Monopoly rent is the extra income a monopolist earns by controlling a resource or market, often surpassing competitive market profits. This economic concept highlights how exclusive ownership or control can lead to higher prices and limited consumer choice. Discover how monopoly rent impacts markets and what it means for your economic decisions in this comprehensive article.

Table of Comparison

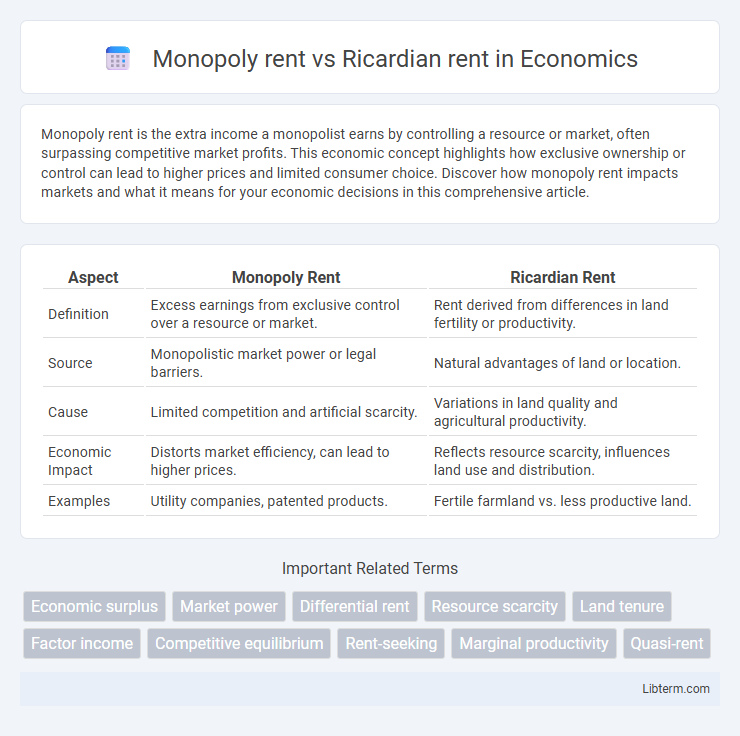

| Aspect | Monopoly Rent | Ricardian Rent |

|---|---|---|

| Definition | Excess earnings from exclusive control over a resource or market. | Rent derived from differences in land fertility or productivity. |

| Source | Monopolistic market power or legal barriers. | Natural advantages of land or location. |

| Cause | Limited competition and artificial scarcity. | Variations in land quality and agricultural productivity. |

| Economic Impact | Distorts market efficiency, can lead to higher prices. | Reflects resource scarcity, influences land use and distribution. |

| Examples | Utility companies, patented products. | Fertile farmland vs. less productive land. |

Understanding Economic Rents: An Overview

Monopoly rent arises when a firm or individual controls a unique resource or market power, allowing them to charge prices above competitive levels without producing additional value. Ricardian rent, rooted in classical economics, refers to the differential returns earned from land of varying fertility or productivity, reflecting the scarcity and quality differences in natural resources. Understanding economic rents involves analyzing these rents as unearned surplus payments that influence resource allocation, market efficiency, and income distribution across economies.

Defining Monopoly Rent

Monopoly rent refers to the excess profit earned by a firm or individual due to exclusive control over a scarce resource or market, allowing them to set prices above competitive levels. This rent arises from barriers to entry, patents, or unique ownership that restrict competition, enabling sustained economic gains. In contrast, Ricardian rent is the return on land or resources due to differences in fertility or location, determined by natural advantages rather than market power.

Defining Ricardian Rent

Ricardian rent refers to the economic rent earned from differences in land fertility or productivity, based on David Ricardo's theory of rent in classical economics. It arises because more fertile or better-located land yields higher output without additional input costs, leading to surplus returns over the least productive land in use. Monopoly rent, in contrast, results from market power allowing a firm or individual to charge above competitive levels, unrelated to natural productivity differences.

Core Differences Between Monopoly and Ricardian Rent

Monopoly rent arises from the exclusive control of a unique resource or market position, enabling a firm or individual to charge higher prices without competition. Ricardian rent derives from differences in the productivity or quality of land or resources, where superior land generates rent due to its inherent advantages over less fertile or productive land. The core difference lies in monopoly rent being driven by market power and barriers to entry, while Ricardian rent is fundamentally linked to natural resource heterogeneity and comparative advantage.

Sources of Monopoly Rent

Monopoly rent arises from exclusive control over a scarce resource or market position, enabling firms to charge prices above competitive levels without losing customers. It originates from barriers such as patents, trademarks, regulatory licenses, or unique technological advantages that restrict entry and competition. Unlike Ricardian rent, which is derived from differential productivity of natural resources, monopoly rent is sustained by artificial scarcity and legal protections in the marketplace.

Sources of Ricardian Rent

Ricardian rent arises from differences in land productivity and fertility, with rent generated by the surplus output of a more fertile or better-located parcel compared to the least productive land in use. This rent is based on the differential advantage of natural land qualities and fixed supply, distinct from Monopoly rent, which emerges from exclusive control or scarcity created by barriers to entry. Understanding Ricardian rent emphasizes the intrinsic economic rent derived solely from natural factors, fundamental to classical land economics.

Market Structures and Their Influence

Monopoly rent arises in market structures where a single firm controls supply, enabling it to set prices above competitive levels and capture excess profits. Ricardian rent is rooted in differential land productivity, reflecting economic returns to the most productive land under competitive market conditions. Both rents illustrate how market power and resource scarcity influence price mechanisms and factor payments within various economic environments.

Real-World Examples: Monopoly vs Ricardian Rent

Monopoly rent arises when a firm controls a unique resource or market niche, such as a tech company owning a patent that limits competition and allows charging premium prices. Ricardian rent is exemplified by agricultural land, where rent depends on the fertility differential; prime farmland commands higher rent due to its superior productivity compared to marginal land. Real-world instances include Silicon Valley startups leveraging intellectual property for monopoly rent, while farmers in the Midwest pay varied land rents reflecting Ricardian rent driven by soil quality.

Policy Implications and Economic Impact

Monopoly rent arises from exclusive control over resources or markets, leading to higher prices and reduced competition, which can result in allocative inefficiency and consumer welfare loss; policy implications include the need for antitrust regulations and rent control measures to prevent market abuse. Ricardian rent, derived from the differential productivity of land based on its inherent qualities or location, influences land use patterns and income distribution, prompting policies aimed at equitable land taxation and sustainable resource management. Understanding the distinct economic impacts of both rents helps policymakers design targeted interventions to balance incentives for investment with social equity and market efficiency.

Comparative Analysis: Maximizing Social Welfare

Monopoly rent arises when a single firm controls a market resource, leading to restricted supply and higher prices, which reduces overall social welfare due to allocative inefficiency. Ricardian rent emerges from differences in land fertility or resource quality, reflecting the surplus generated by more productive inputs without distorting market prices. Comparative analysis shows Ricardian rent tends to promote efficient resource allocation and social welfare maximization, whereas monopoly rent often results in welfare losses due to market power exploitation.

Monopoly rent Infographic

libterm.com

libterm.com