Fiscal stimulus boosts economic growth by increasing government spending and reducing taxes to encourage consumer and business spending. It can help mitigate recessions and support job creation by injecting liquidity into the economy. Discover how fiscal stimulus impacts your financial future and the broader economy in the rest of this article.

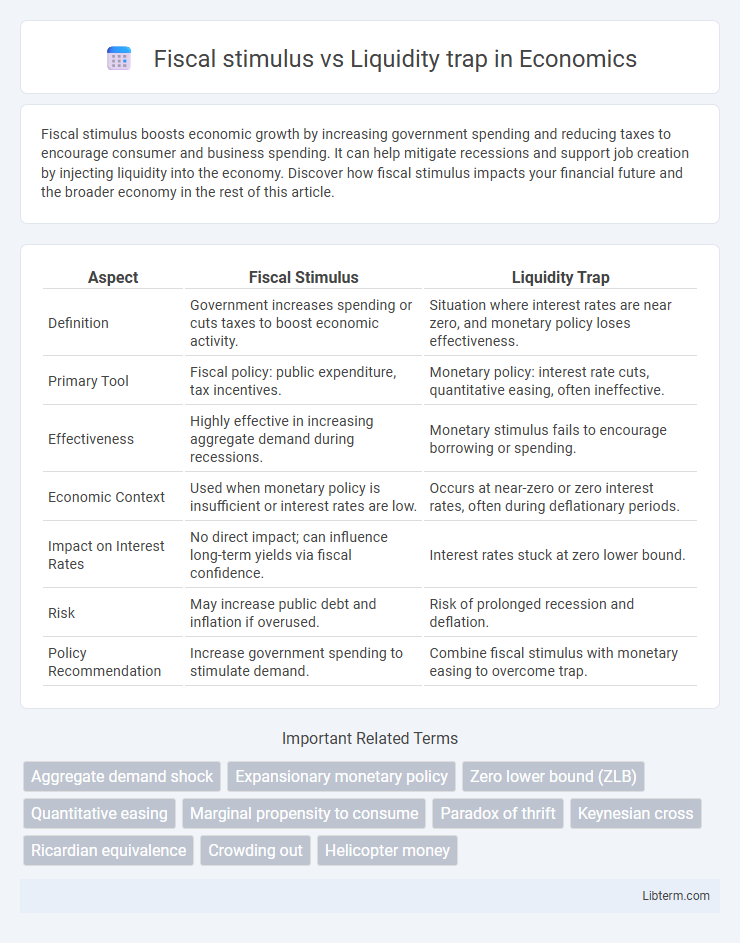

Table of Comparison

| Aspect | Fiscal Stimulus | Liquidity Trap |

|---|---|---|

| Definition | Government increases spending or cuts taxes to boost economic activity. | Situation where interest rates are near zero, and monetary policy loses effectiveness. |

| Primary Tool | Fiscal policy: public expenditure, tax incentives. | Monetary policy: interest rate cuts, quantitative easing, often ineffective. |

| Effectiveness | Highly effective in increasing aggregate demand during recessions. | Monetary stimulus fails to encourage borrowing or spending. |

| Economic Context | Used when monetary policy is insufficient or interest rates are low. | Occurs at near-zero or zero interest rates, often during deflationary periods. |

| Impact on Interest Rates | No direct impact; can influence long-term yields via fiscal confidence. | Interest rates stuck at zero lower bound. |

| Risk | May increase public debt and inflation if overused. | Risk of prolonged recession and deflation. |

| Policy Recommendation | Increase government spending to stimulate demand. | Combine fiscal stimulus with monetary easing to overcome trap. |

Understanding Fiscal Stimulus: Definition and Purpose

Fiscal stimulus involves government measures such as increased public spending or tax cuts designed to boost economic activity and counteract recessions. It aims to increase aggregate demand, encouraging production and employment, especially when private sector confidence is low. Unlike liquidity traps, where monetary policy becomes ineffective due to near-zero interest rates, fiscal stimulus directly injects demand into the economy, helping to overcome stagnant growth.

