Fixed effects control for unobserved variables that are constant over time, allowing more accurate estimation of causal relationships in panel data analysis. This method helps isolate the impact of variables that change within entities while accounting for individual-specific characteristics. Explore the rest of the article to understand how fixed effects can enhance your empirical research.

Table of Comparison

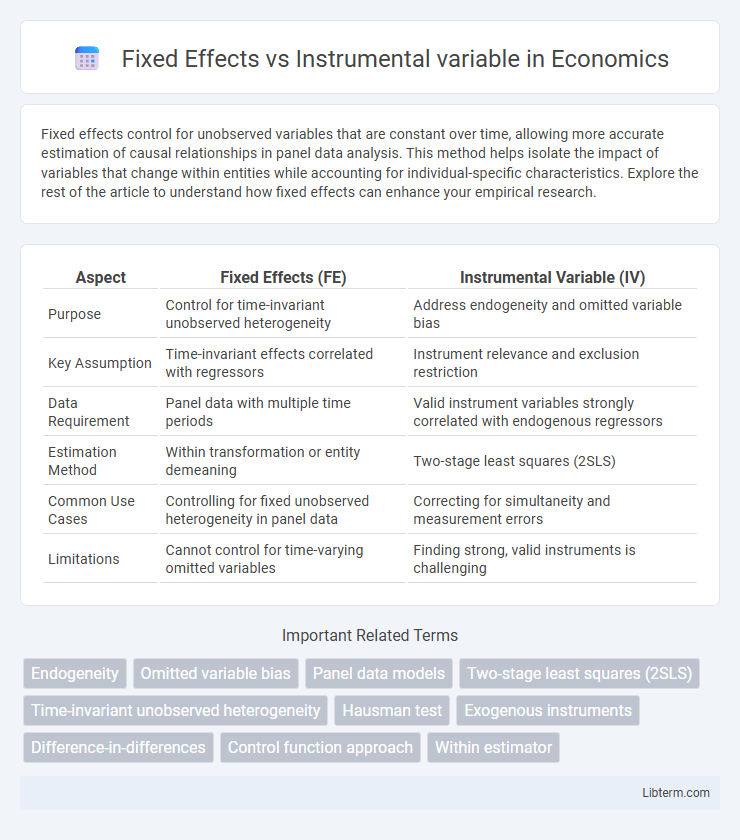

| Aspect | Fixed Effects (FE) | Instrumental Variable (IV) |

|---|---|---|

| Purpose | Control for time-invariant unobserved heterogeneity | Address endogeneity and omitted variable bias |

| Key Assumption | Time-invariant effects correlated with regressors | Instrument relevance and exclusion restriction |

| Data Requirement | Panel data with multiple time periods | Valid instrument variables strongly correlated with endogenous regressors |

| Estimation Method | Within transformation or entity demeaning | Two-stage least squares (2SLS) |

| Common Use Cases | Controlling for fixed unobserved heterogeneity in panel data | Correcting for simultaneity and measurement errors |

| Limitations | Cannot control for time-varying omitted variables | Finding strong, valid instruments is challenging |

Introduction to Causal Inference

Fixed Effects models control for unobserved heterogeneity by using within-entity variation to identify causal effects, assuming time-invariant confounders. Instrumental Variable (IV) estimation addresses endogeneity by leveraging external instruments that influence the treatment but not the outcome directly, enabling consistent causal effect estimation. These methods are foundational in econometrics and social sciences for isolating causal relationships when randomized experiments are infeasible.

Understanding Fixed Effects Models

Fixed Effects models control for time-invariant unobserved heterogeneity by using entity-specific intercepts, isolating the impact of variables that vary over time within entities. This approach is particularly useful in panel data analysis for assessing causal relationships when omitted variables are correlated with explanatory variables but constant over time. In contrast, Instrumental Variable techniques address endogeneity by using instruments that are correlated with endogenous regressors but uncorrelated with the error term, complementing Fixed Effects methods when endogeneity arises from time-varying omitted factors.

