Money non-neutrality occurs when changes in the money supply impact real economic variables like output and employment, rather than just affecting nominal variables such as prices. This phenomenon challenges the classical economic theory that money only influences price levels and highlights the role of monetary policy in shaping economic activity. Explore the article to understand how money non-neutrality affects Your financial decisions and broader economic outcomes.

Table of Comparison

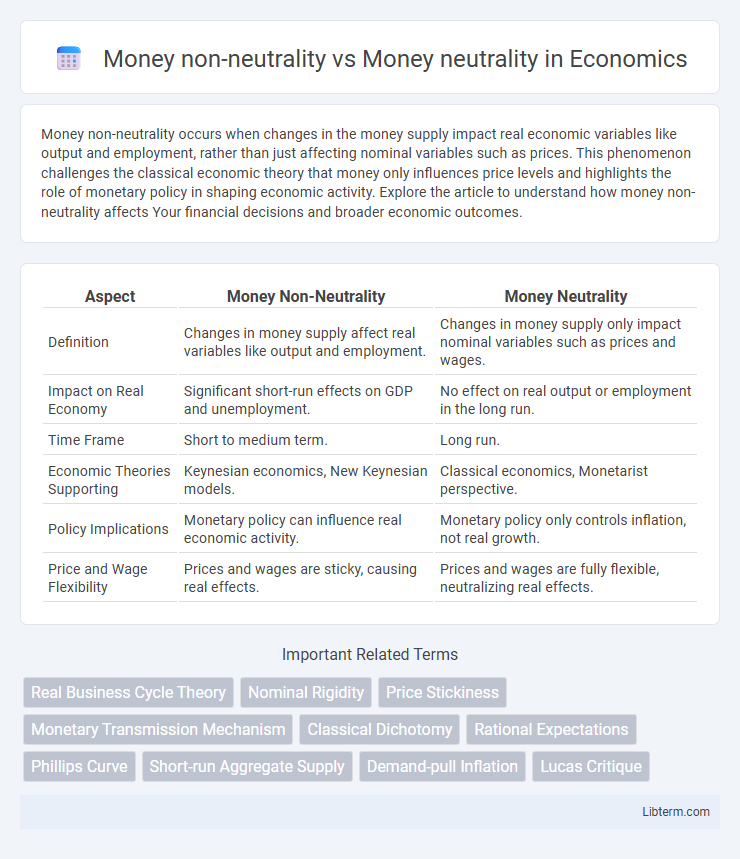

| Aspect | Money Non-Neutrality | Money Neutrality |

|---|---|---|

| Definition | Changes in money supply affect real variables like output and employment. | Changes in money supply only impact nominal variables such as prices and wages. |

| Impact on Real Economy | Significant short-run effects on GDP and unemployment. | No effect on real output or employment in the long run. |

| Time Frame | Short to medium term. | Long run. |

| Economic Theories Supporting | Keynesian economics, New Keynesian models. | Classical economics, Monetarist perspective. |

| Policy Implications | Monetary policy can influence real economic activity. | Monetary policy only controls inflation, not real growth. |

| Price and Wage Flexibility | Prices and wages are sticky, causing real effects. | Prices and wages are fully flexible, neutralizing real effects. |

Introduction to Money Non-Neutrality and Money Neutrality

Money neutrality posits that changes in the money supply only affect nominal variables such as prices and wages, leaving real variables like output and employment unchanged in the long run. Money non-neutrality argues that variations in the money supply can influence real economic activity and output, especially in the short run due to price and wage rigidities. Understanding these concepts is crucial for analyzing monetary policy effects on economic growth, inflation, and unemployment.

Defining Money Neutrality: Core Concepts

Money neutrality refers to the economic theory that changes in the money supply only affect nominal variables, such as prices and wages, without influencing real variables like output, employment, or real GDP. In contrast, money non-neutrality suggests that variations in the money supply can impact real economic activity, especially in the short run due to price and wage rigidities. Core concepts include the classical dichotomy separating real and nominal variables and the short-run versus long-run distinctions in monetary effects.

