Nominal rigidity refers to the resistance of prices and wages to adjust quickly in response to changes in the economy, which can lead to persistent unemployment and inflation issues. This concept is crucial for understanding why markets may not always clear efficiently and why monetary policy effects can be delayed. Explore the rest of the article to discover how nominal rigidity impacts economic stability and policy decisions.

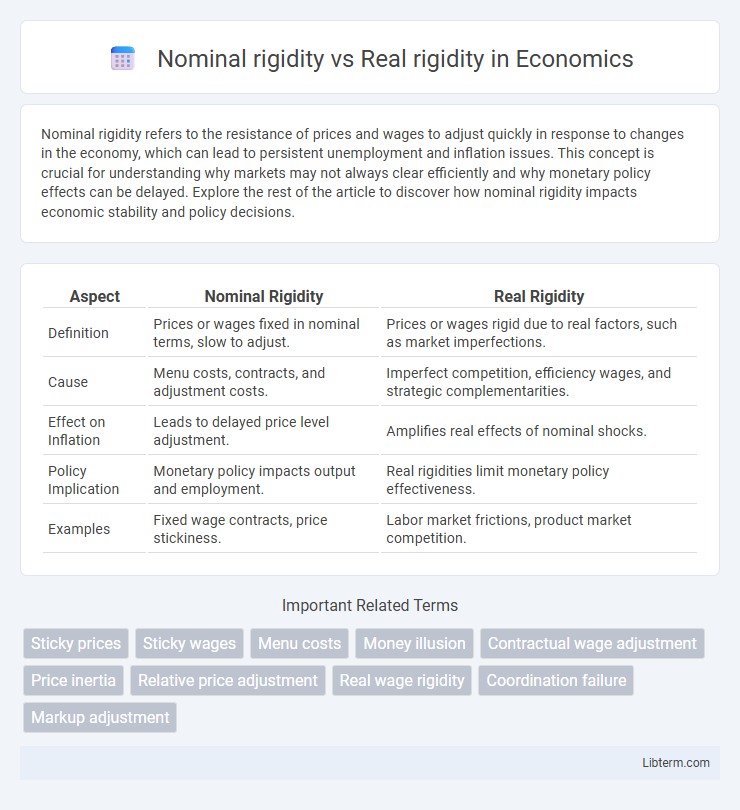

Table of Comparison

| Aspect | Nominal Rigidity | Real Rigidity |

|---|---|---|

| Definition | Prices or wages fixed in nominal terms, slow to adjust. | Prices or wages rigid due to real factors, such as market imperfections. |

| Cause | Menu costs, contracts, and adjustment costs. | Imperfect competition, efficiency wages, and strategic complementarities. |

| Effect on Inflation | Leads to delayed price level adjustment. | Amplifies real effects of nominal shocks. |

| Policy Implication | Monetary policy impacts output and employment. | Real rigidities limit monetary policy effectiveness. |

| Examples | Fixed wage contracts, price stickiness. | Labor market frictions, product market competition. |

Introduction to Nominal and Real Rigidity

Nominal rigidity refers to the resistance of wages and prices to change in nominal terms despite shifts in the economic environment, often influenced by contracts, menu costs, and institutional factors. Real rigidity occurs when real wages or prices are inflexible due to market structures, such as imperfect competition or efficiency wages, causing slow adjustment to changes in productivity or demand. Understanding nominal and real rigidity is crucial for analyzing how economies respond to shocks and the persistence of unemployment and inflation.

Defining Nominal Rigidity

Nominal rigidity refers to the resistance of nominal wages or prices to adjust quickly in response to changes in economic conditions, causing slow adaptation to shifts in demand or supply. This phenomenon often leads to short-term unemployment or inflation persistence because nominal values remain fixed despite changes in real economic variables. Understanding nominal rigidity is crucial for analyzing monetary policy effects, as it influences how price stickiness impacts output and employment variations.

