The balance sheet approach focuses on evaluating a company's financial health by analyzing its assets, liabilities, and equity at a specific point in time. This method provides a clear snapshot of your organization's net worth and liquidity, helping to assess financial stability and risk. Discover how mastering the balance sheet approach can improve your financial decision-making by reading the rest of the article.

Table of Comparison

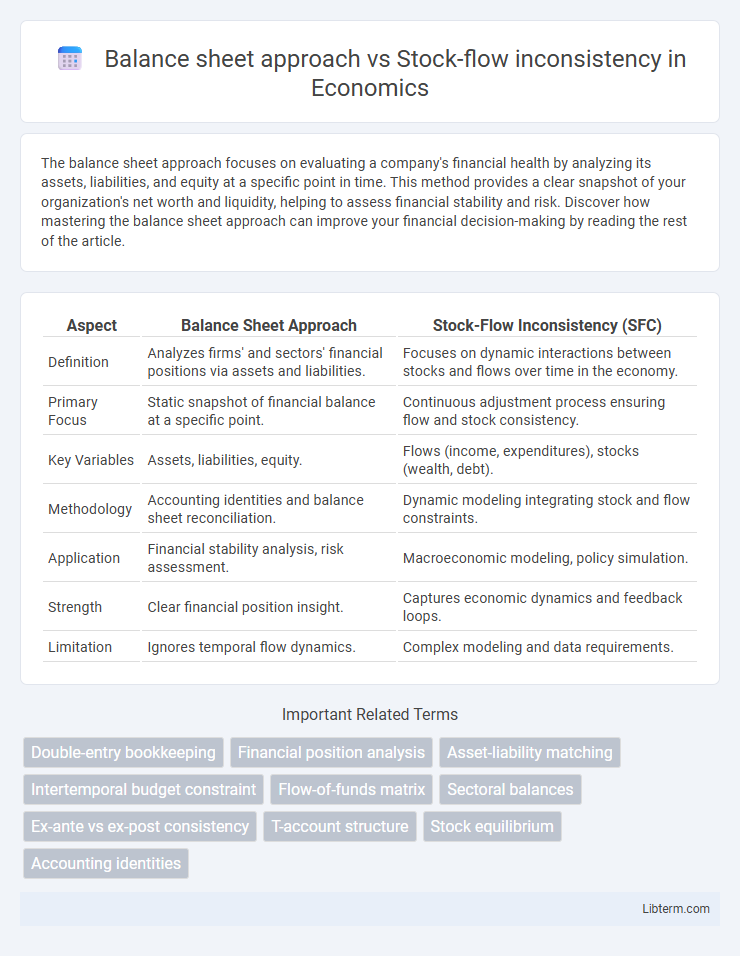

| Aspect | Balance Sheet Approach | Stock-Flow Inconsistency (SFC) |

|---|---|---|

| Definition | Analyzes firms' and sectors' financial positions via assets and liabilities. | Focuses on dynamic interactions between stocks and flows over time in the economy. |

| Primary Focus | Static snapshot of financial balance at a specific point. | Continuous adjustment process ensuring flow and stock consistency. |

| Key Variables | Assets, liabilities, equity. | Flows (income, expenditures), stocks (wealth, debt). |

| Methodology | Accounting identities and balance sheet reconciliation. | Dynamic modeling integrating stock and flow constraints. |

| Application | Financial stability analysis, risk assessment. | Macroeconomic modeling, policy simulation. |

| Strength | Clear financial position insight. | Captures economic dynamics and feedback loops. |

| Limitation | Ignores temporal flow dynamics. | Complex modeling and data requirements. |

Understanding the Balance Sheet Approach

The Balance Sheet Approach in macroeconomics emphasizes the importance of financial positions and net worth in understanding economic stability, contrasting with the Stock-Flow Inconsistency (SFI) modeling that integrates both stocks and flows over time to capture macroeconomic dynamics. By focusing on assets, liabilities, and equity from sectoral balance sheets, the Balance Sheet Approach provides a clear framework for analyzing financial fragilities and systemic risks within households, firms, and governments. This approach enhances policy assessment by linking balance sheet structures to economic outcomes, avoiding the complex feedback loops inherent in SFI models.

