Legal incidence refers to the party who ultimately bears the economic burden of a law or regulation, regardless of who is initially responsible for payment. Understanding legal incidence helps clarify how taxes, fines, or other legal costs affect consumers, businesses, or workers differently. Explore the rest of this article to discover how legal incidence impacts your financial responsibilities and decision-making.

Table of Comparison

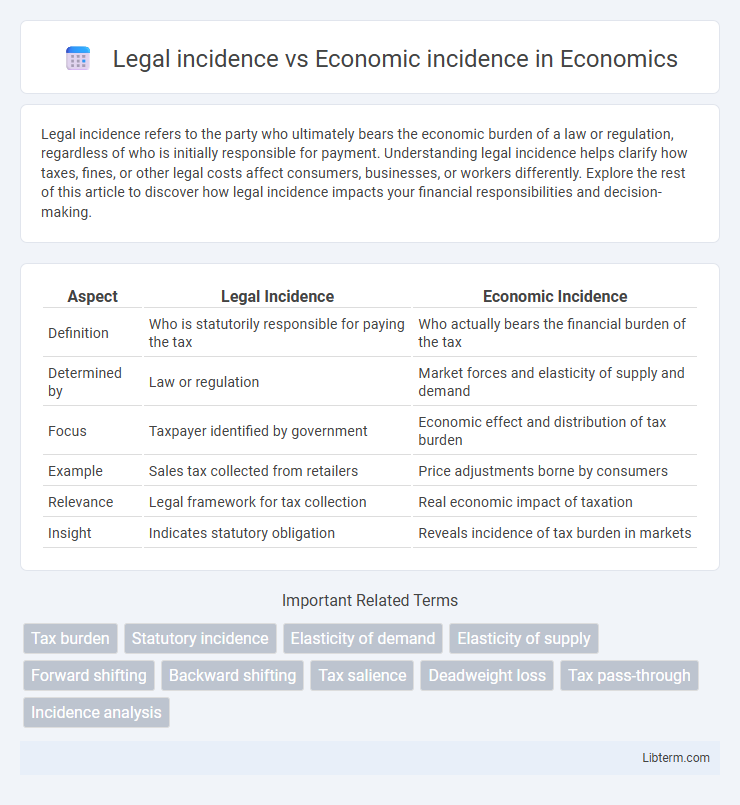

| Aspect | Legal Incidence | Economic Incidence |

|---|---|---|

| Definition | Who is statutorily responsible for paying the tax | Who actually bears the financial burden of the tax |

| Determined by | Law or regulation | Market forces and elasticity of supply and demand |

| Focus | Taxpayer identified by government | Economic effect and distribution of tax burden |

| Example | Sales tax collected from retailers | Price adjustments borne by consumers |

| Relevance | Legal framework for tax collection | Real economic impact of taxation |

| Insight | Indicates statutory obligation | Reveals incidence of tax burden in markets |

Introduction to Legal and Economic Incidence

Legal incidence refers to the party officially responsible for paying a tax as defined by law, such as consumers when a sales tax is levied. Economic incidence examines who ultimately bears the cost of the tax, considering changes in market behavior and price adjustments affecting consumers, producers, or both. Understanding both legal and economic incidence is crucial for assessing the actual impact of taxation on different economic agents and resource allocation efficiency.

Defining Legal Incidence

Legal incidence refers to the party upon whom the law imposes the obligation to pay a tax, such as a consumer or producer designated by legislation. Economic incidence, by contrast, measures the actual burden of the tax, reflecting who ultimately bears the cost after market adjustments, regardless of legal assignment. Understanding legal incidence is crucial for policymakers to determine the entity responsible for remitting taxes to the government, even if the economic burden shifts elsewhere.

Understanding Economic Incidence

Economic incidence refers to the actual burden of a tax on individuals or businesses, regardless of who is legally responsible for paying it. It considers changes in market behavior, such as shifts in supply and demand, to determine who ultimately bears the cost. Understanding economic incidence helps policymakers assess the real impact of taxation on different economic agents and resource allocation.

Key Differences Between Legal and Economic Incidence

Legal incidence refers to the party statutorily responsible for paying a tax, such as a manufacturer or consumer, while economic incidence measures the actual economic burden of the tax regardless of who sends the payment to the government. Key differences include that legal incidence is determined by law and tax regulations, whereas economic incidence depends on market forces like supply and demand elasticities affecting price adjustments. Economic incidence reveals the true distribution of tax burden among consumers, producers, and other stakeholders, which often diverges from the formal legal assignment of tax liability.

Theoretical Framework: Tax Shifting

Legal incidence defines the taxpayer legally responsible for remitting the tax to the government, while economic incidence refers to the actual party who bears the economic burden of the tax. Theoretical frameworks on tax shifting analyze how taxes imposed on producers or consumers can be transferred through changes in prices, wages, or market behaviors, affecting the true economic incidence. Models such as partial equilibrium or general equilibrium emphasize market elasticity and competitive conditions as key determinants in the distribution of tax burden between buyers and sellers.

Factors Influencing Economic Incidence

Economic incidence of a tax depends on market structures and the price elasticity of supply and demand, determining who ultimately bears the tax burden. Factors such as the relative price elasticity of consumers and producers influence whether the tax incidence falls more on buyers or sellers. In markets with inelastic demand, consumers bear a larger economic incidence, whereas in markets with inelastic supply, producers absorb more of the tax burden.

Examples of Legal vs Economic Incidence in Taxation

Legal incidence of taxation refers to the entity formally responsible for paying the tax to the government, such as a business required to remit a sales tax. Economic incidence, on the other hand, examines who ultimately bears the financial burden of the tax, which may shift from the entity legally liable to consumers through higher prices or employees through lower wages. For example, a cigarette tax legally imposed on manufacturers may result in economic incidence falling on smokers due to increased retail prices, while a payroll tax legally paid by employers may economically burden workers through reduced take-home pay.

Policy Implications of Incidence Distinction

Legal incidence determines who is formally responsible for paying a tax, while economic incidence analyzes who actually bears the financial burden after market adjustments. Policymakers must consider economic incidence to assess the true distributional effects of taxes, as relying solely on legal incidence can misrepresent the impact on consumers and producers. Understanding this distinction informs more equitable tax policies and targeted fiscal interventions that align with economic realities.

Real-World Case Studies: Incidence Analysis

Legal incidence defines who is statutorily responsible for paying a tax, while economic incidence reveals who ultimately bears the tax burden after market adjustments. Real-world case studies, such as the tobacco tax in the United States, demonstrate that despite legal obligations on producers, consumers often shoulder most of the economic incidence through higher prices. Detailed incidence analyses in sectors like fuel and labor markets show significant disparities between statutory tax assignments and actual economic impacts, underlining the importance of understanding both for effective policy design.

Conclusion: Importance of Incidence in Public Finance

Legal incidence identifies who is statutorily responsible for tax payment, while economic incidence reveals who ultimately bears the tax burden through market adjustments. Understanding the divergence between these incidences is crucial in public finance for designing equitable tax systems and predicting behavioral responses. Accurate incidence analysis enables policymakers to assess tax efficiency, redistribution effects, and the true economic impact on consumers and producers.

Legal incidence Infographic

libterm.com

libterm.com