Modified accrual accounting combines elements of cash and accrual accounting to provide a more accurate financial picture for governmental entities. It recognizes revenues when they become both measurable and available while recording expenditures when the related liability is incurred. Discover how this method impacts your government's financial reporting and decision-making in the rest of the article.

Table of Comparison

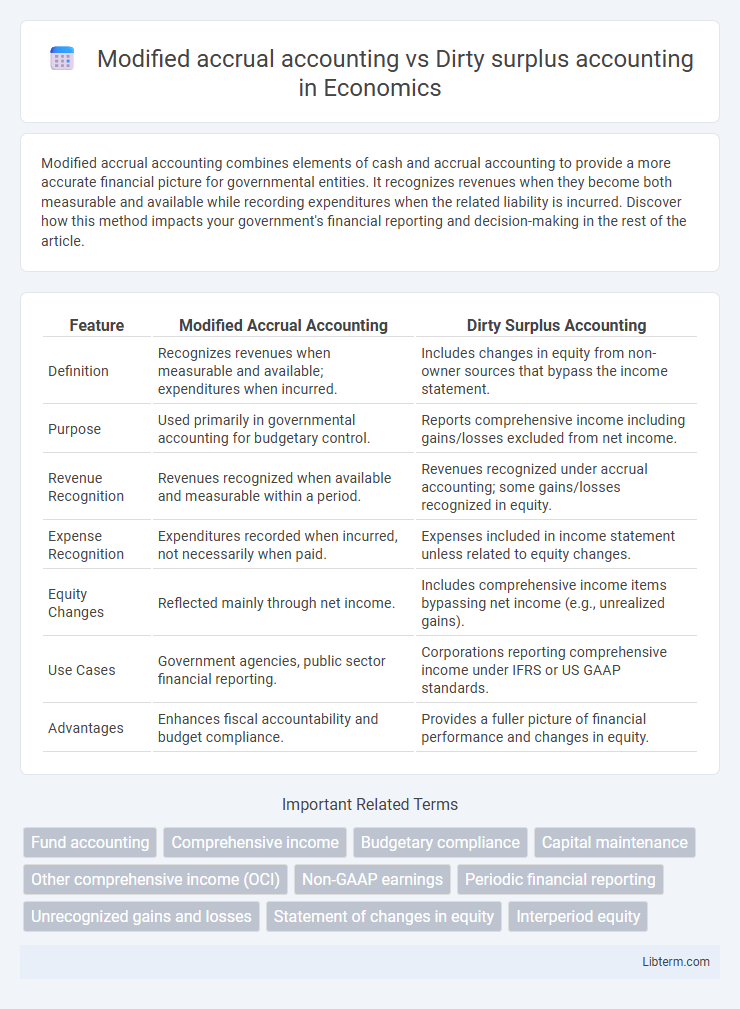

| Feature | Modified Accrual Accounting | Dirty Surplus Accounting |

|---|---|---|

| Definition | Recognizes revenues when measurable and available; expenditures when incurred. | Includes changes in equity from non-owner sources that bypass the income statement. |

| Purpose | Used primarily in governmental accounting for budgetary control. | Reports comprehensive income including gains/losses excluded from net income. |

| Revenue Recognition | Revenues recognized when available and measurable within a period. | Revenues recognized under accrual accounting; some gains/losses recognized in equity. |

| Expense Recognition | Expenditures recorded when incurred, not necessarily when paid. | Expenses included in income statement unless related to equity changes. |

| Equity Changes | Reflected mainly through net income. | Includes comprehensive income items bypassing net income (e.g., unrealized gains). |

| Use Cases | Government agencies, public sector financial reporting. | Corporations reporting comprehensive income under IFRS or US GAAP standards. |

| Advantages | Enhances fiscal accountability and budget compliance. | Provides a fuller picture of financial performance and changes in equity. |

Introduction to Modified Accrual and Dirty Surplus Accounting

Modified accrual accounting combines elements of accrual and cash basis accounting, recognizing revenues when they become available and measurable, while expenditures are recorded when liabilities are incurred. Dirty surplus accounting encompasses traditional accrual accounting but extends reported income by excluding certain comprehensive income items, affecting equity changes directly in shareholders' equity without passing through the income statement. Understanding the differences in revenue recognition and equity reporting between these methodologies is crucial for accurate financial analysis and government accounting practices.