Understanding Real Rigidity

Real rigidity refers to the resistance of wages and prices to adjust in response to changes in economic conditions, independent of nominal factors like inflation or monetary policy. Unlike nominal rigidity, which involves sticky wages or prices due to contracts or menu costs, real rigidity arises from structural factors such as bargaining power, labor market frictions, and productivity fluctuations. Understanding real rigidity is crucial for analyzing persistent unemployment and sluggish output responses during economic shocks, as it explains why wages and prices do not fully reflect real economic changes.

Key Differences Between Nominal and Real Rigidity

Nominal rigidity refers to the inflexibility of prices and wages in monetary terms, preventing immediate adjustments to inflation or deflation, whereas real rigidity involves resistance in the actual quantities or relative prices due to factors like contracts, norms, or market structures. Key differences include nominal rigidity's direct link to monetary variables and price stickiness, while real rigidity is tied to real economic factors such as labor market frictions and product differentiation. Understanding these distinctions is crucial for analyzing inflation persistence and the effectiveness of monetary policy in macroeconomic models.

Causes of Nominal Rigidity in Economics

Nominal rigidity in economics occurs when prices and wages are slow to adjust to changes in the market, often due to long-term contracts, menu costs, and wage stickiness caused by labor contracts and social norms. These rigidities prevent immediate price adjustments despite fluctuations in demand or supply, contrasting with real rigidity where factors like input substitutability and product market imperfections resist quantity adjustments. Understanding causes of nominal rigidity is crucial for explaining why monetary policy impacts output and employment in the short run.

Factors Driving Real Rigidity

Factors driving real rigidity include long-term contracts, implicit agreements between employers and employees, and adjustment costs related to labor and capital that prevent prices and wages from quickly responding to economic changes. Real rigidity also arises from firm-specific skills, menu costs, and coordination failures which reinforce wage and price stickiness despite nominal changes. These elements create substantial frictions in the labor market and product pricing, sustaining unemployment and output fluctuations during economic shocks.

Impacts of Nominal Rigidity on Monetary Policy

Nominal rigidity, characterized by sticky prices and wages, limits the immediate adjustment of prices to changes in monetary policy, causing delayed effects on inflation and output. This rigidity reduces the effectiveness of monetary policy in stabilizing the economy, as nominal shocks cannot be quickly absorbed, leading to prolonged periods of unemployment or inflation. Central banks must therefore consider the degree of nominal rigidity when designing policies to achieve optimal economic outcomes.

Effects of Real Rigidity on Labor and Product Markets

Real rigidity in labor and product markets causes wages and prices to remain inflexible despite changes in economic conditions, hindering the adjustment process after shocks. This inflexibility can lead to prolonged unemployment and output gaps as firms and workers cannot quickly adapt to demand fluctuations. In product markets, real rigidity reduces competitive pricing responses, resulting in slower recovery from recessions and less efficient resource allocation.

Nominal vs Real Rigidity: Empirical Evidence

Nominal rigidity refers to price or wage stickiness in monetary terms, while real rigidity involves the resistance of relative prices or wages to adjust, affecting resource allocation and output. Empirical evidence from micro-level studies highlights that nominal rigidities significantly influence short-term economic fluctuations, as prices and wages often remain fixed due to contracts and menu costs. Research using firm-level data and labor market analyses confirms that real rigidities amplify the effects of nominal shocks, complicating monetary policy transmission.

Policy Implications and Economic Outcomes

Nominal rigidity refers to the slow adjustment of nominal prices and wages, which limits the effectiveness of monetary policy in stabilizing output and inflation. Real rigidity involves factors like price stickiness and market imperfections that prevent relative prices from adjusting, exacerbating unemployment and output fluctuations during economic shocks. Understanding the distinction helps policymakers design targeted interventions, as nominal rigidities often call for monetary stimulus while real rigidities may require structural reforms to improve labor market flexibility and promote long-term economic stability.

Nominal rigidity Infographic

libterm.com

libterm.com