Beta testing plays a crucial role in software development by allowing real users to identify bugs and provide feedback before the official release. This phase helps developers refine features and improve overall user experience based on real-world usage. Discover how beta testing can enhance your product's success by reading the rest of this article.

Table of Comparison

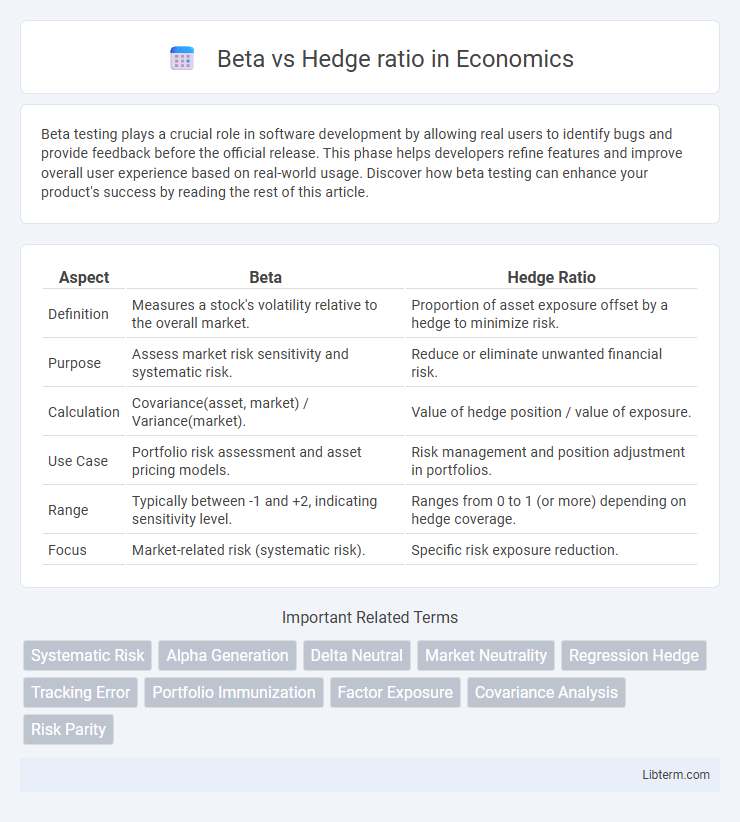

| Aspect | Beta | Hedge Ratio |

|---|---|---|

| Definition | Measures a stock's volatility relative to the overall market. | Proportion of asset exposure offset by a hedge to minimize risk. |

| Purpose | Assess market risk sensitivity and systematic risk. | Reduce or eliminate unwanted financial risk. |

| Calculation | Covariance(asset, market) / Variance(market). | Value of hedge position / value of exposure. |

| Use Case | Portfolio risk assessment and asset pricing models. | Risk management and position adjustment in portfolios. |

| Range | Typically between -1 and +2, indicating sensitivity level. | Ranges from 0 to 1 (or more) depending on hedge coverage. |

| Focus | Market-related risk (systematic risk). | Specific risk exposure reduction. |

Understanding Beta: A Key Risk Metric

Beta measures a stock's sensitivity to market movements, quantifying systematic risk relative to the overall market index. A beta greater than 1 indicates higher volatility than the market, while a beta less than 1 signals lower sensitivity to market fluctuations. Investors use beta to assess risk exposure and construct portfolios aligned with their risk tolerance and expected market behavior.

What is the Hedge Ratio?

The hedge ratio measures the proportion of a portfolio's value that should be hedged to minimize risk exposure, often calculated as the ratio of the value of the hedging instrument to the value of the asset being hedged. Unlike beta, which represents the sensitivity of a stock's returns to market movements, the hedge ratio focuses on the optimal position size needed to offset price fluctuations. Calculating an accurate hedge ratio is essential for effective risk management in derivatives trading and portfolio hedging strategies.

Beta vs Hedge Ratio: Core Differences

Beta measures the sensitivity of an asset's returns relative to market movements, indicating systematic risk, while the hedge ratio quantifies the proportion of an asset to be hedged to offset potential losses. Beta is a dimensionless coefficient used in portfolio management and CAPM to assess volatility, whereas the hedge ratio is a practical metric applied in risk management to determine the size of a hedge position. The core difference lies in beta's role as a risk indicator versus the hedge ratio's function as a tactical tool for minimizing risk exposure.

How Beta Measures Market Risk

Beta measures market risk by quantifying the sensitivity of a stock's returns relative to the overall market returns, indicating its volatility compared to a benchmark index like the S&P 500. A beta greater than 1 suggests higher risk and greater potential returns, while a beta less than 1 implies lower risk and reduced volatility. Unlike the hedge ratio, which is used to determine the optimal amount of hedging in a portfolio, beta specifically focuses on systematic risk and market-driven fluctuations.

The Role of Hedge Ratio in Portfolio Protection

The hedge ratio plays a crucial role in portfolio protection by quantifying the proportion of a hedging instrument required to offset potential losses in an underlying asset. Unlike beta, which measures an asset's sensitivity to market movements, the hedge ratio directly determines the exact position size needed to minimize risk exposure. Effective use of the hedge ratio enables investors to construct strategies that mitigate downside risk while maintaining desired market exposure.

Calculating Beta: Practical Steps

Calculating beta involves regressing the stock's returns against the market's returns over a specific period, typically using monthly or weekly data for at least two years. The slope coefficient derived from this linear regression represents the beta, indicating the stock's sensitivity to market movements. Accurate beta calculation requires selecting an appropriate market index, ensuring data frequency consistency, and adjusting for any outliers or anomalies in the return data.

Computing the Hedge Ratio Effectively

Computing the hedge ratio effectively involves determining the optimal proportion of a position to hedge based on the regression beta between the asset and the hedging instrument. Beta measures the sensitivity of the asset's returns to market movements, while the hedge ratio adjusts for differences in volatility and correlation to minimize risk. Using the formula hedge ratio = beta x (s_asset / s_hedge), where s denotes standard deviation, ensures a precise and dynamic hedge aligned with market conditions.

Applications of Beta and Hedge Ratio in Trading

Beta measures an asset's sensitivity to market movements, widely used by traders to assess systematic risk and portfolio diversification strategies. Hedge ratio quantifies the proportion of a position to hedge against price fluctuations, critical for risk management and minimizing losses in derivative trading. Both metrics guide decision-making in portfolio adjustments and tactical risk mitigation under varying market conditions.

Choosing Between Beta and Hedge Ratio

Choosing between beta and hedge ratio depends on the investment objective and risk management strategy. Beta measures systematic risk relative to a benchmark, ideal for portfolio diversification and market exposure assessment. Hedge ratio quantifies the exact proportion of a hedge needed to offset risk, essential for minimizing losses in derivatives and hedging strategies.

Best Practices for Managing Portfolio Risk

Beta measures a portfolio's sensitivity to market movements, while the hedge ratio quantifies the extent of exposure offset by hedging instruments. Best practices for managing portfolio risk include using beta to assess overall market risk and applying the hedge ratio to determine the optimal positions in derivatives or hedging assets to minimize potential losses. Regularly recalibrating both metrics ensures that risk aligns with investment objectives and market conditions.

Beta Infographic

libterm.com

libterm.com