Defining Modified Accrual Accounting

Modified accrual accounting combines elements of cash and accrual accounting by recognizing revenues when they become available and measurable, while expenditures are recorded when incurred, except for long-term liabilities. It is predominantly used by government entities to provide a more accurate picture of short-term financial resources and obligations. This method contrasts with dirty surplus accounting, which incorporates certain unrealized gains and losses directly into equity, affecting net income less transparently.

Understanding Dirty Surplus Accounting

Dirty surplus accounting captures income statement items that bypass the profit and loss statement but directly affect shareholders' equity, such as revaluation gains or losses and foreign currency translation adjustments. Unlike modified accrual accounting, which recognizes revenues when they become both measurable and available and expenses when incurred, dirty surplus accounting allows certain gains and losses to be recorded in equity without impacting net income immediately. Understanding dirty surplus accounting is critical for accurate financial analysis as it reveals the impact of comprehensive income components excluded from traditional earnings metrics.

Key Principles and Methodologies

Modified accrual accounting recognizes revenues when they become both measurable and available, focusing on short-term financial resources, while expenditures are recorded when liabilities are incurred, emphasizing budgetary compliance. Dirty surplus accounting incorporates gains and losses that bypass the income statement, recording them directly in equity to reflect comprehensive income, thus capturing all economic events beyond traditional profit and loss. The key methodological difference lies in modified accrual's focus on current financial resources for governmental accounting versus dirty surplus's inclusion of unrealized gains and losses affecting net worth.

Major Differences in Financial Reporting

Modified accrual accounting records revenues when they become both measurable and available, emphasizing short-term fiscal accountability primarily used in governmental funds, whereas dirty surplus accounting includes all changes in equity, such as unrealized gains and losses, in the financial statements beyond net income. Modified accrual focuses on fund-based reporting that excludes long-term assets and liabilities, while dirty surplus accounting integrates comprehensive income items directly into equity without passing through the income statement. These differing approaches impact the transparency of asset valuation and timing of revenue recognition, influencing stakeholders' assessment of financial health and performance.

Impact on Financial Statements

Modified accrual accounting primarily affects government financial statements by recognizing revenues when they are both measurable and available, leading to more conservative liability and asset reporting. Dirty surplus accounting allows certain gains and losses to bypass the income statement and flow directly to equity, impacting the comprehensiveness of net income and altering retained earnings disclosures. These differences influence stakeholders' interpretation of financial health, liquidity, and performance metrics across public and private sector entities.

Advantages and Limitations of Modified Accrual Accounting

Modified accrual accounting offers the advantage of recognizing revenues when they become measurable and available, enhancing budgetary control and short-term financial planning for government entities. It limits the recognition of long-term assets and liabilities, which simplifies reporting but can obscure full financial obligations and asset values. This approach provides clear insights into current financial resources but may understate long-term fiscal health compared to other accounting methods like dirty surplus accounting.

Pros and Cons of Dirty Surplus Accounting

Dirty surplus accounting recognizes gains and losses directly in equity without passing through the income statement, which can enhance transparency for certain financial events like revaluations and actuarial gains. This method simplifies the income statement by excluding volatile items but may reduce comparability and obscure the true performance of operations. However, dirty surplus accounting can lead to less consistent earnings reporting, making it challenging for investors to assess profitability trends accurately.

Use Cases and Industry Adoption

Modified accrual accounting is predominantly used by government entities and public sector organizations to track financial resources and obligations within budgetary constraints, providing a clear view of fiscal compliance and fund accountability. Dirty surplus accounting is commonly adopted in corporate finance and banking sectors to capture comprehensive income changes not reflected in traditional net income, offering a fuller representation of equity fluctuations. Government agencies prefer modified accrual accounting due to regulatory requirements, while dirty surplus accounting gains traction in industries valuing nuanced equity reporting, such as financial services and investment firms.

Choosing the Right Accounting Method for Your Organization

Choosing between modified accrual accounting and dirty surplus accounting depends on your organization's reporting goals and financial clarity needs. Modified accrual accounting offers a blend of cash flow tracking and accrual insights, making it ideal for public sector entities focused on budget compliance and fund accountability. Dirty surplus accounting, emphasizing comprehensive income including unrealized gains and losses, suits organizations prioritizing detailed equity changes for investors and stakeholders.

Modified accrual accounting Infographic

libterm.com

libterm.com