Pecking Order Theory explains how companies prioritize their sources of financing, favoring internal funds over debt and issuing new equity as a last resort to minimize costs and information asymmetry. This theory highlights the importance of a firm's internal resources and the implications for financial strategy and capital structure decisions. Discover how understanding Pecking Order Theory can guide Your business financing choices in the rest of this article.

Table of Comparison

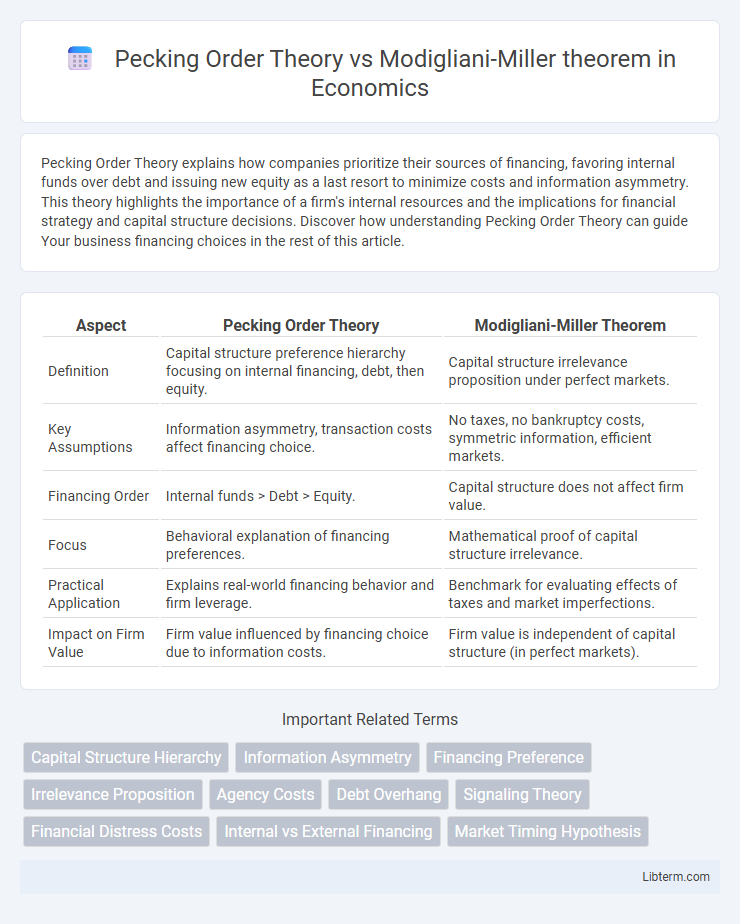

| Aspect | Pecking Order Theory | Modigliani-Miller Theorem |

|---|---|---|

| Definition | Capital structure preference hierarchy focusing on internal financing, debt, then equity. | Capital structure irrelevance proposition under perfect markets. |

| Key Assumptions | Information asymmetry, transaction costs affect financing choice. | No taxes, no bankruptcy costs, symmetric information, efficient markets. |

| Financing Order | Internal funds > Debt > Equity. | Capital structure does not affect firm value. |

| Focus | Behavioral explanation of financing preferences. | Mathematical proof of capital structure irrelevance. |

| Practical Application | Explains real-world financing behavior and firm leverage. | Benchmark for evaluating effects of taxes and market imperfections. |

| Impact on Firm Value | Firm value influenced by financing choice due to information costs. | Firm value is independent of capital structure (in perfect markets). |

Introduction to Capital Structure Theories

Pecking Order Theory explains capital structure based on firms' preference to finance investments first with internal funds, then debt, and finally equity to avoid asymmetric information costs. The Modigliani-Miller theorem posits that under perfect markets, a firm's value is unaffected by its capital structure, emphasizing neutrality in financing choices. These foundational theories provide contrasting perspectives on corporate financing decisions, highlighting information asymmetry and market imperfections.

Overview of Pecking Order Theory

The Pecking Order Theory suggests that firms prioritize internal financing and prefer debt over equity when external funds are needed, reflecting asymmetric information between managers and investors. This theory contrasts with the Modigliani-Miller theorem, which assumes capital structure irrelevance under perfect market conditions. Pecking Order Theory emphasizes practical financing behavior influenced by information costs, making it more applicable to real-world corporate finance decisions.