Overview of Instrumental Variable Methods

Instrumental variable (IV) methods address endogeneity by using instruments--variables correlated with the endogenous regressors but uncorrelated with the error term--to obtain consistent parameter estimates. IV techniques such as Two-Stage Least Squares (2SLS) separate the variation used for identification, mitigating bias from omitted variables or measurement errors that standard fixed effects models cannot fully resolve. This approach is crucial in econometrics when dealing with simultaneity or reverse causality, ensuring more reliable causal inference compared to fixed effects alone.

Key Assumptions in Fixed Effects

Fixed Effects models assume that all time-invariant characteristics of individuals are controlled for and unobserved heterogeneity is correlated with the explanatory variables. The key assumption is strict exogeneity, meaning that the idiosyncratic error term must be uncorrelated with the explanatory variables in all time periods. This allows Fixed Effects to consistently estimate causal effects by eliminating bias arising from omitted variables that do not vary over time.

Core Assumptions for Instrumental Variables

Instrumental Variables (IV) require the instrument to satisfy three core assumptions: relevance, meaning it must be strongly correlated with the endogenous explanatory variable; exogeneity, indicating the instrument is uncorrelated with the error term in the structural equation; and the exclusion restriction, which states the instrument affects the dependent variable only through the endogenous regressor. Fixed Effects models control for time-invariant unobserved heterogeneity by differencing or demeaning data but rely on strict exogeneity, failing to address endogeneity caused by omitted variable bias that varies over time. IV estimation overcomes this limitation by providing consistent parameter estimates when endogenous regressors correlate with the error term, provided valid instruments exist.

Strengths of Fixed Effects Approaches

Fixed effects models effectively control for time-invariant unobserved heterogeneity by using within-entity variation, reducing omitted variable bias. They allow precise estimation of causal relationships when unobserved factors are correlated with explanatory variables, improving internal validity. Fixed effects approaches are particularly strong in panel data settings where individual-specific traits remain constant over time, ensuring robust and consistent parameter estimates.

Limitations of Instrumental Variable Techniques

Instrumental variable (IV) techniques face limitations such as the difficulty in finding valid instruments that are both strongly correlated with the endogenous regressors and uncorrelated with the error term, which can lead to weak instrument bias. IV estimates often have larger standard errors compared to fixed effects models, reducing statistical precision and power. Fixed effects control for unobserved heterogeneity by using within-entity variation, whereas invalid instruments can compromise causal inference in IV methods.

When to Use Fixed Effects vs Instrumental Variables

Use fixed effects models when controlling for unobservable, time-invariant heterogeneity within panel data to isolate the impact of variables that vary over time. Instrumental variables are appropriate when addressing endogeneity caused by omitted variable bias, measurement error, or simultaneity in cross-sectional or panel datasets. Choose fixed effects for controlling unobserved individual-specific traits, and select instrumental variables to obtain consistent estimators when regressors correlate with the error term.

Practical Examples and Applications

Fixed effects models are widely used in panel data analysis to control for unobserved heterogeneity when examining the impact of variables such as education on earnings across individuals over time. Instrumental variable (IV) techniques address endogeneity issues by using instruments, like proximity to colleges, to obtain unbiased estimates in cases where explanatory variables, for example, years of schooling, are correlated with the error term. Practical applications include evaluating policy impacts in labor economics and health economics, where fixed effects control for time-invariant traits and IV methods resolve simultaneity and omitted variable bias.

Summary: Choosing the Right Estimation Method

Fixed effects models control for unobserved heterogeneity by using within-entity variation, making them ideal for panel data with time-invariant omitted variables. Instrumental variable estimation addresses endogeneity by leveraging external instruments that correlate with the endogenous regressors but not with the error term. Selecting between fixed effects and instrumental variables depends on the data structure, presence of endogeneity, and availability of valid instruments to ensure consistent and unbiased estimates.

Fixed Effects Infographic

libterm.com

libterm.com