Floating rate bonds offer investors protection against rising interest rates by adjusting the coupon payments based on a reference rate, such as LIBOR or the Fed funds rate. These bonds typically have lower interest rate risk compared to fixed-rate bonds, making them attractive in volatile or inflationary environments. Explore the rest of this article to understand how floating rate bonds can enhance your investment portfolio.

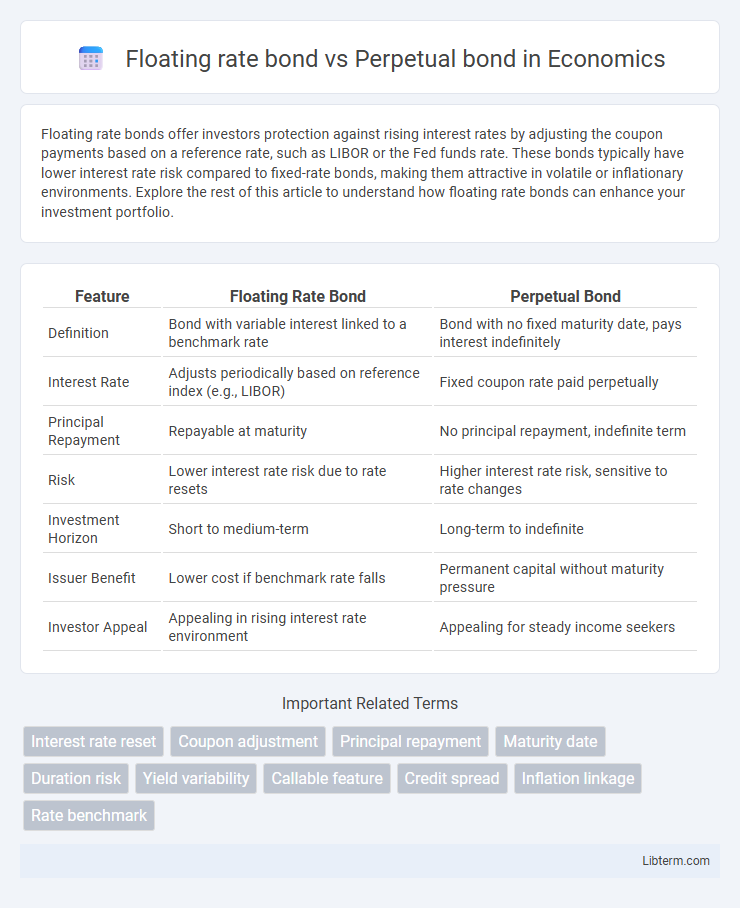

Table of Comparison

| Feature | Floating Rate Bond | Perpetual Bond |

|---|---|---|

| Definition | Bond with variable interest linked to a benchmark rate | Bond with no fixed maturity date, pays interest indefinitely |

| Interest Rate | Adjusts periodically based on reference index (e.g., LIBOR) | Fixed coupon rate paid perpetually |

| Principal Repayment | Repayable at maturity | No principal repayment, indefinite term |

| Risk | Lower interest rate risk due to rate resets | Higher interest rate risk, sensitive to rate changes |

| Investment Horizon | Short to medium-term | Long-term to indefinite |

| Issuer Benefit | Lower cost if benchmark rate falls | Permanent capital without maturity pressure |

| Investor Appeal | Appealing in rising interest rate environment | Appealing for steady income seekers |

Introduction to Floating Rate Bonds and Perpetual Bonds

Floating rate bonds feature variable interest rates that adjust periodically based on a reference benchmark like LIBOR or SOFR, providing protection against rising interest rates and reducing interest rate risk for investors. Perpetual bonds have no maturity date, paying interest indefinitely, which allows issuers to treat them as equity-like instruments while offering investors steady income with higher credit risk. Both bond types cater to different investment strategies: floating rate bonds suit those seeking inflation protection and liquidity, while perpetual bonds attract investors looking for long-term income streams.

Key Features of Floating Rate Bonds

Floating rate bonds feature variable interest rates that adjust periodically based on a reference benchmark like LIBOR or SOFR, providing investors protection against rising interest rates. These bonds have a fixed maturity date, unlike perpetual bonds, which have no maturity and pay coupons indefinitely. The interest payments of floating rate bonds fluctuate with market rates, offering more stable value and reducing interest rate risk compared to fixed-rate or perpetual bonds.

