Ad valorem tax is a tax based on the assessed value of an item, such as real estate or personal property, typically expressed as a percentage of its market value. This tax system ensures that the amount paid corresponds directly to the value of the property, making it a fair and widely used method for local governments to generate revenue. Explore the rest of the article to understand how ad valorem taxes might impact your financial planning and property ownership.

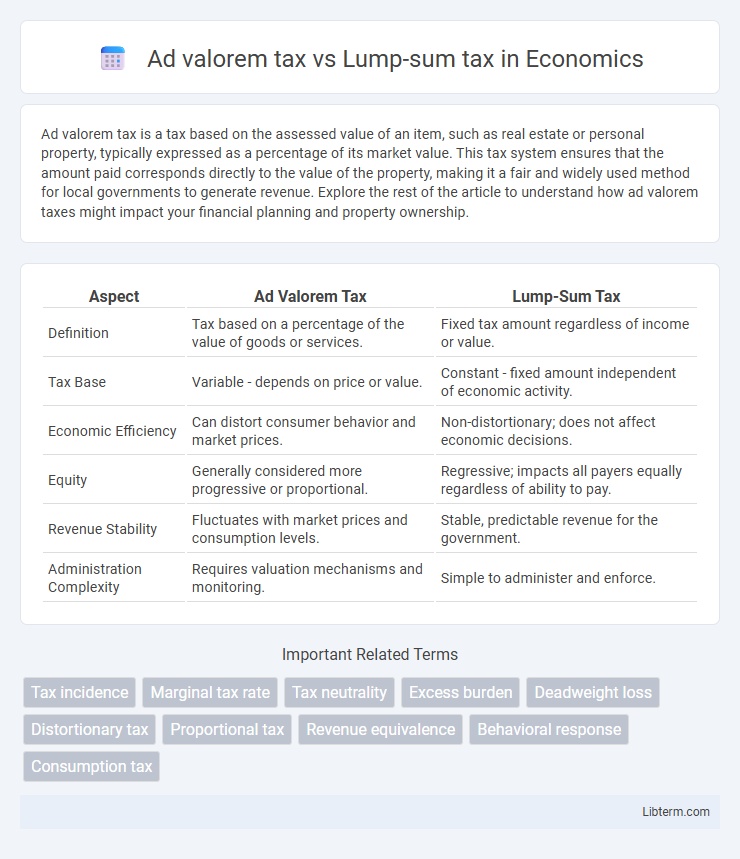

Table of Comparison

| Aspect | Ad Valorem Tax | Lump-Sum Tax |

|---|---|---|

| Definition | Tax based on a percentage of the value of goods or services. | Fixed tax amount regardless of income or value. |

| Tax Base | Variable - depends on price or value. | Constant - fixed amount independent of economic activity. |

| Economic Efficiency | Can distort consumer behavior and market prices. | Non-distortionary; does not affect economic decisions. |

| Equity | Generally considered more progressive or proportional. | Regressive; impacts all payers equally regardless of ability to pay. |

| Revenue Stability | Fluctuates with market prices and consumption levels. | Stable, predictable revenue for the government. |

| Administration Complexity | Requires valuation mechanisms and monitoring. | Simple to administer and enforce. |

Introduction to Tax Structures

Ad valorem tax is a proportional tax based on the assessed value of an item, such as property, sales, or imports, directly affecting price and consumption behavior. Lump-sum tax is a fixed amount paid regardless of the taxpayer's economic status or transaction value, offering simplicity and predictability in revenue collection. Understanding these tax structures helps governments balance efficiency, equity, and administrative ease in fiscal policy design.

Defining Ad Valorem Tax

Ad valorem tax is a tax based on the assessed value of an item, property, or transaction, typically expressed as a percentage of its market value. Commonly applied to real estate, vehicles, and sales, this tax adjusts according to changes in the item's value, ensuring revenue reflects current worth. In contrast, lump-sum tax remains fixed irrespective of the taxpayer's value or income, lacking the value-sensitivity inherent in ad valorem taxation.

