

Cournot competitors choose output quantities simultaneously, leading to a Nash equilibrium where each firm's decision is based on the expected output of rivals, while Stackelberg followers react sequentially to the leader's pre-decided quantity. The Stackelberg model results in a first-mover advantage, with the leader securing a higher market share and profit compared to the Cournot model's symmetric outcomes. Key differences include timing of moves, strategic commitment, and the resulting equilibrium quantities and profits, where Stackelberg equilibrium typically dominates Cournot in terms of leader's strategic benefits.

Strategic Decision-Making in Both Frameworks

Cournot competitors make simultaneous quantity decisions, each firm assuming the rival's output as fixed, leading to mutual interdependence in strategic quantity setting. Stackelberg followers, in contrast, observe the leader's committed output before choosing their own quantity, enabling them to optimize their response based on the leader's strategic move. This sequential decision-making in Stackelberg models creates a first-mover advantage for leaders, while Cournot competitors face symmetric strategic uncertainty.

Market Outcomes: Quantity and Pricing

Cournot competitors choose quantities simultaneously, leading to equilibrium quantities where each firm's output decision affects market price, typically resulting in moderate total quantity and intermediate prices. Stackelberg followers, acting after leaders set their output, produce smaller quantities due to the leader's commitment, causing overall market quantity to be higher than Cournot but with lower prices set by leaders. The Stackelberg model generally yields a strategic advantage for leaders by allowing them to influence market outcomes more effectively, driving prices down compared to the Cournot equilibrium.

First-Mover and Second-Mover Advantages

In Cournot competition, firms choose quantities simultaneously, which means no firm has a first-mover advantage, leading to symmetric outcomes. Stackelberg competition features a leader-follower dynamic where the first mover (leader) commits to a quantity first, securing a strategic advantage by influencing the follower's decision. The second mover (follower) in Stackelberg competition reacts optimally to the leader's choice but typically earns lower profits due to the leader's first-mover advantage.

Real-World Examples of Cournot and Stackelberg Roles

In the telecommunications industry, major firms like AT&T and Verizon often act as Cournot competitors by simultaneously deciding output levels to maximize profits under mutual interdependence. In contrast, automotive companies such as Toyota frequently assume the Stackelberg follower role by reacting strategically to industry leaders like Ford, who set production quantities first. These real-world examples illustrate how firms dynamically position themselves within oligopolistic markets based on the Cournot and Stackelberg competition models.

Implications for Business Strategy

Cournot competitors simultaneously choose output quantities based on rivals' expected production, creating a stable equilibrium but limited market influence. Stackelberg followers react sequentially to a leader's output decision, resulting in diminished strategic power and reduced profits compared to the leader. Businesses facing Stackelberg followers can leverage first-mover advantages, setting quantities to capture larger market shares and influence competitor behavior effectively.

Conclusion: Choosing the Right Competitive Approach

Choosing between Cournot competition and Stackelberg follower strategies depends on market structure and firm capabilities; Cournot fits firms with simultaneous decision-making and comparable market power, while Stackelberg benefits firms with leader-follower dynamics and first-mover advantages. The Stackelberg follower optimizes output by observing the leader's quantity, often resulting in strategic responses that improve outcomes under asymmetric information. Firms should evaluate their strategic positioning, market influence, and information availability to select the competitive approach that maximizes profit and market efficiency.

Cournot competitor Infographic

libterm.com

libterm.com