Monetarists emphasize the critical role of controlling the money supply to regulate economic stability and inflation. Their theory suggests that managing monetary policy effectively can prevent economic downturns and ensure steady growth. Discover how monetarist principles influence modern economic strategies and what this means for your financial decisions.

Table of Comparison

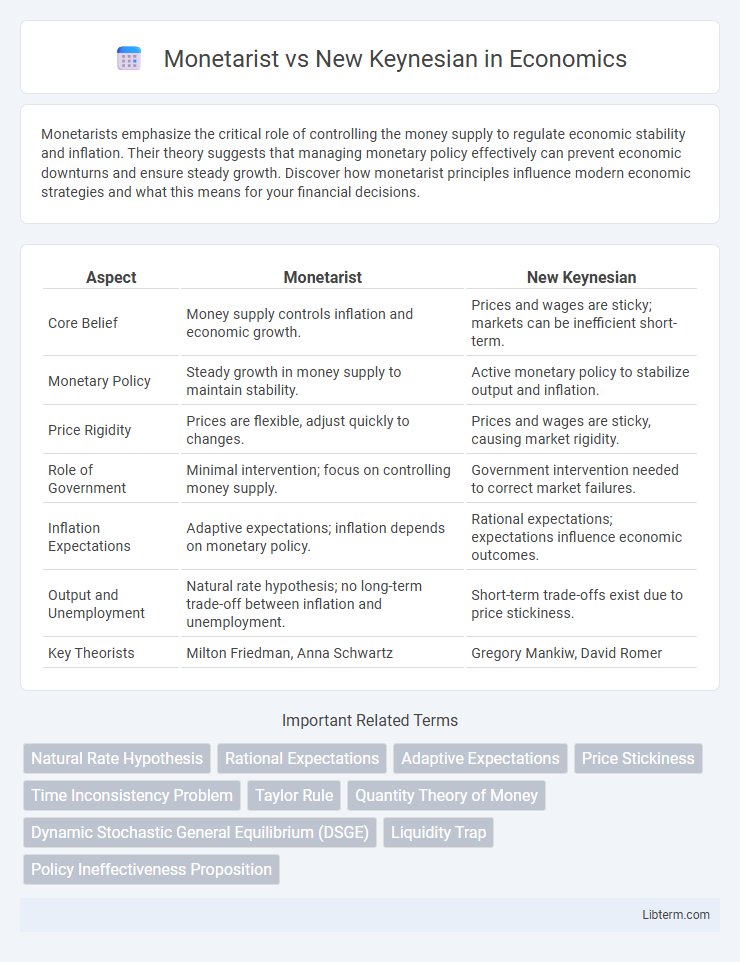

| Aspect | Monetarist | New Keynesian |

|---|---|---|

| Core Belief | Money supply controls inflation and economic growth. | Prices and wages are sticky; markets can be inefficient short-term. |

| Monetary Policy | Steady growth in money supply to maintain stability. | Active monetary policy to stabilize output and inflation. |

| Price Rigidity | Prices are flexible, adjust quickly to changes. | Prices and wages are sticky, causing market rigidity. |

| Role of Government | Minimal intervention; focus on controlling money supply. | Government intervention needed to correct market failures. |

| Inflation Expectations | Adaptive expectations; inflation depends on monetary policy. | Rational expectations; expectations influence economic outcomes. |

| Output and Unemployment | Natural rate hypothesis; no long-term trade-off between inflation and unemployment. | Short-term trade-offs exist due to price stickiness. |

| Key Theorists | Milton Friedman, Anna Schwartz | Gregory Mankiw, David Romer |

Introduction to Monetarist and New Keynesian Economics

Monetarist economics, pioneered by Milton Friedman, emphasizes the role of government in controlling the money supply to manage inflation and stabilize the economy, advocating for predictable monetary policies rather than active fiscal intervention. New Keynesian economics builds on Keynesian principles by incorporating microeconomic foundations such as price stickiness and imperfect competition, supporting the use of monetary policy to address short-term economic fluctuations and stabilize output and employment. Both schools diverge on policy effectiveness concerns, with monetarists focusing on long-term monetary equilibrium and New Keynesians emphasizing short-term market imperfections.

