Benefit taxation focuses on taxing individuals or entities based on the benefits they receive rather than their income or consumption. This approach ensures a fairer allocation of tax burdens, aligning tax liabilities with the actual advantages gained from public services or resources. Explore the rest of the article to understand how benefit taxation could impact Your financial planning and public policy.

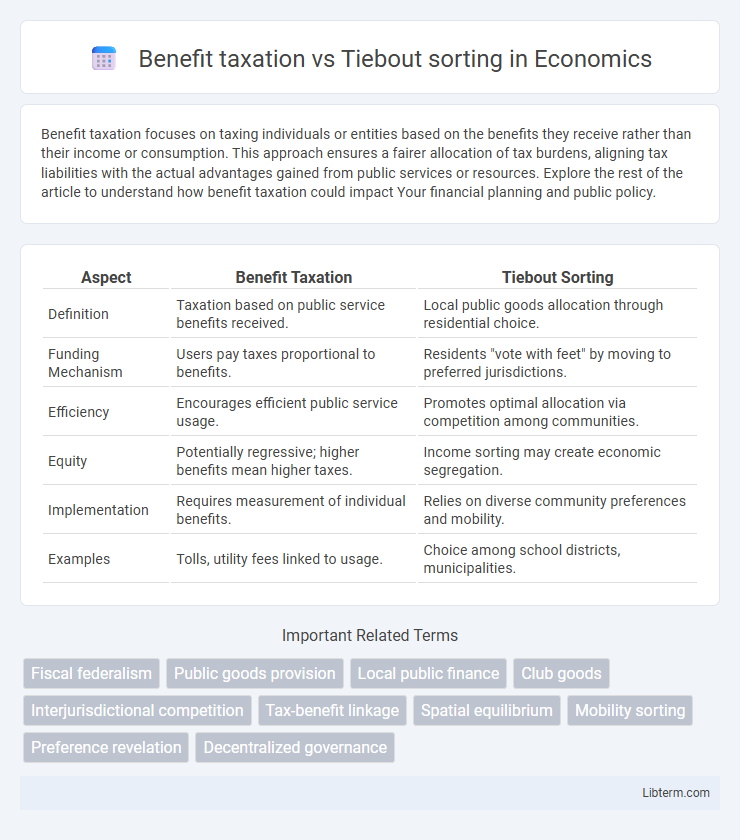

Table of Comparison

| Aspect | Benefit Taxation | Tiebout Sorting |

|---|---|---|

| Definition | Taxation based on public service benefits received. | Local public goods allocation through residential choice. |

| Funding Mechanism | Users pay taxes proportional to benefits. | Residents "vote with feet" by moving to preferred jurisdictions. |

| Efficiency | Encourages efficient public service usage. | Promotes optimal allocation via competition among communities. |

| Equity | Potentially regressive; higher benefits mean higher taxes. | Income sorting may create economic segregation. |

| Implementation | Requires measurement of individual benefits. | Relies on diverse community preferences and mobility. |

| Examples | Tolls, utility fees linked to usage. | Choice among school districts, municipalities. |

Understanding Benefit Taxation: A Semantic Overview

Benefit taxation allocates public service costs based on the benefits received by taxpayers, ensuring a direct correlation between tax contributions and service usage. This approach contrasts with Tiebout sorting, where individuals "vote with their feet" by choosing communities that best match their preference for public goods and tax levels. Understanding benefit taxation requires analyzing fiscal equity, efficiency in public goods provision, and taxpayer mobility incentives within heterogeneous local jurisdictions.

The Tiebout Model: Core Principles and Mechanisms

The Tiebout model centers on the idea that individuals "vote with their feet" by moving to communities offering their preferred mix of public goods and tax levels, promoting local government efficiency through competition. Core principles include mobility of residents, full information about local services, and a variety of communities differentiated by public goods provision and taxation. Mechanisms of this model rely on local governments setting tax-benefit packages, enabling residents to sort themselves into jurisdictions that best align with their preferences, which theoretically results in optimal public goods provision and efficient benefit taxation.

