Indifference curves represent combinations of two goods that provide the same level of satisfaction or utility to a consumer, illustrating their preferences without specifying actual quantities. These curves are crucial for understanding consumer choice behavior and how individuals allocate resources to maximize happiness under budget constraints. Explore the rest of the article to see how indifference curves shape economic decision-making and influence market dynamics.

Table of Comparison

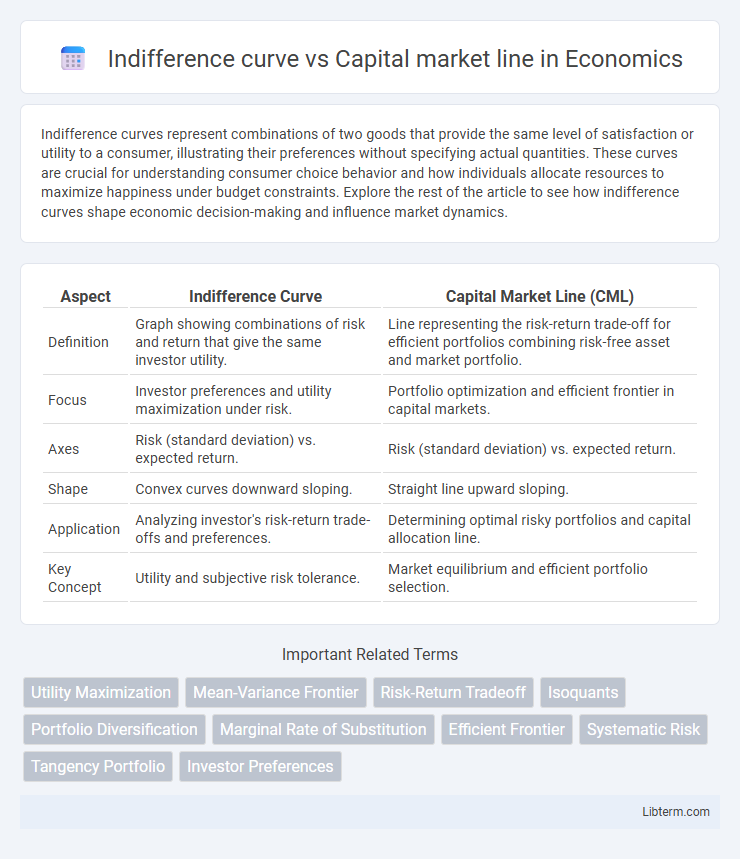

| Aspect | Indifference Curve | Capital Market Line (CML) |

|---|---|---|

| Definition | Graph showing combinations of risk and return that give the same investor utility. | Line representing the risk-return trade-off for efficient portfolios combining risk-free asset and market portfolio. |

| Focus | Investor preferences and utility maximization under risk. | Portfolio optimization and efficient frontier in capital markets. |

| Axes | Risk (standard deviation) vs. expected return. | Risk (standard deviation) vs. expected return. |

| Shape | Convex curves downward sloping. | Straight line upward sloping. |

| Application | Analyzing investor's risk-return trade-offs and preferences. | Determining optimal risky portfolios and capital allocation line. |

| Key Concept | Utility and subjective risk tolerance. | Market equilibrium and efficient portfolio selection. |

Introduction to Indifference Curve and Capital Market Line

Indifference curves represent combinations of risk and return that provide investors with equal satisfaction or utility, illustrating their risk preferences. The Capital Market Line (CML) depicts the risk-return trade-off for efficient portfolios combining a risk-free asset with the market portfolio, showing the highest expected return for a given level of risk. Understanding both concepts is essential for optimizing portfolio allocation and maximizing investor utility in modern portfolio theory.

Core Concepts: Utility and Investment Efficiency

Indifference curves represent combinations of risk and return that provide investors with equal utility, reflecting their personal risk preferences and satisfaction levels. The Capital Market Line (CML) illustrates the most efficient portfolios by maximizing expected return for a given level of risk through a combination of the risk-free asset and the market portfolio. While indifference curves focus on investor utility, the CML emphasizes investment efficiency by identifying the optimal risk-return trade-off available in the capital market.