Defining Stock-Flow Inconsistency

Stock-flow inconsistency occurs when the recorded changes in stocks of assets or liabilities do not align with the corresponding flows in income or expenses, leading to discrepancies in accounting records. The balance sheet approach emphasizes ensuring that all stock variables, such as assets, liabilities, and equity, accurately reflect cumulative flows over time, maintaining consistency between stocks and flows. Addressing stock-flow inconsistency is crucial for accurate financial analysis, as it ensures coherent integration of balance sheets and flow-of-funds data within macroeconomic models.

Core Principles of Both Frameworks

The Balance Sheet approach emphasizes the accounting identity that assets must equal liabilities plus equity, ensuring financial consistency across sectors by tracking stocks at a point in time, while the Stock-Flow Inconsistency framework focuses on the dynamic relationship between flows (transactions) and stocks, highlighting how imbalances in flows can cause changes in stock variables and economic instability. Core to the Balance Sheet approach is the maintenance of equilibrium in financial positions through double-entry bookkeeping, whereas the SFC framework integrates real and financial sectors by modeling continuous interactions and adjustments via differential equations. Both frameworks address financial stability but differ in temporal focus: static snapshots for Balance Sheets versus dynamic processes for Stock-Flow Consistency.

Key Differences in Financial Analysis

The balance sheet approach emphasizes the accurate measurement and reconciliation of assets, liabilities, and equity at a given point in time, providing a snapshot of financial health. In contrast, the stock-flow inconsistency framework analyzes the dynamic interaction between accumulated stocks and flows over time, highlighting potential discrepancies in financial flows and stock adjustments. Key differences in financial analysis involve the static nature of balance sheets versus the temporal, process-oriented perspective of stock-flow inconsistency models.

Implications for Macroeconomic Modeling

The balance sheet approach enhances macroeconomic modeling by explicitly incorporating financial asset and liability stocks, improving the accuracy of debt dynamics and default risk analysis. Stock-flow inconsistency models address discrepancies between flows and stocks, capturing the disequilibrium in sectoral balances that traditional models often overlook. Integrating these methods advances the understanding of systemic financial stability, endogenous money creation, and the propagation of economic shocks.

Advantages of the Balance Sheet Approach

The Balance Sheet Approach offers clear advantages by providing a comprehensive snapshot of an economy's financial positions at a given time, enabling precise tracking of assets, liabilities, and net worth across sectors. It enhances transparency and helps identify financial imbalances and vulnerabilities that may not be apparent through flow-based models. This approach facilitates improved policy-making by linking sectoral balance sheets with macroeconomic dynamics, supporting more robust analysis of financial stability and economic resilience.

Limitations of Stock-Flow Inconsistencies

Stock-flow inconsistency models often face challenges in capturing dynamic financial interdependencies and real-time economic adjustments, leading to limited predictive accuracy. These models struggle to integrate comprehensive balance sheet data, resulting in potential misalignments between asset values and flow variables. The inability to fully reconcile stock variables with corresponding flows restricts their effectiveness in analyzing financial stability and systemic risk.

Real-World Applications and Case Studies

The balance sheet approach emphasizes the detailed accounting of assets, liabilities, and equity to assess financial stability, widely applied in banking stress tests and corporate risk management. Stock-flow inconsistency models analyze the dynamic interactions between stocks and flows, proving essential for macroeconomic policy simulations and forecasting financial crises. Case studies in the European banking sector demonstrate how integrating both methods enhances predictive accuracy and regulatory compliance.

Policy Implications and Recommendations

The balance sheet approach emphasizes the importance of asset-liability matching and financial stability, advocating for policies that enhance transparency and accurate valuation of financial positions to prevent systemic risk. In contrast, the stock-flow inconsistency framework highlights macroeconomic imbalances arising from disequilibrium between flows and accumulated stocks, recommending coordinated fiscal and monetary policies to address persistent deficits and surpluses. Policymakers should integrate both approaches by ensuring robust regulatory oversight of financial institutions while simultaneously monitoring sectoral financial flows to promote sustainable economic growth and financial resilience.

Conclusion: Choosing the Right Analytical Framework

Selecting the appropriate analytical framework depends on the research objective: the balance sheet approach provides a detailed snapshot of financial positions at a given time, useful for assessing solvency and liquidity. Stock-flow inconsistency models capture dynamic interactions between stocks and flows over time, essential for understanding macroeconomic imbalances and financial instability. Analysts must weigh the static precision of balance sheets against the systemic insights offered by stock-flow consistent frameworks to ensure accurate economic analysis.

Balance sheet approach Infographic

libterm.com

libterm.com