Transfer earnings represent the minimum payment required to keep a factor of production in its current use, reflecting its opportunity cost. Understanding transfer earnings helps you evaluate the true cost of labor or capital when allocating resources efficiently in the economy. Explore the rest of the article to grasp how transfer earnings influence resource distribution and market equilibrium.

Table of Comparison

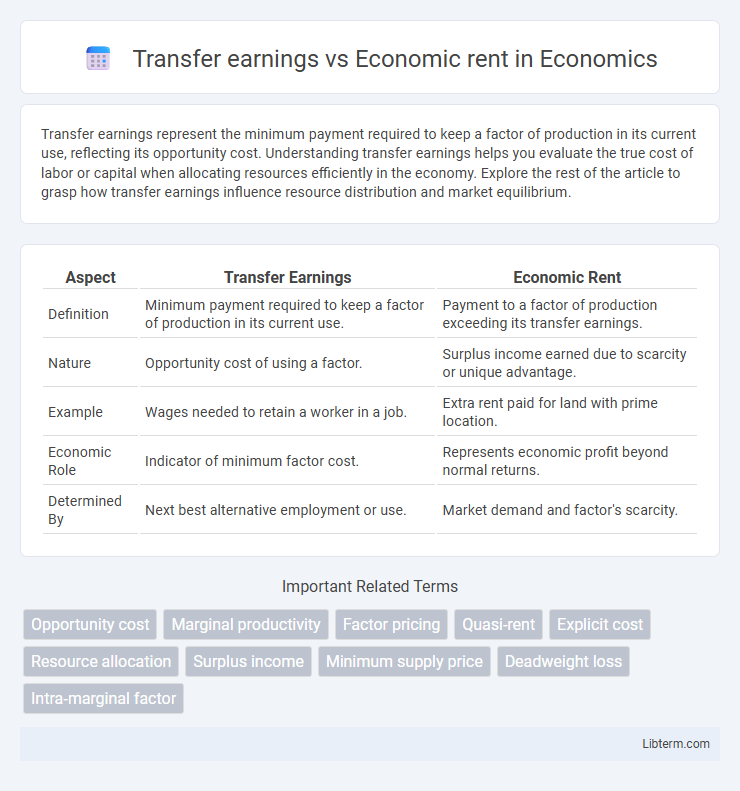

| Aspect | Transfer Earnings | Economic Rent |

|---|---|---|

| Definition | Minimum payment required to keep a factor of production in its current use. | Payment to a factor of production exceeding its transfer earnings. |

| Nature | Opportunity cost of using a factor. | Surplus income earned due to scarcity or unique advantage. |

| Example | Wages needed to retain a worker in a job. | Extra rent paid for land with prime location. |

| Economic Role | Indicator of minimum factor cost. | Represents economic profit beyond normal returns. |

| Determined By | Next best alternative employment or use. | Market demand and factor's scarcity. |

Understanding Transfer Earnings: Definition and Examples

Transfer earnings represent the minimum payment required to keep a resource employed in its current use, reflecting the opportunity cost of its next best alternative. For example, a worker's transfer earnings are the wages they could earn in their next best job, ensuring they remain in their current position. Economic rent arises when earnings exceed transfer earnings, indicating surplus income due to unique advantages or scarcity.

What is Economic Rent? Key Concepts Explained

Economic rent is the payment to a factor of production exceeding its transfer earnings, representing surplus income earned due to scarcity or unique advantages. It arises when resources have no alternative uses, or market conditions limit competition, allowing owners to earn above normal returns. This concept highlights the income generated purely from ownership or control rather than productive effort or opportunity cost.

Differences Between Transfer Earnings and Economic Rent

Transfer earnings represent the minimum payment required to keep a factor of production in its current use, reflecting its opportunity cost, while economic rent is the payment earned above this minimum, indicating surplus income. Transfer earnings ensure the resource remains employed, whereas economic rent captures the extra return due to scarcity or unique advantage. Differences lie in transfer earnings being opportunity costs and economic rent being excess returns beyond these opportunity costs.

Factors Influencing Transfer Earnings

Transfer earnings represent the minimum payment required to keep a factor of production in its current use, influenced by alternative employment opportunities and opportunity cost. Economic rent refers to any payment above transfer earnings, determined by scarcity, unique skills, and market demand for the factor. Factors influencing transfer earnings include availability of substitutes, mobility of resources, skill specificity, and the ease of reallocation across different industries.

Determinants of Economic Rent in Markets

Economic rent is determined by the scarcity and unique attributes of a factor of production, with market demand and supply conditions influencing its magnitude. Transfer earnings represent the minimum payment required to keep a resource in its current use, while economic rent arises from the difference between actual earnings and this transfer payment. Factors such as limited resource availability, differing productivity levels, and barriers to entry in markets are critical determinants that elevate economic rent.

Real-world Examples of Transfer Earnings

Transfer earnings represent the minimum payment required to keep a factor of production in its current use, exemplified by a skilled electrician earning $50,000 annually, which matches the next best alternative job offer. Economic rent refers to any payment above the transfer earnings, such as a landlord charging $2,000 monthly for an apartment that costs only $1,200 to maintain, with $800 considered economic rent. Real-world examples of transfer earnings include farmers working land where the next best use yields a specific income level, or freelance graphic designers who accept projects at rates that equal their opportunity costs in alternative assignments.

Economic Rent in Practice: Case Studies

Economic rent refers to the surplus payment to a factor of production over its transfer earnings, representing value beyond opportunity cost. In practice, case studies reveal that landowners earn substantial economic rent due to limited land supply, while monopolists capture rent through restricted competition. Understanding these real-world examples highlights how economic rent influences income distribution and resource allocation in various markets.

The Role of Factor Mobility in Transfer Earnings and Economic Rent

Transfer earnings represent the minimum payment required to keep a factor of production in its current use, reflecting its next best alternative, while economic rent is any payment exceeding this minimum. Factor mobility influences transfer earnings by determining how easily resources can move to alternative uses, thereby affecting the opportunity cost and the calculation of transfer earnings. In cases of perfect mobility, transfer earnings closely align with opportunity costs, minimizing economic rent, whereas immobility restricts movement, often increasing economic rent as factors cannot freely reallocate.

Implications for Income Distribution

Transfer earnings represent the minimum payment required to keep a factor of production in its current use, while economic rent is any payment exceeding this amount, reflecting scarcity and unique advantages. Economic rent often concentrates income among owners of scarce resources, exacerbating income inequality, whereas transfer earnings align more closely with opportunity costs and fair compensation. Understanding these distinctions helps in formulating policies aimed at equitable income distribution and efficient resource allocation.

Policy Considerations: Managing Transfer Earnings and Economic Rent

Policy considerations in managing transfer earnings and economic rent revolve around optimizing resource allocation and minimizing market distortions. Governments often implement taxation or regulation strategies to capture economic rent without reducing the incentives for productive investment, while ensuring transfer payments fairly compensate for alternative opportunities. Targeted interventions aim to balance equity and efficiency by addressing rent-seeking behaviors and supporting labor mobility.

Transfer earnings Infographic

libterm.com

libterm.com