The Kuznets curve illustrates the relationship between economic development and income inequality, showing that inequality tends to rise during early industrialization before eventually declining as a country becomes wealthier. This concept highlights the dynamic nature of economic growth and its impact on social structures. Explore the full article to understand how the Kuznets curve applies to modern economies and what it means for your perspective on income distribution.

Table of Comparison

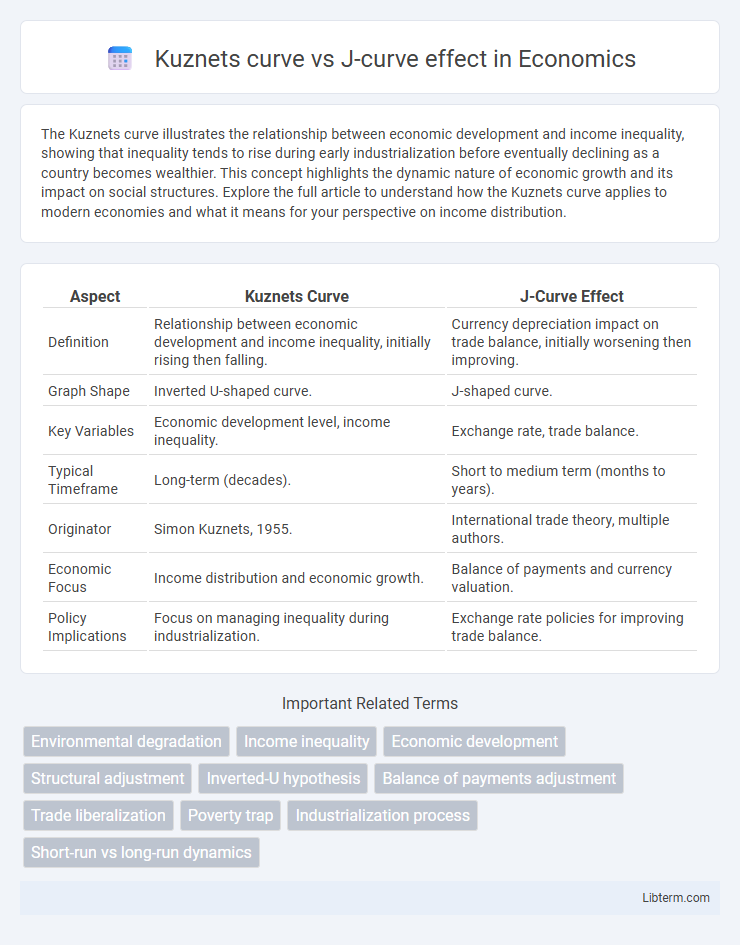

| Aspect | Kuznets Curve | J-Curve Effect |

|---|---|---|

| Definition | Relationship between economic development and income inequality, initially rising then falling. | Currency depreciation impact on trade balance, initially worsening then improving. |

| Graph Shape | Inverted U-shaped curve. | J-shaped curve. |

| Key Variables | Economic development level, income inequality. | Exchange rate, trade balance. |

| Typical Timeframe | Long-term (decades). | Short to medium term (months to years). |

| Originator | Simon Kuznets, 1955. | International trade theory, multiple authors. |

| Economic Focus | Income distribution and economic growth. | Balance of payments and currency valuation. |

| Policy Implications | Focus on managing inequality during industrialization. | Exchange rate policies for improving trade balance. |

Introduction to Economic Curves

Economic curves like the Kuznets curve and the J-curve illustrate distinct relationships between variables over time, highlighting patterns of development and recovery. The Kuznets curve demonstrates an inverted U-shaped link between economic growth and income inequality, suggesting that inequality first rises and then falls as an economy develops. In contrast, the J-curve represents a decline followed by a sharp improvement in trade balance or economic performance after a shock or policy change.