Assumptions Behind Indifference Curves

Indifference curves assume investors are rational and prefer higher returns for the same level of risk, exhibiting consistent risk aversion and diminishing marginal rates of substitution between wealth combinations. These curves depict combinations of risk and return yielding equal investor satisfaction, relying on smooth, convex shapes reflecting continuous trade-offs. Unlike the Capital Market Line, which assumes perfect markets and risk-free borrowing, indifference curve assumptions focus on investor preferences without market equilibrium constraints.

Foundations of the Capital Market Line

The Capital Market Line (CML) represents portfolios that optimally combine risk and return, rooted in the Capital Asset Pricing Model (CAPM) which assumes investors hold efficient portfolios combining a risk-free asset and the market portfolio. Unlike indifference curves that depict individual investor preferences for risk-return trade-offs without specifying market equilibrium, the CML quantifies the highest expected return for a given level of portfolio risk based on market-wide parameters. The foundational concept of the CML is the availability of a risk-free asset that enables investors to achieve superior risk-return combinations compared to those illustrated by traditional indifference curves, leading to market efficiency and equilibrium pricing.

Graphical Representation and Interpretation

The indifference curve graphically represents combinations of risk and expected return providing an investor with equal satisfaction or utility, typically convex to the origin reflecting risk aversion. The capital market line (CML) plots the risk-return trade-off of efficient portfolios, showing the highest expected return achievable at each level of risk, represented by a straight line originating from the risk-free rate. While the indifference curve illustrates investor preferences, the CML illustrates the market's optimal portfolio choices, and their tangency point determines the optimal risky portfolio.

Key Differences: Risk Preferences vs Market Opportunities

Indifference curves represent individual investor risk preferences by illustrating combinations of risk and return that provide equal satisfaction, while the Capital Market Line (CML) depicts the best achievable risk-return trade-offs available through market opportunities, assuming efficient portfolios. Indifference curves are subjective and vary across investors based on their unique utility functions, whereas the CML is an objective benchmark derived from the market portfolio and the risk-free asset. The key difference lies in risk preferences reflecting personal tolerance for risk, whereas market opportunities define the optimal portfolio choices available to all investors in the market.

The Role of Risk and Return in Each Model

Indifference curves represent investor preferences by illustrating combinations of risk and return that yield equal utility, emphasizing how investors balance their tolerance for risk against anticipated returns. The Capital Market Line (CML) demonstrates the risk-return trade-off in efficient portfolios, showing expected portfolio returns as a linear function of systematic risk, with the market portfolio as the tangent point. While indifference curves focus on subjective risk aversion levels of investors, the CML quantifies risk using standard deviation and assumes all investors choose portfolios along the line to achieve optimal risk-return combinations.

Practical Applications in Portfolio Management

Indifference curves represent investor preferences, illustrating combinations of risk and return that provide equal satisfaction, crucial for tailoring portfolios to individual risk tolerance. Capital Market Line (CML) depicts the optimal risk-return trade-off achievable by combining risk-free assets with the market portfolio, serving as a benchmark for efficient portfolios in capital market theory. Portfolio managers integrate indifference curves with the CML to identify the highest utility investment point, balancing personal risk aversion and market opportunities for optimal asset allocation.

Limitations of Indifference Curves and Capital Market Line

Indifference curves assume investors have consistent preferences and can accurately rank their utility, but they often overlook real-world complexities like changing risk tolerance and behavioral biases. The Capital Market Line (CML) model relies on assumptions such as frictionless markets and homogeneous expectations, which rarely hold true, limiting its practical application. Both tools fail to fully capture market imperfections, transaction costs, and investor heterogeneity, restricting their effectiveness in comprehensive portfolio analysis.

Conclusion: Integrating Investor Preferences with Market Possibilities

The indifference curve represents investor preferences by illustrating combinations of risk and return that yield equal satisfaction, while the Capital Market Line (CML) depicts optimal portfolios achievable in the market offering the best risk-return trade-off. Integrating these concepts enables investors to identify the tangency portfolio where their personal utility aligns with market efficiency, maximizing their expected utility given prevailing market conditions. This synergy guides portfolio selection by balancing individual risk tolerance with accessible market opportunities, optimizing investment decisions.

Indifference curve Infographic

libterm.com

libterm.com