Stackelberg equilibrium is a strategic game concept where one player, the leader, moves first and the other players, the followers, move subsequently, optimizing their strategies based on the leader's decision. This equilibrium highlights how the leader's commitment influences the followers' responses, creating a sequential advantage in competitive scenarios. Discover how understanding Stackelberg equilibrium can enhance your strategic decision-making by exploring the detailed analysis in this article.

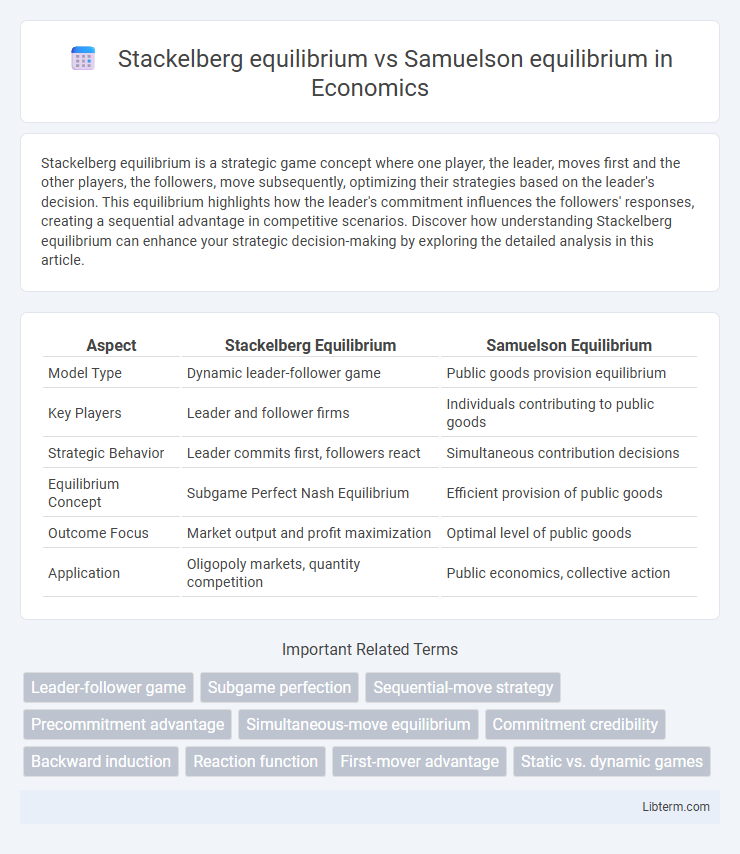

Table of Comparison

| Aspect | Stackelberg Equilibrium | Samuelson Equilibrium |

|---|---|---|

| Model Type | Dynamic leader-follower game | Public goods provision equilibrium |

| Key Players | Leader and follower firms | Individuals contributing to public goods |

| Strategic Behavior | Leader commits first, followers react | Simultaneous contribution decisions |

| Equilibrium Concept | Subgame Perfect Nash Equilibrium | Efficient provision of public goods |

| Outcome Focus | Market output and profit maximization | Optimal level of public goods |

| Application | Oligopoly markets, quantity competition | Public economics, collective action |

Introduction to Stackelberg and Samuelson Equilibria

Stackelberg equilibrium models strategic interactions in sequential games where leaders commit to strategies before followers, influencing optimal decision-making in oligopolies and market competition. Samuelson equilibrium extends general equilibrium theory incorporating dynamic adjustments and stochastic elements, often applied in macroeconomic models with intertemporal optimization. Understanding these concepts is essential for analyzing decision-making processes under sequential moves and dynamic uncertainty in economic theory.

Conceptual Foundations: Stackelberg vs Samuelson

Stackelberg equilibrium centers on sequential games where leaders commit to strategies before followers respond, emphasizing strategic commitment and information asymmetry in oligopolistic competition. Samuelson equilibrium, rooted in overlapping generations models, focuses on dynamic efficiency and intertemporal allocation of resources, highlighting how agents' expectations and asset holdings evolve over time. The conceptual distinction lies in Stackelberg's emphasis on sequential strategic moves versus Samuelson's analysis of equilibrium in dynamic, intergenerational economic systems.