Key Features of Perpetual Bonds

Perpetual bonds are fixed-income securities with no maturity date, offering investors indefinite coupon payments, which differ from floating rate bonds that have variable interest tied to benchmark rates like LIBOR or SOFR. These bonds typically provide higher yields to compensate for interest rate risk and lack of principal repayment, appealing to investors seeking long-term income streams. Their key features include the absence of a redemption date, fixed coupon rates, and subordinated claim status in case of issuer insolvency.

Interest Rate Mechanisms: Floating vs Fixed

Floating rate bonds feature variable interest payments tied to a benchmark rate such as LIBOR or SOFR, adjusting periodically to market fluctuations, which helps mitigate interest rate risk for investors. Perpetual bonds, in contrast, pay fixed interest rates indefinitely with no maturity date, exposing holders to greater sensitivity from market interest rate changes. The adjustable coupon of floating rate bonds makes them more attractive during rising rate environments, while perpetual bonds appeal to those seeking stable, long-term income despite potential price volatility.

Maturity and Redemption Differences

Floating rate bonds have a fixed maturity date, allowing investors to redeem their principal at that specific time, while perpetual bonds lack a maturity date and do not require redemption, potentially providing indefinite interest payments. The absence of maturity in perpetual bonds increases interest rate risk and limits liquidity compared to floating rate bonds, which reset coupon rates periodically based on benchmark rates like LIBOR or SOFR. Investors seeking capital return at a defined horizon typically prefer floating rate bonds, whereas perpetual bonds appeal to those targeting long-term income without principal repayment.

Risk Profiles: Credit and Interest Rate Risks

Floating rate bonds exhibit lower interest rate risk due to their coupon payments adjusting with benchmark rates like LIBOR or SOFR, making them more resilient to rising rates but susceptible to credit risk depending on the issuer's creditworthiness. Perpetual bonds carry higher interest rate risk as their fixed coupons remain constant indefinitely, causing price sensitivity to rate fluctuations, while also facing elevated credit risk tied to the issuer's ability to meet perpetual obligations without maturity. Investors must assess credit ratings and market interest trends to balance yield potential against exposure to credit deterioration and rate volatility in both bond types.

Return Potential and Income Stability

Floating rate bonds offer return potential linked to prevailing interest rates, providing protection against rising rates and more stable income through periodic coupon adjustments. Perpetual bonds lack maturity, often yielding higher fixed coupons to compensate for increased interest rate risk, resulting in less predictable income streams. Investors seeking stable income favor floating rate bonds, while those targeting higher, long-term returns may consider perpetual bonds despite volatility.

Investor Suitability and Use Cases

Floating rate bonds suit investors seeking protection against interest rate volatility through variable coupon payments linked to benchmark rates, making them ideal for conservative portfolios and short- to medium-term horizons. Perpetual bonds appeal to investors prioritizing steady income streams with no maturity date, fitting well in long-term income-focused strategies or institutional portfolios aiming for yield enhancement. Both instruments serve distinct risk profiles and investment goals, with floating rate bonds mitigating interest rate risk and perpetual bonds emphasizing income stability.

Market Performance and Liquidity Factors

Floating rate bonds typically exhibit lower interest rate risk due to their coupon payments adjusting with benchmark rates, enhancing market performance during rising rate environments. Perpetual bonds carry no maturity date, often resulting in higher price volatility and sensitivity to interest rate changes, which can negatively impact market performance. Liquidity for floating rate bonds is generally stronger, as investors favor their adaptability, while perpetual bonds may experience thinner trading volumes due to their complex risk profile and indefinite duration.

Choosing Between Floating Rate and Perpetual Bonds

Choosing between floating rate bonds and perpetual bonds depends on risk tolerance and investment goals. Floating rate bonds offer variable interest tied to benchmark rates, reducing interest rate risk but with uncertain coupon payments, while perpetual bonds provide fixed, infinite coupon payments but carry higher interest rate sensitivity and no principal repayment. Investors seeking income stability with inflation protection may prefer floating rate bonds, whereas those aiming for long-term income with higher yield might opt for perpetual bonds.

Floating rate bond Infographic

libterm.com

libterm.com