Initial incidence refers to the number of new cases of a disease or condition occurring in a specific population during a defined time period. Understanding initial incidence helps public health officials identify emerging health threats and allocate resources effectively. Explore the rest of this article to learn how initial incidence impacts disease control strategies and your community's health.

Table of Comparison

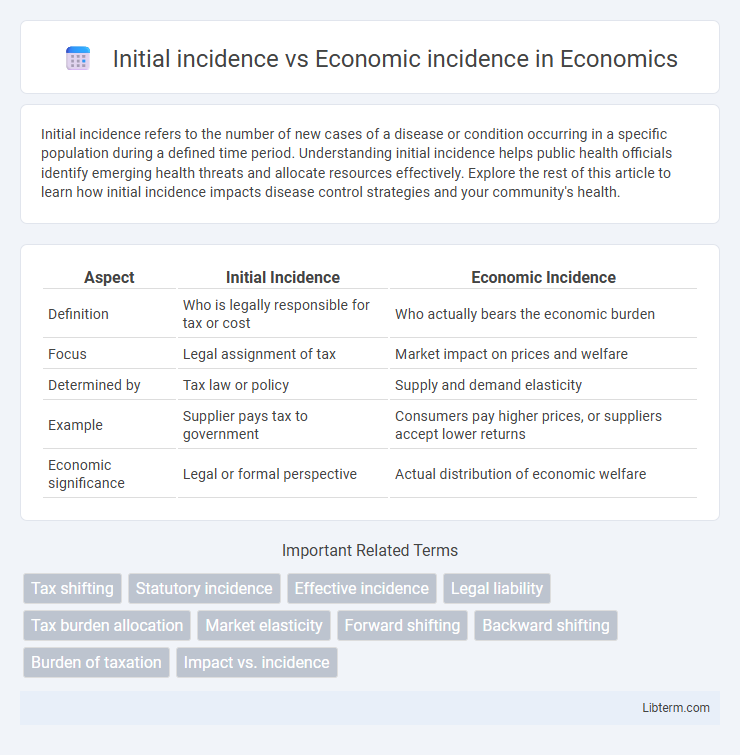

| Aspect | Initial Incidence | Economic Incidence |

|---|---|---|

| Definition | Who is legally responsible for tax or cost | Who actually bears the economic burden |

| Focus | Legal assignment of tax | Market impact on prices and welfare |

| Determined by | Tax law or policy | Supply and demand elasticity |

| Example | Supplier pays tax to government | Consumers pay higher prices, or suppliers accept lower returns |

| Economic significance | Legal or formal perspective | Actual distribution of economic welfare |

Understanding Initial Incidence vs Economic Incidence

Initial incidence refers to who legally bears the burden of a tax or cost, such as producers or consumers, while economic incidence examines the true distribution of that burden after market adjustments. Understanding initial incidence helps identify direct payers, but economic incidence reveals how tax effects shift through prices, wages, and resource allocation. Analyzing both concepts clarifies the real impact of fiscal policies on different economic agents and overall welfare.

Defining Initial Incidence: The First Impact

Initial incidence refers to the immediate burden of a tax or economic policy on the entity directly responsible for payment, such as consumers or producers. It represents the first impact of the tax before market adjustments or shifts in supply and demand redistribute the economic burden. Understanding initial incidence is crucial for analyzing how taxes affect prices, production, and resource allocation at the outset.

Exploring Economic Incidence: The Final Burden

Economic incidence reveals who ultimately bears the financial burden of a tax, contrasting with initial incidence, which identifies where the tax is legally imposed. Market adjustments, such as changes in prices and production, shift the economic incidence between consumers and producers. Understanding this distinction is crucial for accurate tax policy analysis and assessing real-world impacts on economic agents.

Key Differences Between Initial and Economic Incidence

Initial incidence refers to the party legally responsible for paying a tax, such as consumers or producers at the point of collection. Economic incidence measures the actual distribution of the tax burden, reflecting who ultimately bears the cost after market adjustments. Key differences include the legal obligation in initial incidence versus the practical financial impact in economic incidence, influenced by factors like price elasticity and market structure.

The Role of Market Forces in Shifting Incidence

Initial incidence refers to the immediate legal obligation to pay a tax or bear a cost, while economic incidence describes the actual burden on consumers or producers after market adjustments. Market forces such as supply and demand elasticity determine how much of the tax or cost burden is shifted between buyers and sellers. When demand is inelastic, consumers bear a larger share of the economic incidence, whereas highly elastic supply leads producers to absorb more of the initial incidence.

Factors Influencing Economic Incidence

Initial incidence refers to who legally bears the tax burden at the time of imposition, while economic incidence identifies who ultimately absorbs the cost after market adjustments. Factors influencing economic incidence include the relative price elasticities of supply and demand, market structure, and the ability of firms or consumers to shift the tax burden. Highly elastic demand or supply tends to shift the economic incidence away from the party with greater flexibility, affecting overall tax incidence distribution.

Real-World Examples of Tax Incidence Shift

Initial incidence refers to the party legally responsible for paying a tax, while economic incidence reveals who actually bears the tax burden after market adjustments. For instance, cigarette taxes initially imposed on producers often shift to consumers through higher prices, demonstrating economic incidence on buyers. Similarly, labor taxes aimed at employers can result in reduced wages, transferring the economic burden to workers despite the initial incidence on firms.

Policy Implications of Incidence Analysis

Initial incidence identifies who formally bears a tax burden, while economic incidence reveals who actually experiences the cost after market adjustments. Understanding economic incidence is crucial for policymakers to design tax systems that equitably distribute burdens and avoid unintended consequences like reduced labor supply or investment. Incidence analysis guides decisions on tax targeting, efficiency, and equity by highlighting the real economic impact beyond statutory obligations.

Measuring and Analyzing Tax Burden Distribution

Initial incidence refers to the party legally responsible for paying a tax, typically analyzed through statutory tax rates and billing mechanisms. Economic incidence examines the actual distribution of tax burden after market adjustments, assessing how taxes affect prices, wages, and resource allocation. Measuring tax burden distribution requires econometric models and data on elasticity of supply and demand to capture shifts in economic welfare beyond formal tax liability.

Conclusion: Importance of Distinguishing Incidence Types

Distinguishing between initial incidence and economic incidence is crucial for accurately assessing tax burden distribution and policy impact on different economic agents. Initial incidence identifies who is legally responsible for paying a tax, while economic incidence reveals who ultimately bears the financial cost, reflecting market adjustments. Understanding both types ensures more effective tax design and equitable resource allocation in public finance.

Initial incidence Infographic

libterm.com

libterm.com