Bertrand competition occurs when firms compete by setting prices rather than quantities, leading to prices that often equal marginal costs in equilibrium. This model highlights how intense price rivalry can drive profits to zero, especially when products are homogeneous. Explore the full article to understand how Bertrand competition shapes market strategies and consumer outcomes.

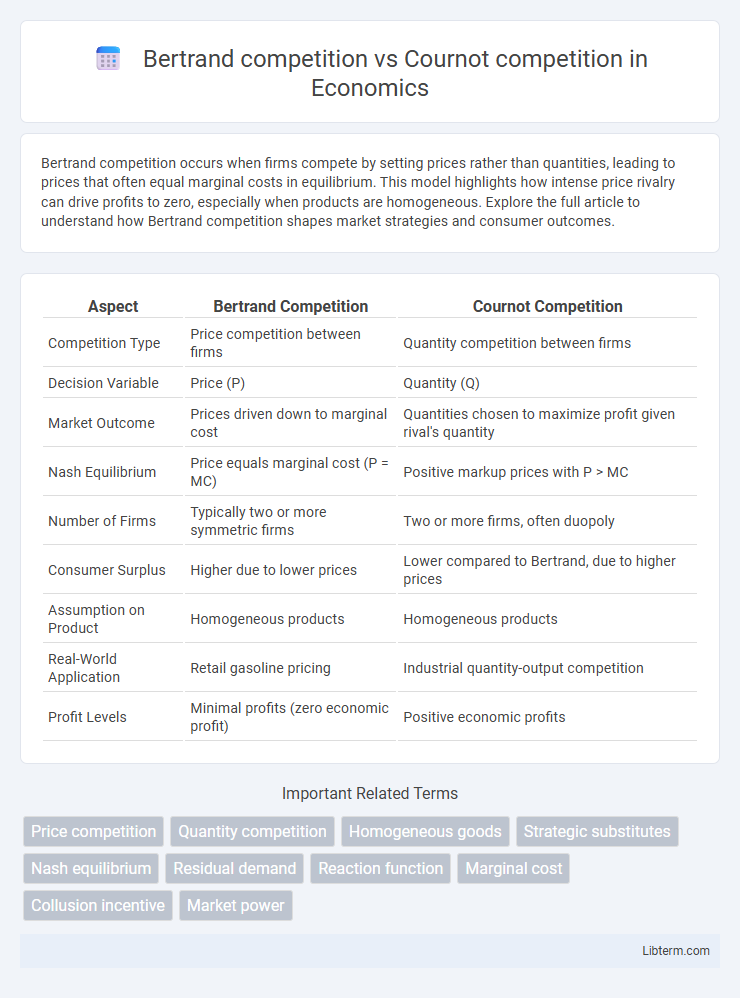

Table of Comparison

| Aspect | Bertrand Competition | Cournot Competition |

|---|---|---|

| Competition Type | Price competition between firms | Quantity competition between firms |

| Decision Variable | Price (P) | Quantity (Q) |

| Market Outcome | Prices driven down to marginal cost | Quantities chosen to maximize profit given rival's quantity |

| Nash Equilibrium | Price equals marginal cost (P = MC) | Positive markup prices with P > MC |

| Number of Firms | Typically two or more symmetric firms | Two or more firms, often duopoly |

| Consumer Surplus | Higher due to lower prices | Lower compared to Bertrand, due to higher prices |

| Assumption on Product | Homogeneous products | Homogeneous products |

| Real-World Application | Retail gasoline pricing | Industrial quantity-output competition |

| Profit Levels | Minimal profits (zero economic profit) | Positive economic profits |

Introduction to Bertrand and Cournot Competition

Bertrand competition models firms competing by setting prices simultaneously, assuming products are perfect substitutes, leading to prices driven down to marginal cost in equilibrium. Cournot competition involves firms competing by choosing quantities simultaneously, where each firm's output decision influences market price through aggregate supply. Both models analyze strategic interactions in oligopolistic markets but differ in the variables firms control and resulting market outcomes.

