Perfect competition occurs when numerous small firms compete in a market with identical products and no barriers to entry or exit, leading to optimal price and resource allocation. This market structure benefits consumers through lower prices and increased efficiency, as firms are forced to operate at their most productive capacity. Explore the rest of the article to understand how perfect competition shapes your everyday economic choices and market dynamics.

Table of Comparison

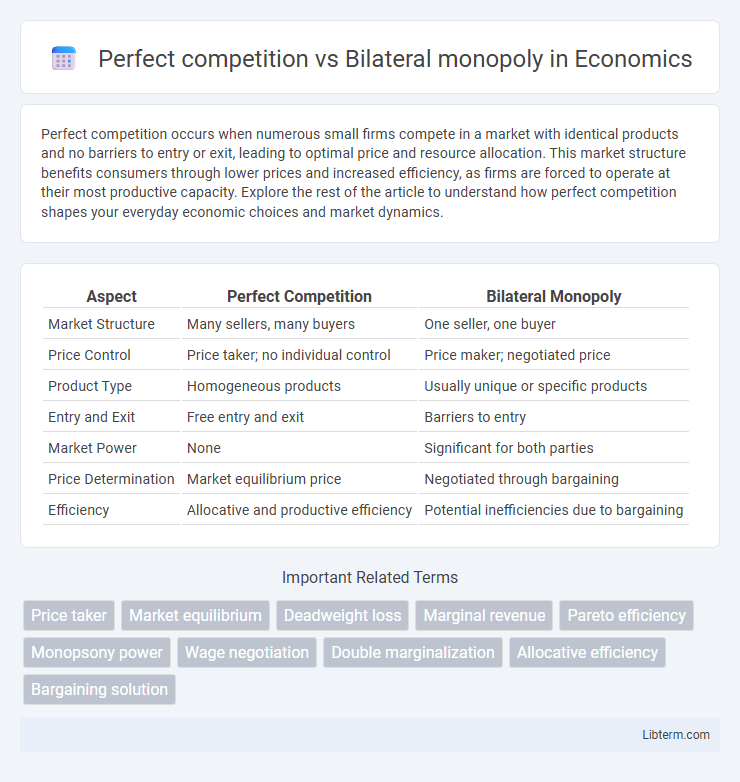

| Aspect | Perfect Competition | Bilateral Monopoly |

|---|---|---|

| Market Structure | Many sellers, many buyers | One seller, one buyer |

| Price Control | Price taker; no individual control | Price maker; negotiated price |

| Product Type | Homogeneous products | Usually unique or specific products |

| Entry and Exit | Free entry and exit | Barriers to entry |

| Market Power | None | Significant for both parties |

| Price Determination | Market equilibrium price | Negotiated through bargaining |

| Efficiency | Allocative and productive efficiency | Potential inefficiencies due to bargaining |

Introduction to Market Structures

Perfect competition features numerous buyers and sellers trading homogeneous products with free market entry and exit, ensuring price-taking behavior and efficient resource allocation. Bilateral monopoly exists when a single seller faces a single buyer, creating unique bargaining dynamics that can influence price and output levels. Market structures vary widely in terms of competition intensity, market power distribution, and price-setting abilities.

Defining Perfect Competition

Perfect competition is an economic market structure characterized by numerous small firms selling identical products, with no single seller able to influence market prices. It assumes perfect information, free entry and exit, and homogeneous goods, resulting in firms being price takers. In contrast, a bilateral monopoly features a single seller and a single buyer, leading to negotiation power concentrated between the two entities rather than price determined by market forces.

Understanding Bilateral Monopoly

Bilateral monopoly occurs when a single seller (monopoly) and a single buyer (monopsony) dominate a market, creating unique negotiation dynamics that influence price and output. Unlike perfect competition, where numerous sellers and buyers ensure market equilibrium through supply and demand forces, bilateral monopoly results in strategic bargaining power between the two entities. Understanding bilateral monopoly requires analyzing how the interaction between the monopolist and monopsonist affects market outcomes, often leading to negotiated prices that diverge from competitive equilibrium levels.

Key Characteristics of Perfect Competition

Perfect competition features numerous small firms selling identical products, ensuring no single seller can influence market price, which is determined solely by supply and demand. Firms are price takers with free entry and exit, leading to allocative and productive efficiency in the long run. Perfect information and homogeneous products ensure transparency and prevent market power abuse, contrasting sharply with the market power dynamics in a bilateral monopoly.

Main Features of Bilateral Monopoly

Bilateral monopoly occurs when a single seller (monopolist) faces a single buyer (monopsonist), creating a unique market structure where both parties have significant market power. The main features include a single seller controlling supply, a single buyer controlling demand, and the price outcome being determined through negotiation or bargaining rather than market competition. This results in an equilibrium price that reflects the relative bargaining strengths of the monopolist and monopsonist, often leading to market inefficiencies compared to perfect competition.

Price Determination Mechanisms

In perfect competition, price determination relies on the interaction of numerous buyers and sellers, where the market equilibrium price reflects the point at which supply equals demand. In contrast, a bilateral monopoly involves a single seller and a single buyer negotiating price, resulting in a bargaining process that depends on each party's market power and alternative options. The price in a bilateral monopoly typically falls between the seller's minimum acceptable price and the buyer's maximum willingness to pay, determined through strategic negotiation rather than straightforward market equilibrium.

Efficiency and Welfare Implications

Perfect competition maximizes allocative efficiency by ensuring that price equals marginal cost, leading to optimal resource distribution and maximum consumer and producer surplus. In contrast, a bilateral monopoly, where a single buyer and seller negotiate terms, often results in inefficient outcomes due to bargaining power imbalances, causing deadweight loss and reduced total welfare. Welfare implications in bilateral monopolies typically include lower output and higher prices compared to perfect competition, harming both allocative efficiency and overall market welfare.

Real-World Examples and Applications

Perfect competition is exemplified by agricultural markets where numerous farmers sell homogeneous products such as wheat, ensuring no single seller influences prices. In contrast, a bilateral monopoly occurs in labor markets like professional sports, where one team (buyer) negotiates exclusively with a star player (seller), leading to unique bargaining dynamics. These real-world applications highlight distinct market power distributions and pricing mechanisms critical for economic strategy and policy.

Advantages and Disadvantages Comparison

Perfect competition offers advantages such as efficient resource allocation, low prices for consumers, and high levels of market transparency due to numerous small firms competing. In contrast, bilateral monopoly, characterized by a single seller and a single buyer, can lead to negotiation complexities and potential inefficiencies, but allows for customized agreements and potentially higher profits for the involved parties. Disadvantages of perfect competition include limited innovation incentives and minimal profits for firms, whereas bilateral monopoly may result in market power imbalances and reduced overall welfare.

Conclusion: Insights and Policy Implications

Perfect competition drives market efficiency through numerous sellers and buyers, ensuring optimal price allocation and consumer welfare, whereas bilateral monopoly creates unique negotiation dynamics leading to potential inefficiencies and market power abuse. Policymakers should promote competitive entry and transparency to mitigate bilateral monopoly distortions and enhance market outcomes. Addressing negotiation asymmetries in bilateral monopolies is crucial for fostering fair pricing and preventing welfare losses.

Perfect competition Infographic

libterm.com

libterm.com