Defining the Kuznets Curve

The Kuznets Curve illustrates the relationship between economic development and income inequality, proposing that inequality initially rises during early industrialization but decreases as a society becomes more affluent. This hypothesis is graphically represented as an inverted U-shaped curve, where economic growth first exacerbates then alleviates inequality. In contrast, the J-curve effect describes a pattern where economic indicators worsen before improving, often seen in currency depreciation or trade balance adjustments.

Explaining the J-Curve Effect

The J-Curve effect describes the short-term deterioration of a country's trade balance following a currency depreciation, caused by initially higher import costs outweighing export volume gains. Over time, as export demand becomes more elastic and import volumes adjust, the trade balance improves, tracing a J-shaped trajectory on a graph. This contrasts with the Kuznets Curve, which depicts income inequality changes over economic development stages rather than trade balance fluctuations.

Key Differences Between Kuznets Curve and J-Curve

The Kuznets Curve illustrates the relationship between economic development and income inequality, typically showing an inverted U-shape where inequality rises then falls as a country industrializes. The J-Curve effect describes the short-term depreciation of a currency following a devaluation, which worsens the trade balance before improving it over time. Key differences lie in their focus: Kuznets Curve addresses socio-economic inequality dynamics during growth phases, while the J-Curve centers on trade balance fluctuations post-exchange rate adjustments.

Theoretical Foundations of Both Curves

The Kuznets Curve theorizes an inverted U-shaped relationship between economic development and income inequality, suggesting that inequality first rises and then falls as a country industrializes. The J-Curve effect describes the short-term worsening and long-term improvement of a country's trade balance following currency depreciation, based on price elasticity of imports and exports. Both theoretical frameworks emphasize dynamic adjustments over time in economic indicators driven by structural changes and market responses.

Real-World Applications and Case Studies

The Kuznets curve illustrates how economic inequality initially rises and then falls during industrialization, observed in countries like the United States and South Korea during rapid economic growth phases. The J-curve effect describes the short-term trade deficit worsening followed by long-term improvement after currency devaluation, evident in economies such as Turkey and Argentina following exchange rate adjustments. Both models provide critical insights for policymakers in managing economic transitions and trade policies to balance growth and equity.

Policy Implications of the Kuznets Curve

The Kuznets Curve suggests that income inequality initially rises during economic development but eventually declines as a country attains higher income levels, indicating policies should prioritize equitable growth during early industrialization stages. Emphasizing investments in education, social safety nets, and progressive taxation can mitigate inequality peaks while fostering sustainable economic expansion. Policymakers must tailor interventions to different development phases, recognizing that promoting inclusive institutions and infrastructure improves long-term social welfare and economic stability.

Policy Implications of the J-Curve Effect

The J-Curve effect indicates that currency depreciation initially worsens a country's trade balance before improving it, which demands policymakers to prepare for short-term economic challenges such as increased import costs and inflation. Monetary and fiscal policies should target cushioning the temporary negative impacts on domestic industries and consumers while promoting export competitiveness to realize long-term trade balance improvements. Strategic planning includes timing exchange rate adjustments and implementing supportive measures like export incentives and import substitution to optimize the benefits of currency depreciation over time.

Criticisms and Limitations

The Kuznets curve faces criticism for its oversimplified assumption that economic growth automatically leads to reduced inequality, ignoring factors like institutional changes and policy interventions. Limitations of the J-curve effect include its reliance on short-term depreciation impacts without accounting for long-term economic adjustments or external shocks. Both models often fail to capture complex socioeconomic dynamics, limiting their predictive accuracy in diverse economic contexts.

Conclusion: Comparing Insights and Future Research

The Kuznets curve illustrates an inverted U-shaped relationship between economic development and income inequality, suggesting inequality rises during early growth stages and falls in advanced economies. The J-curve effect describes an initial deterioration in trade balance following currency depreciation, with gradual improvement over time. Future research should integrate these models to explore complex interactions between economic growth, inequality, and trade dynamics across diverse institutional contexts.

Kuznets curve Infographic

libterm.com

libterm.com