Underfunded projects often face significant challenges that hinder progress and reduce overall effectiveness, leading to compromised quality and delayed timelines. Proper funding ensures access to essential resources and skilled personnel, directly impacting success rates and outcomes. Discover how managing underfunded situations can be turned around and what strategies you can implement by reading the rest of the article.

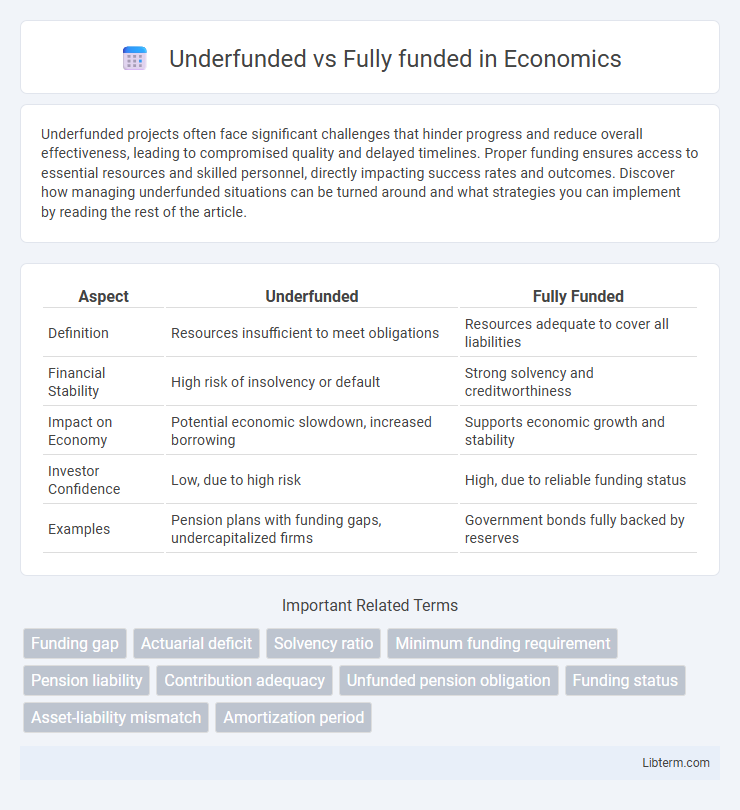

Table of Comparison

| Aspect | Underfunded | Fully Funded |

|---|---|---|

| Definition | Resources insufficient to meet obligations | Resources adequate to cover all liabilities |

| Financial Stability | High risk of insolvency or default | Strong solvency and creditworthiness |

| Impact on Economy | Potential economic slowdown, increased borrowing | Supports economic growth and stability |

| Investor Confidence | Low, due to high risk | High, due to reliable funding status |

| Examples | Pension plans with funding gaps, undercapitalized firms | Government bonds fully backed by reserves |

Understanding Underfunded and Fully Funded: Key Definitions

Understanding underfunded and fully funded status hinges on the relationship between a pension plan's liabilities and its assets. An underfunded plan possesses liabilities that exceed its assets, signaling a funding gap that can threaten benefit security. In contrast, a fully funded plan maintains assets equal to or greater than its liabilities, indicating sufficient resources to meet future obligations.

Causes of Underfunding in Organizations

Underfunding in organizations often stems from insufficient budget allocation, declining revenue streams, or economic downturns reducing available financial resources. Poor financial management and lack of strategic planning can also lead to underfunded operations despite potential funding opportunities. External factors such as policy changes, reduced grants, or limited donor engagement contribute significantly to funding gaps.

Characteristics of a Fully Funded Model

A fully funded model is characterized by having sufficient assets to cover all present and future liabilities, ensuring long-term financial stability and risk mitigation. This model often features strong funding ratios, typically at or above 100%, reflecting an organization's robust ability to meet its obligations. Emphasizing proactive contributions and conservative actuarial assumptions, the fully funded approach supports sustainable growth and reduces the likelihood of unexpected funding shortfalls.

Financial Implications: Underfunded vs Fully Funded

Underfunded projects often face cash flow issues, leading to delayed payments and increased borrowing costs, which heighten financial risk and operational inefficiencies. Fully funded initiatives benefit from secured capital, enabling timely expense coverage, reduced reliance on external funding, and stronger financial stability. The disparity affects credit ratings, investor confidence, and long-term project sustainability.

Impact on Operations and Performance

Underfunded projects often face resource constraints that hinder operational efficiency and delay critical deliverables, negatively affecting overall performance metrics. Fully funded initiatives benefit from adequate financial backing, enabling seamless resource allocation, timely execution, and higher quality outcomes. The disparity in funding levels directly influences the ability to maintain operational stability and achieve strategic goals effectively.

Risk Exposure: Which Model Is Safer?

Underfunded pension plans carry higher risk exposure due to potential shortfalls in asset values needed to meet future liabilities, increasing the probability of benefit reductions or additional contributions. Fully funded pension plans maintain asset levels equal to or exceeding their obligations, offering greater financial stability and lower risk of insolvency. Regulatory frameworks and actuarial assumptions often favor fully funded models to ensure long-term sustainability and minimize funding gaps.

Strategies to Transition from Underfunded to Fully Funded

Implementing a comprehensive fundraising strategy that includes grant applications, donor engagement, and corporate partnerships accelerates the transition from underfunded to fully funded status. Prioritizing transparent budgeting and demonstrating measurable impact increases stakeholder confidence and attracts sustainable investments. Leveraging digital marketing tools and data-driven outreach enhances fundraising effectiveness, enabling organizations to achieve financial stability and program scalability.

Case Studies: Lessons from Real-World Examples

Case studies reveal that underfunded projects often face delays, scope reductions, and compromised quality due to financial constraints, highlighting the critical role of adequate budgeting in project success. Fully funded initiatives demonstrate higher completion rates, improved stakeholder satisfaction, and enhanced risk management, as seen in examples from infrastructure development and nonprofit programs. These real-world cases emphasize that securing full funding upfront is essential for achieving project objectives and long-term sustainability.

Common Misconceptions about Funding Levels

Common misconceptions about underfunded versus fully funded projects often stem from oversimplifying financial health; underfunded does not always mean failure, nor does fully funded guarantee success. Many believe that simply securing full funding ensures project completion, ignoring factors like budget management and unforeseen expenses. Underfunded projects may still succeed through strategic allocation and supplemental funding, while fully funded projects can struggle without effective oversight.

Future Outlook: Achieving and Sustaining Full Funding

Achieving full funding ensures a pension plan's ability to meet long-term obligations and maintain financial health amid market volatility. Underfunded plans face increased risks of benefit cuts, higher contribution requirements, and potential insolvency, which undermine stakeholder confidence. Strategic investment management and consistent contributions are essential for sustaining full funding and securing future financial stability.

Underfunded Infographic

libterm.com

libterm.com