Historical Background of Both Schools

Monetarism emerged in the 1950s and 1960s, spearheaded by economist Milton Friedman, emphasizing controlling money supply to manage inflation and economic stability, reacting against Keynesian fiscal policies dominant after the Great Depression. New Keynesian economics developed in the 1980s as a refinement of Keynesian thought, integrating microeconomic foundations and price stickiness into models to explain real-world market imperfections and justify active monetary policy. Both schools arose from critiques of classical economics, with monetarists advocating limited government intervention and New Keynesians supporting strategic fiscal and monetary policies to address market failures.

Core Principles of Monetarism

Monetarism emphasizes the control of the money supply as the primary tool for regulating economic activity and managing inflation, advocating for a steady, predictable growth rate of money supply. It asserts that markets are generally efficient and that government intervention often leads to destabilization and inflationary pressures. Monetarists prioritize long-term price stability and argue against active fiscal policy, contrasting with New Keynesian focus on price stickiness and the effectiveness of monetary and fiscal policy in managing demand fluctuations.

Key Tenets of New Keynesian Theory

New Keynesian theory emphasizes price and wage stickiness, leading to market imperfections that prevent immediate equilibrium and justify government intervention for stabilization. It incorporates rational expectations and imperfect competition, explaining persistent unemployment and output gaps during economic fluctuations. The framework supports the use of monetary policy to manage demand and addresses the role of nominal rigidities in influencing economic cycles.

Monetary Policy: Monetarist vs New Keynesian Approaches

Monetarist monetary policy emphasizes controlling the money supply to manage inflation and economic stability, advocating for steady, predictable growth in money supply to avoid economic fluctuations. New Keynesian approaches incorporate price stickiness and market imperfections, supporting active monetary policy interventions, such as adjusting interest rates, to stabilize output and employment in the short term. While Monetarists prioritize rules-based policies to reduce uncertainty, New Keynesians favor discretionary policies to respond flexibly to economic shocks.

Fiscal Policy Perspectives: Contrasts and Similarities

Monetarists emphasize controlling inflation through strict monetary policy, viewing fiscal policy as largely ineffective or destabilizing, while New Keynesians support active fiscal interventions to stabilize output and employment during economic downturns. Both schools agree on the importance of expectations and inflation targeting, but New Keynesians incorporate price and wage rigidities that justify fiscal stimulus, contrasting with the Monetarist preference for predictable monetary growth rules. Despite differing views on fiscal policy efficacy, both recognize the central bank's role in managing inflation and influencing economic stability.

Inflation Control Mechanisms

Monetarists emphasize controlling inflation through managing the money supply, advocating for a fixed growth rate of money to maintain price stability and avoid inflationary pressures. New Keynesians support using monetary policy tools like interest rate adjustments by central banks to influence inflation expectations and aggregate demand, aiming to stabilize prices without causing unemployment. Both approaches recognize inflation control as crucial, but Monetarists rely primarily on monetary aggregates while New Keynesians integrate price rigidities and expectations into their mechanisms.

Responses to Economic Shocks

Monetarists emphasize the importance of controlling the money supply to stabilize the economy following economic shocks, advocating for predictable monetary policy to avoid destabilizing expectations. New Keynesians highlight the role of price and wage rigidities, supporting active fiscal and monetary interventions to counteract demand fluctuations and restore output to potential. Both schools agree that the timing and credibility of policy responses are critical in mitigating the effects of shocks on inflation and employment.

Policy Applications in Recent Decades

Monetarist policy applications emphasize controlling money supply growth to manage inflation, advocating for predictable, rule-based monetary policy, prominently influencing central banks in the 1980s. New Keynesian models inform contemporary policy through the use of interest rate adjustments and forward guidance, addressing market imperfections and price stickiness while incorporating expectations management. In recent decades, integration of New Keynesian frameworks in central banking has enhanced responsiveness to economic shocks, complementing monetarist principles with inflation targeting and dynamic stabilization policies.

Future Directions and Debates

Future directions in Monetarist versus New Keynesian debates emphasize the integration of monetary policy rules with real-world frictions like price stickiness and financial market imperfections. Emerging research investigates the dynamic interaction between expectations management and the effectiveness of central bank interventions, especially under zero lower bound constraints. Scholars continue to debate the role of fiscal policy coordination alongside monetary strategies in stabilizing economies amid evolving global uncertainties.

Monetarist Infographic

libterm.com

libterm.com