Historical Background of Market Competition Theories

Bertrand competition traces back to Joseph Bertrand's 1883 critique of Cournot's 1838 model, emphasizing price-setting firms competing simultaneously in markets. Cournot's model, pioneering quantitative analysis in economics, focused on firms choosing quantities to maximize profits under mutual interdependence. These foundational theories shaped modern oligopoly analysis by illustrating distinct strategic variables--price versus quantity--in market competition dynamics.

Key Assumptions: Bertrand vs Cournot Models

Bertrand competition assumes firms compete by setting prices simultaneously, leading to the outcome where prices equal marginal cost in markets with homogeneous products and constant marginal costs. Cournot competition assumes firms compete by choosing quantities simultaneously, with each firm determining output based on the expected output of competitors, resulting in higher equilibrium prices than Bertrand due to strategic quantity setting. The key distinction lies in Bertrand's price-setting assumption versus Cournot's quantity-setting assumption, influencing equilibrium outcomes and market dynamics.

Pricing Strategies in Bertrand Competition

In Bertrand competition, firms simultaneously set prices, assuming rivals' prices remain fixed, leading to aggressive undercutting until prices reach marginal cost. This pricing strategy incentivizes firms to capture market share by offering the lowest prices, resulting in minimal profits typical of perfect competition outcomes. Unlike Cournot competition, where firms compete on quantities, Bertrand competition's price-focused strategy drives prices down sharply and benefits consumers with lower prices.

Quantity Decisions in Cournot Competition

Cournot competition models firms competing by simultaneously choosing quantities to maximize profits, assuming rivals' quantities remain fixed. Each firm determines its output level, leading to a Nash equilibrium where no firm can increase profits by unilaterally changing quantity. This contrasts with Bertrand competition, which focuses on price-setting strategies rather than quantity decisions.

Market Outcomes: Prices, Quantities, and Profits

In Bertrand competition, firms simultaneously set prices, leading to prices equating marginal cost and zero economic profits, with quantities determined by market demand at these prices. Cournot competition involves firms choosing quantities simultaneously, resulting in prices above marginal cost, positive economic profits, and intermediate output levels between monopoly and perfect competition. Market outcomes in Bertrand reflect price-driven competition with intense rivalry and minimal profits, whereas Cournot outcomes demonstrate quantity-driven strategic interaction and moderate profitability.

Impact of Product Differentiation on Competition

Product differentiation reduces the intensity of Bertrand competition by allowing firms to set prices above marginal cost due to perceived differences in products, leading to higher market power. In Cournot competition, product differentiation affects firms' output decisions by making quantities less directly substitutable, which results in higher equilibrium quantities and prices compared to homogeneous goods. The degree of differentiation shapes strategic interactions in both models, influencing firms' pricing and quantity strategies and ultimately affecting market outcomes.

Real-World Applications of Bertrand and Cournot Models

In real-world markets, Bertrand competition models price wars in industries with homogeneous products, such as airlines and e-commerce platforms, where firms undercut each other's prices to gain market share. Cournot competition applies to oligopolistic industries like oil production and telecommunications, where firms decide quantities simultaneously, influencing market output and prices more gradually. Both models provide frameworks for analyzing strategic interactions, pricing, and output decisions in sectors characterized by different competitive dynamics.

Strengths and Limitations of Each Model

Bertrand competition excels in modeling price competition, showing how firms can drive prices down to marginal cost, which benefits consumers through lower prices but assumes instantaneous price adjustments and homogeneous products. Cournot competition highlights quantity-setting firms, capturing strategic interdependence in output decisions, making it more realistic for industries with capacity constraints but often resulting in higher prices than Bertrand outcomes. Both models have limitations: Bertrand oversimplifies with price-only competition and product homogeneity, while Cournot may underestimate competitive intensity by focusing on quantities and ignoring price dynamics.

Conclusion: Choosing Between Bertrand and Cournot Approaches

Choosing between Bertrand and Cournot competition models depends on market characteristics such as product homogeneity and firms' strategic variables. Bertrand competition suits markets with identical products and price-setting firms, leading to prices approaching marginal cost, while Cournot competition applies when firms compete on quantities, resulting in higher equilibrium prices. Firms should evaluate whether price or quantity competition better reflects their market behavior to select the appropriate model for strategic analysis.

Bertrand competition Infographic

libterm.com

libterm.com