Understanding Money Non-Neutrality: Key Principles

Money non-neutrality refers to the concept that changes in the money supply can have real effects on output, employment, and economic decisions in the short run due to price and wage rigidities. Key principles include the impact of nominal rigidities, where prices and wages do not adjust instantly, causing monetary fluctuations to influence real variables. This contrasts with money neutrality, which suggests that changes in the money supply only affect nominal variables like price levels, having no lasting impact on real economic outcomes.

Historical Evolution of Monetary Thought

Monetary thought evolved from classical economists advocating money neutrality, where changes in money supply only affect nominal variables, to Keynesian perspectives emphasizing money non-neutrality, highlighting its impact on real output and employment in the short run. The Monetarist school reasserted a partial neutrality view, arguing for long-term neutrality but acknowledging short-term effects due to price rigidities. Recent New Keynesian models integrate microfoundations and price stickiness, reinforcing money's non-neutral role in influencing real economic activity during economic fluctuations.

Short-Run vs Long-Run Effects of Monetary Policy

Money non-neutrality occurs in the short run when changes in the money supply affect real variables like output and employment due to price stickiness and imperfect information. In contrast, money neutrality holds in the long run as prices fully adjust, making monetary policy influence only nominal variables such as inflation and the money supply. Central banks can exploit short-run non-neutrality to stabilize the economy, but long-run neutrality limits monetary policy's ability to impact real economic growth.

Classical vs Keynesian Perspectives

Classical economists argue for money neutrality, positing that changes in the money supply only affect nominal variables without impacting real output or employment in the long run. Keynesian theory challenges this by emphasizing money non-neutrality, asserting that variations in money supply can influence real economic activity and aggregate demand, especially in the short run due to price and wage rigidities. Empirical evidence supports Keynesian views during periods of economic downturns where monetary policy can stimulate demand and reduce unemployment.

Real-World Evidence: Case Studies and Empirical Data

Empirical data from diverse economies illustrate money non-neutrality through short-term effects of monetary policy on output and employment, as seen in the 2008 financial crisis stimulus measures that boosted GDP growth rates temporarily. Case studies from emerging markets, such as Brazil and India, reveal that changes in money supply influence inflation and real wages, contradicting strict neutrality assumptions. However, long-term data from hyperinflation episodes in Zimbabwe and Venezuela support money neutrality by demonstrating nominal variables adjusting fully without lasting real output changes.

Policy Implications of Money Neutrality and Non-Neutrality

Money non-neutrality implies changes in the money supply can influence real variables such as output and employment, suggesting that monetary policy can effectively stabilize the economy during recessions. Money neutrality, however, argues that changes in the money supply only affect nominal variables like prices and wages, indicating limited effectiveness of monetary policy on real economic performance in the long run. Policymakers must consider whether money is neutral or non-neutral to design appropriate interventions; if non-neutral, active monetary policy can mitigate business cycles, while if neutral, emphasis should shift to structural reforms for sustained growth.

Criticisms and Limitations of Each Viewpoint

Money non-neutrality faces criticism for overemphasizing short-term effects and underestimating the economy's adjustment mechanisms, leading to potential misguidance in monetary policy. Money neutrality, on the other hand, is limited by its assumption of long-term money supply changes having no real effects, which ignores short-run price stickiness and market frictions observed in empirical data. Both perspectives face challenges in fully capturing complex economic dynamics, necessitating more integrated approaches to monetary theory.

Conclusion: Money’s Role in Modern Economic Analysis

Money non-neutrality emphasizes the short-term impact of monetary policy on real economic variables such as output and employment, reflecting how price and wage rigidities influence economic fluctuations. Money neutrality asserts that in the long run, changes in the money supply only affect nominal variables like inflation, leaving real variables unchanged. Modern economic analysis integrates both views, recognizing monetary policy's critical role in stabilizing the economy short-term while acknowledging its limited influence on long-term real growth.

Money non-neutrality Infographic

libterm.com

libterm.com