Fundamentals of the Modigliani-Miller Theorem

The Modigliani-Miller theorem establishes that, under perfect market conditions without taxes, bankruptcy costs, or asymmetric information, a firm's value remains unaffected by its capital structure. It asserts that the cost of equity increases linearly with leverage, offsetting benefits of cheaper debt financing, resulting in an invariant firm value. This foundational theorem contrasts with the Pecking Order Theory, which emphasizes financing decisions driven by asymmetric information and preference for internal funds over external equity.

Core Assumptions of Both Theories

Pecking Order Theory assumes firms prefer internal financing and debt over equity due to asymmetric information and associated costs, highlighting managerial preference for retained earnings to avoid signaling adverse information. The Modigliani-Miller theorem rests on core assumptions of perfect capital markets, no taxes, bankruptcy costs, or asymmetric information, asserting that a firm's value is unaffected by its capital structure under these conditions. Contrasting these frameworks reveals how information asymmetry and market imperfections are central to Pecking Order, while Modigliani-Miller idealizes a frictionless environment where financing decisions are irrelevant to firm value.

Key Differences Between Pecking Order Theory and MM Theorem

Pecking Order Theory emphasizes that firms prefer internal financing and debt over equity due to asymmetric information and transaction costs, influencing their capital structure decisions. In contrast, the Modigliani-Miller Theorem asserts that in perfect markets without taxes, bankruptcy costs, or asymmetric information, a firm's value remains unaffected by its capital structure. The key difference lies in Pecking Order Theory's reliance on market imperfections impacting financing preferences, whereas the MM Theorem assumes ideal conditions where capital structure is irrelevant to firm value.

Impact of Information Asymmetry

Pecking Order Theory emphasizes that firms prioritize internal financing due to information asymmetry, where managers possess more information than external investors, leading to a preference for retained earnings over debt or equity to minimize adverse selection costs. In contrast, the Modigliani-Miller theorem assumes perfect information and no tax or bankruptcy costs, suggesting capital structure irrelevance and no impact from information asymmetry on firm value. The key distinction is that Pecking Order Theory incorporates asymmetric information as a driving factor in financing decisions, whereas Modigliani-Miller abstracts from information asymmetry effects.

Real-World Applicability and Empirical Evidence

The Pecking Order Theory, grounded in asymmetric information, aligns closely with observed corporate financing patterns, emphasizing internal funds and debt over equity issuance due to cost differentials and managerial preferences. In contrast, the Modigliani-Miller theorem, under idealized conditions of no taxes, bankruptcy costs, or information asymmetry, posits capital structure irrelevance, which empirical evidence consistently challenges in real-world markets. Studies show firms often exhibit pecking order behavior, suggesting practical financing decisions deviate from the theorem's assumptions, highlighting the theory's limited real-world applicability and underscoring the significance of market imperfections.

Limitations and Criticisms of Each Theory

Pecking Order Theory faces criticism for its assumption that firms prioritize internal financing due to asymmetric information, often neglecting external market conditions and managerial motives, which limits its real-world applicability. The Modigliani-Miller theorem, despite its foundational role in capital structure theory, is criticized for its reliance on idealized conditions such as no taxes, bankruptcy costs, or asymmetric information, making it less practical for actual corporate finance decisions. Both theories are limited by their abstract assumptions, which restrict their effectiveness in explaining complex, dynamic financing behaviors observed in firms.

Implications for Corporate Financial Decision-Making

Pecking Order Theory emphasizes internal financing through retained earnings and debt over equity due to asymmetric information and issuing costs, influencing firms to prefer hierarchical funding sources in capital structure decisions. In contrast, the Modigliani-Miller theorem posits that, under perfect market conditions, capital structure is irrelevant to firm value, suggesting financial decisions should not impact valuation. These contrasting implications guide corporate finance strategies by highlighting the importance of market imperfections in real-world funding choices and capital structure optimization.

Conclusion: Integrating Theory with Practice

Pecking Order Theory emphasizes that firms prioritize internal financing and debt over equity due to asymmetric information and cost differences, while the Modigliani-Miller theorem insists capital structure is irrelevant in perfect markets. Integrating these theories into practice reveals that real-world frictions like taxes, bankruptcy costs, and information asymmetry significantly influence capital structure decisions. Firms must balance theoretical insights with market imperfections, optimizing financing choices to minimize costs and maximize value.

Pecking Order Theory Infographic

libterm.com

libterm.com