Key Differences Between Benefit Taxation and Tiebout Sorting

Benefit taxation imposes taxes based on the direct benefits received from public goods, ensuring a link between payment and service usage, while Tiebout sorting relies on individuals choosing communities that best match their preference for public goods and tax levels. Benefit taxation emphasizes equitable cost recovery through user charges, whereas Tiebout sorting highlights mobility and competition among jurisdictions to reveal residents' demand for services. Key differences include the mechanism of funding public goods--direct taxation versus residential sorting--and the assumptions about individual behavior, either paying for benefits received or relocating to preferred service-tax bundles.

Fiscal Federalism: Context for the Debate

Benefit taxation aligns tax payments with the provision of specific local public goods, promoting efficiency by matching costs to benefits within jurisdictions. Tiebout sorting emphasizes residential choice, where individuals select communities that best fit their preferences for public services and tax levels, fostering competition among local governments. In fiscal federalism, the debate centers on balancing centralized taxation efficiency and decentralized choice mechanisms to optimize public goods provision and economic welfare.

Efficiency Outcomes in Benefit Taxation vs Tiebout Sorting

Benefit taxation aligns public service provision with individual preferences by charging users based on their consumption, promoting allocative efficiency through direct cost-benefit signals. Tiebout sorting, whereby individuals sort themselves into jurisdictions matching their service-price preferences, enhances efficiency by enabling local governments to tailor public goods to residents' preferences, reducing mismatch costs. Both mechanisms improve efficiency outcomes, but benefit taxation directly incentivizes usage patterns while Tiebout sorting relies on residential mobility to reveal preference heterogeneity.

Equity and Redistribution Implications

Benefit taxation links public service payments directly to individual usage, promoting efficiency but often resulting in less equitable outcomes due to varied ability to pay. Tiebout sorting encourages residents to self-select communities based on preferences and tax levels, which can lead to economic segregation and limit redistribution across different income groups. Equity concerns arise as benefit taxation may disproportionately burden lower-income individuals, while Tiebout sorting can hinder broader redistributive policies by fragmenting the tax base.

Mobility, Voting with Feet, and Local Choice

Benefit taxation aligns local public goods provision directly with residents' preferences through user fees, enhancing mobility by enabling individuals to "vote with their feet" when relocating to communities that best match their desired services. Tiebout sorting emphasizes that competition among local governments leads to efficient public good allocation by allowing residents to choose jurisdictions according to tax-price bundles, reinforcing local choice and incentivizing governments to tailor policies for diverse preferences. Both frameworks underscore the role of mobility in improving local governance, where benefit taxation provides clear service pricing while Tiebout sorting relies on the sorting mechanism to reveal residents' preferences and influence municipal decision-making.

Practical Challenges and Real-World Evidence

Benefit taxation faces practical challenges such as accurately measuring individual benefits and administrative costs, which complicate its implementation and reduce efficiency. Tiebout sorting assumes perfect mobility and complete information, conditions rarely met in real-world settings, leading to less-than-ideal residential sorting and public good allocation. Empirical evidence shows mixed outcomes, with Tiebout models performing better in homogeneous, mobile populations, while benefit taxation struggles in complex, heterogeneous urban environments.

Policy Implications for Local Governments

Benefit taxation aligns public service funding with individual usage, promoting efficiency and fairness in local government finance. Tiebout sorting, where residents choose jurisdictions based on preferences for public goods and tax levels, incentivizes local governments to tailor services competitively. Policy implications suggest local authorities should balance benefit-based taxation with strategic service differentiation to optimize resource allocation and attract diverse resident profiles.

Future Directions: Integrating Benefit Taxation and Tiebout Insights

Future research may explore integrating benefit taxation with Tiebout sorting by designing local public finance models that align taxation more closely with residents' revealed preferences for public goods. Empirical studies could leverage advanced data analytics to assess how varying tax-benefit structures influence migration patterns and local service provision efficiency. This integration aims to optimize allocation of resources, enhance fiscal equity, and improve public goods delivery by combining market mechanisms with tailored tax-benefit approaches.

Benefit taxation Infographic

libterm.com

libterm.com