Accounting profit represents the financial gain calculated by subtracting explicit costs, such as wages and materials, from total revenue during a specific period. It focuses on actual monetary transactions and is crucial for assessing your business's current financial success. Explore the rest of the article to understand how accounting profit differs from economic profit and its impact on decision-making.

Table of Comparison

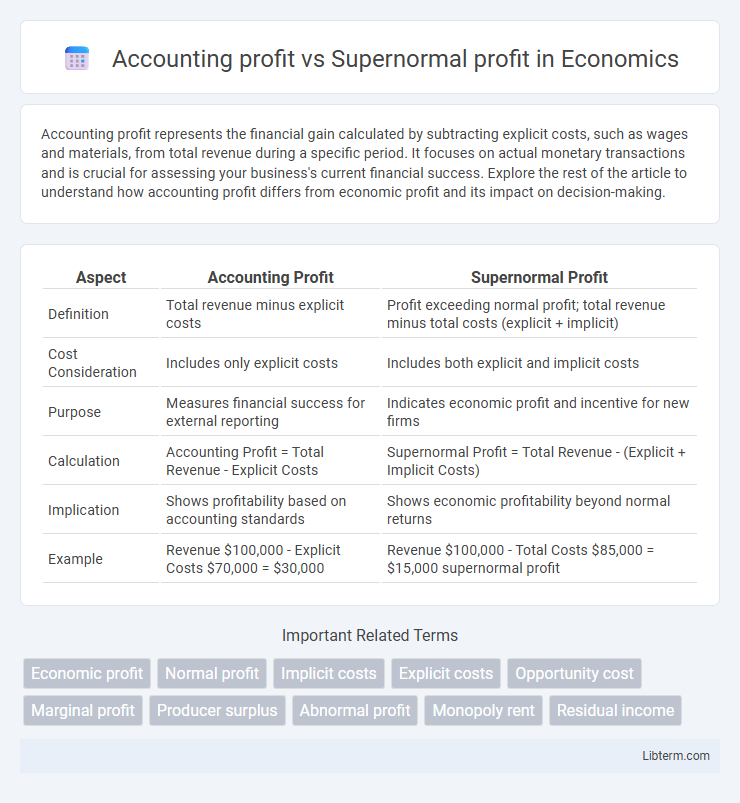

| Aspect | Accounting Profit | Supernormal Profit |

|---|---|---|

| Definition | Total revenue minus explicit costs | Profit exceeding normal profit; total revenue minus total costs (explicit + implicit) |

| Cost Consideration | Includes only explicit costs | Includes both explicit and implicit costs |

| Purpose | Measures financial success for external reporting | Indicates economic profit and incentive for new firms |

| Calculation | Accounting Profit = Total Revenue - Explicit Costs | Supernormal Profit = Total Revenue - (Explicit + Implicit Costs) |

| Implication | Shows profitability based on accounting standards | Shows economic profitability beyond normal returns |

| Example | Revenue $100,000 - Explicit Costs $70,000 = $30,000 | Revenue $100,000 - Total Costs $85,000 = $15,000 supernormal profit |

Understanding Accounting Profit

Accounting profit represents the total revenue minus explicit costs, reflecting the financial gain reported on standard financial statements. It excludes implicit costs such as opportunity costs, focusing purely on actual monetary transactions incurred during business operations. Understanding accounting profit is essential for assessing a company's short-term financial health and tax obligations.

Defining Supernormal Profit

Supernormal profit, also known as economic profit, is the profit earned by a firm that exceeds the normal profit level, which covers all explicit and implicit costs including opportunity costs. Unlike accounting profit, which only considers explicit costs, supernormal profit accounts for total opportunity costs, reflecting the true profitability of a business. Firms earning supernormal profits are generating returns above the minimum required to keep resources in their current use, signaling exceptional financial performance.

Key Differences Between Accounting and Supernormal Profit

Accounting profit measures total revenue minus explicit costs, reflecting the firm's financial gain recorded in financial statements. Supernormal profit, or economic profit, accounts for both explicit and implicit costs, indicating earnings above normal expected returns including opportunity costs. The key difference lies in supernormal profit capturing economic value beyond accounting figures by considering all costs, thus providing deeper insight into a firm's true profitability.

Components of Accounting Profit

Accounting profit consists of total revenue minus explicit costs, including wages, rent, and materials paid during the accounting period. It excludes implicit costs such as opportunity costs and normal profit, which are considered in economic profit calculations. Understanding accounting profit helps businesses evaluate financial performance based on actual cash flows and expenses recorded in financial statements.

Economic Concepts Behind Supernormal Profit

Supernormal profit, also known as economic profit, occurs when total revenue exceeds both explicit and implicit costs, reflecting a firm's ability to earn more than the normal return on investment. Unlike accounting profit, which only subtracts explicit costs from total revenue, supernormal profit accounts for opportunity costs, highlighting a firm's competitive advantage and market power. This economic concept is crucial for understanding firm behavior, resource allocation, and long-term industry dynamics.

Role of Implicit and Explicit Costs

Accounting profit measures the difference between total revenue and explicit costs, which include direct payments like wages and rent. Supernormal profit, or economic profit, accounts for both explicit and implicit costs, such as opportunity costs of the owner's resources. The inclusion of implicit costs in calculating supernormal profit provides a more comprehensive assessment of a firm's profitability beyond accounting figures.

Profit Measurement in Different Business Scenarios

Accounting profit measures total revenue minus explicit costs, providing a clear snapshot of a company's financial performance in routine business scenarios. Supernormal profit, or economic profit, accounts for both explicit and implicit costs, revealing when a firm's earnings exceed normal returns, signaling competitive advantage or market dominance. Understanding these profit types aids businesses in various scenarios, from operational budgeting to strategic investment decisions.

Importance of Supernormal Profit in Market Structures

Supernormal profit represents earnings that exceed the normal profit level in a market, serving as a crucial indicator of a firm's competitive advantage and market power. In imperfect competition and monopoly market structures, supernormal profits signal barriers to entry and innovation incentives, driving firms to enhance efficiency and product differentiation. The presence of supernormal profit influences resource allocation and long-term market dynamics by affecting entry decisions and investment strategies.

Impact on Business Decision-Making

Accounting profit represents total revenue minus explicit costs, providing a clear measure of financial performance used for tax reporting and internal assessments. Supernormal profit, which exceeds normal profit (total costs including opportunity costs), signals exceptional business success and can influence strategic decisions such as market entry, expansion, or investment in innovation. Businesses prioritize supernormal profit metrics to evaluate competitive advantage and long-term sustainability, guiding decisions that drive growth and resource allocation.

Conclusion: Choosing the Right Profit Metric

Choosing the right profit metric depends on the business objective: accounting profit provides a clear measure of financial performance by subtracting explicit costs from total revenue, making it ideal for tax reporting and basic profitability analysis. Supernormal profit, or economic profit, accounts for both explicit and implicit costs, offering deeper insight into true economic viability and competitive advantage. Businesses seeking long-term strategic decisions and resource allocation should prioritize supernormal profit to capture opportunity costs and sustainable value creation.

Accounting profit Infographic

libterm.com

libterm.com