Understanding Lump-Sum Tax

Lump-sum tax is a fixed amount imposed on individuals or businesses regardless of income or economic activity, making it simple to administer and predictable in revenue generation for governments. Unlike ad valorem tax, which varies based on the value of a good, service, or property, lump-sum tax does not distort economic decisions or behavior since it remains constant irrespective of changes in wealth or production. This tax approach ensures efficiency and equity by avoiding disincentives for earning more income or investing in assets.

Key Differences Between Ad Valorem and Lump-Sum Taxes

Ad valorem tax is based on the value of an item or property, resulting in payments proportional to its assessed worth, whereas lump-sum tax requires a fixed payment regardless of the taxpayer's value or income. The ad valorem tax effectively adjusts with market fluctuations, providing a variable revenue stream, while lump-sum tax offers predictable, stable revenue but can be regressive, disproportionately impacting lower-income individuals. Key differences include the basis of tax calculation, variability in tax amount, and the economic impact on equity and efficiency.

Economic Implications of Ad Valorem Tax

Ad valorem tax, imposed as a percentage of the value of goods or property, creates efficiency losses by distorting economic incentives and reducing consumer and producer surplus, often leading to deadweight losses in the market. Unlike lump-sum tax, which is fixed and does not affect marginal decisions, ad valorem tax alters relative prices, influencing consumption, production, and investment behaviors adversely. The fluctuating tax burden based on value promotes tax equity but can exacerbate economic inefficiencies and volatility in resource allocation.

Economic Impacts of Lump-Sum Tax

Lump-sum taxes impose a fixed payment regardless of income or wealth, minimizing distortions in labor supply and investment decisions, thereby enhancing economic efficiency compared to ad valorem taxes. These taxes do not affect marginal incentives, leading to less market distortion and promoting optimal resource allocation. However, lump-sum taxes may raise equity concerns due to their regressive nature, impacting low-income households disproportionately.

Advantages of Ad Valorem Taxation

Ad valorem tax provides a fair revenue system by levying taxes based on the assessed value of goods, property, or income, ensuring taxpayers contribute proportionally to their economic capacity. It encourages efficient resource allocation and consumption behavior by reflecting true market values, helping to reduce market distortions. Ad valorem taxation also facilitates automatic adjustment to inflation and economic growth, maintaining consistent government revenue over time.

Benefits of Lump-Sum Taxation

Lump-sum taxation provides predictable and fixed revenue for governments, simplifying budget planning and reducing administrative costs compared to ad valorem taxes, which fluctuate based on property value assessments. It eliminates distortions in economic decision-making since it does not alter incentives for consumption, investment, or production. This neutrality promotes efficiency by avoiding deadweight loss commonly associated with ad valorem taxes on goods, services, and property transactions.

Ad Valorem vs Lump-Sum: Which Is More Efficient?

Ad valorem taxes, based on the assessed value of assets or transactions, adjust with market fluctuations, potentially leading to more equitable revenue generation but introducing economic distortions by influencing consumer and producer behavior. Lump-sum taxes, fixed amounts regardless of economic activity or value, minimize market distortions and administrative costs, enhancing allocative efficiency but raising concerns about fairness and regressivity. Efficiency in tax policy depends on balancing revenue stability, equity, and economic incentives, with lump-sum taxes promoting efficiency through minimal distortion, while ad valorem taxes offer flexibility and responsiveness to economic conditions.

Conclusion: Choosing the Right Tax Approach

Selecting the appropriate tax approach depends on economic efficiency and equity considerations; ad valorem taxes, based on transaction value, provide proportional revenue but can distort consumption and investment decisions. Lump-sum taxes, fixed regardless of behavior, minimize market distortions but may be perceived as regressive and less politically feasible. Policymakers must weigh the trade-offs between efficiency, fairness, and administrative ease to optimize tax policy outcomes.

Ad valorem tax Infographic

libterm.com

libterm.com