Game Theory Contexts: Sequential vs Simultaneous Moves

Stackelberg equilibrium applies to sequential-move games where one player, the leader, commits to a strategy before the follower, resulting in strategic advantage through first-mover commitment. Samuelson equilibrium, in contrast, addresses simultaneous-move games where players choose strategies without knowledge of others' choices, relying on mutual best responses to achieve equilibrium. These distinctions influence strategic decision-making, with Stackelberg emphasizing hierarchical play and Samuelson capturing conditions of simultaneous interaction in game theory.

Mathematical Formulation of Stackelberg Equilibrium

The Stackelberg equilibrium is mathematically formulated through a leader-follower dynamic in a sequential game, where the leader maximizes its payoff anticipating the follower's best response function. This involves solving a bilevel optimization problem, with the leader's strategy \(x\) chosen first, and the follower's reaction \(y^*(x)\) determined by \(y^*(x) = \arg\max_y U_f(y, x)\). The equilibrium is reached at \(\max_x U_l(x, y^*(x))\), contrasting with the Samuelson equilibrium, which models simultaneous strategy selections without hierarchical decision-making.

Defining Samuelson Equilibrium: Historical Perspective

Samuelson Equilibrium, grounded in the pioneering work of Paul Samuelson during the mid-20th century, represents a foundational concept in neoclassical economics emphasizing market efficiency and resource allocation under perfect competition. Unlike the Stackelberg Equilibrium, which models strategic firm behavior in leader-follower dynamics within oligopolies, Samuelson focused on aggregate equilibrium effects in economy-wide contexts, particularly through his formalization of public goods and welfare economics. This equilibrium concept highlights how individual optimization and market mechanisms collectively determine efficient outcomes in large-scale economic systems without dominant players.

Strategic Leadership: The Stackelberg Leader-Follower Model

The Stackelberg equilibrium models strategic leadership where the leader firm commits to an output level first, influencing the follower's best response in a sequential move game. This leader-follower dynamic contrasts with the Samuelson equilibrium, which typically assumes simultaneous moves without a hierarchical decision process. In the Stackelberg model, the leader capitalizes on its first-mover advantage to maximize profit by anticipating and shaping the follower's strategy.

Comparison of Outcome Efficiency in Both Equilibria

Stackelberg equilibrium typically results in higher overall efficiency compared to Samuelson equilibrium due to the leader's strategic advantage in setting quantities first, which leads to more optimal resource allocation and higher total welfare. In contrast, Samuelson equilibrium, often linked with public goods provision, may reflect inefficiencies due to free-rider problems and the difficulty in aligning individual incentives with social optimality. Empirical studies indicate that Stackelberg models better internalize interdependent decisions, whereas Samuelson equilibrium outcomes often require external interventions to achieve efficiency.

Real-World Applications: Industry and Economics

Stackelberg equilibrium models hierarchical decision-making in markets where leaders move first and followers react, commonly used in oligopoly industries like telecommunications and energy to predict competitive strategies and market outcomes. Samuelson equilibrium applies to public goods and externalities by balancing individual contributions and social welfare, influencing policies in environmental economics and taxation. Both equilibria guide firms and policymakers in optimizing resource allocation and strategic interactions within real-world economic and industrial frameworks.

Limitations and Critiques of Each Equilibrium

Stackelberg equilibrium faces criticism for its assumption of perfect leader-follower dynamics, which may oversimplify real-world strategic interactions where sequential moves and information asymmetry are often imperfect. Samuelson equilibrium, rooted in evolutionary game theory, is limited by its reliance on replicator dynamics that may not accurately capture rational decision-making processes or predict equilibrium in games with complex strategy spaces. Both equilibria struggle with applicability in dynamic, multi-stage games involving multiple players and uncertain payoffs, reducing their predictive power in practical economic and strategic scenarios.

Conclusion: Choosing Between Stackelberg and Samuelson Approaches

Stackelberg equilibrium is optimal in strategic settings with sequential moves where one player commits before others, maximizing their advantage by anticipating followers' responses. Samuelson equilibrium, often applied in continuous-time trading or public goods contexts, models simultaneous decision-making emphasizing equilibrium in expectations and contributions. Selecting between Stackelberg and Samuelson approaches depends on the timing of decisions and information asymmetry, with Stackelberg suited for leader-follower dynamics and Samuelson for symmetric, simultaneous interaction environments.

Stackelberg equilibrium Infographic

libterm.com

libterm.com