What is a Liquidity Trap? Key Characteristics

A liquidity trap occurs when interest rates are near zero, rendering monetary policy ineffective as people hoard cash instead of spending or investing, even when central banks increase the money supply. Key characteristics include a stagnant economy, deflationary pressures, and an unwillingness to borrow despite low borrowing costs. In this scenario, fiscal stimulus becomes crucial to boost demand and revive economic growth.

Historical Examples: Fiscal Stimulus in Action

During the Great Depression, the U.S. government's New Deal programs exemplified effective fiscal stimulus by increasing public spending to boost demand and reduce unemployment. Japan's response to the 1990s asset bubble collapse highlighted challenges in a liquidity trap, where ultra-low interest rates failed to spur private investment despite aggressive fiscal measures. More recently, the 2009 American Recovery and Reinvestment Act demonstrated how targeted fiscal stimulus can mitigate recession impacts even when monetary policy faces limitations.

How Liquidity Traps Undermine Monetary Policy

Liquidity traps undermine monetary policy by rendering interest rate cuts ineffective, as consumers and businesses hoard cash instead of spending or investing despite low rates. In this environment, central banks cannot stimulate demand through traditional monetary tools, leading to stagnant economic growth. Fiscal stimulus becomes crucial to boost aggregate demand when monetary policy loses its potency in a liquidity trap.

Fiscal Stimulus as a Solution to Liquidity Traps

Fiscal stimulus effectively counters liquidity traps by increasing government spending and boosting aggregate demand when monetary policy becomes ineffective due to near-zero interest rates. Direct fiscal interventions such as infrastructure projects and transfer payments inject liquidity into the economy, stimulating consumption and investment despite stagnant private spending. Empirical data from post-2008 recession analyses highlight that targeted fiscal stimulus raised GDP growth and employment, breaking the inertia typical in liquidity trap scenarios.

Limitations of Fiscal Stimulus During Economic Slumps

Fiscal stimulus often faces significant limitations during liquidity traps because low interest rates and pessimistic consumer outlooks weaken the effectiveness of government spending to spur demand. In such conditions, increased fiscal outlays may not translate into higher consumption or investment, as households prefer to save rather than spend despite fiscal incentives. This diminished multiplier effect highlights the challenge of relying solely on fiscal policy when monetary policy loses traction due to zero-bound interest rates and widespread economic uncertainty.

Case Study: Japan’s Lost Decade and Policy Lessons

Japan's Lost Decade exemplifies the challenges of fiscal stimulus amid a liquidity trap, where ultra-low interest rates failed to spur economic growth despite massive government spending. Persistent deflation and bank failures constrained monetary policy effectiveness, emphasizing the need for coordinated fiscal reforms and structural adjustments beyond mere stimulus packages. This case underscores that in liquidity traps, fiscal measures must focus on boosting demand while addressing financial sector weaknesses to restore economic vitality.

Comparing Fiscal Stimulus and Monetary Policy Measures

Fiscal stimulus involves targeted government spending or tax cuts to directly boost aggregate demand during economic downturns, effectively addressing demand shortfalls. Monetary policy measures, such as lowering interest rates or quantitative easing, aim to increase money supply and encourage borrowing, but often lose effectiveness in a liquidity trap where interest rates approach zero and consumers prefer holding cash. In comparison, fiscal stimulus can be more potent in escaping a liquidity trap, as it directly injects funds into the economy without relying on changes in interest rates.

Policy Recommendations in the Face of a Liquidity Trap

In a liquidity trap, traditional monetary policy loses effectiveness as interest rates approach zero and consumers hoard cash instead of spending. Fiscal stimulus becomes critical, with direct government spending on infrastructure, social programs, or tax cuts stimulating aggregate demand when monetary tools fail. Policymakers should prioritize targeted fiscal interventions to boost consumption and investment, while maintaining credible long-term fiscal plans to avoid crowding out private investment.

Future Challenges: Navigating Economic Recovery

Fiscal stimulus faces challenges in a liquidity trap when interest rates approach zero, limiting monetary policy effectiveness and risking diminishing returns on public spending. Future economic recovery depends on coordinated strategies combining targeted fiscal measures with structural reforms to boost demand and confidence. Policymakers must balance debt sustainability with inflation control while fostering innovation and labor market adaptability to navigate post-crisis uncertainties.

Fiscal stimulus Infographic

libterm.com

libterm.com