The diamond growth model explores how diamonds form naturally through carbon crystallization under intense heat and pressure deep within the Earth's mantle. Understanding this process provides insights into the conditions required for synthetic diamond production and can enhance industrial applications. Discover how this fascinating phenomenon unfolds and what it means for your knowledge of geology by reading the full article.

Table of Comparison

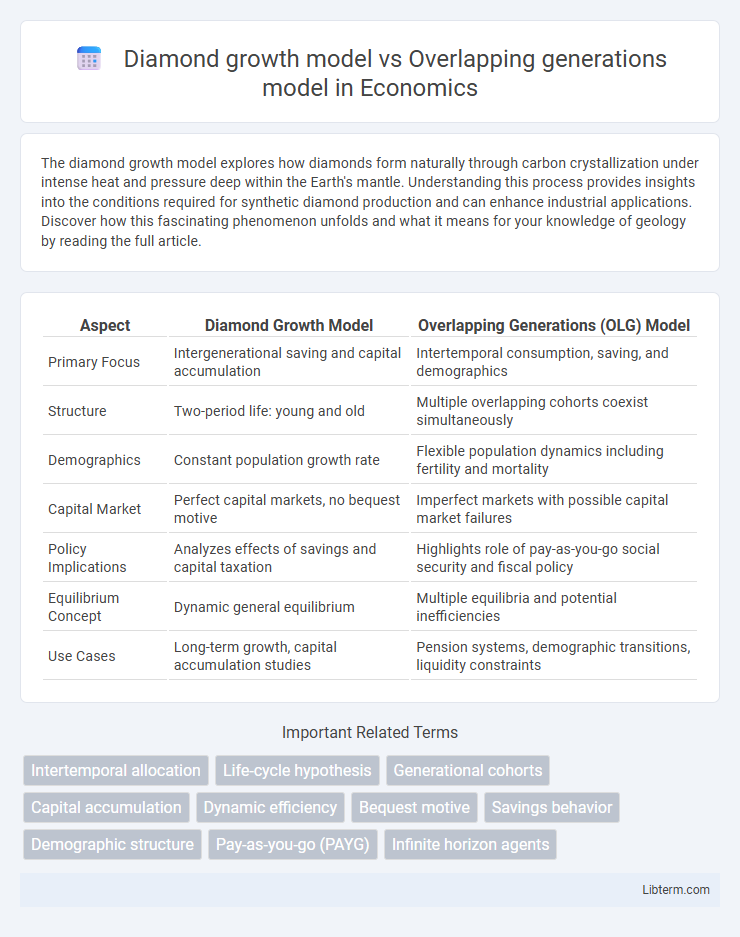

| Aspect | Diamond Growth Model | Overlapping Generations (OLG) Model |

|---|---|---|

| Primary Focus | Intergenerational saving and capital accumulation | Intertemporal consumption, saving, and demographics |

| Structure | Two-period life: young and old | Multiple overlapping cohorts coexist simultaneously |

| Demographics | Constant population growth rate | Flexible population dynamics including fertility and mortality |

| Capital Market | Perfect capital markets, no bequest motive | Imperfect markets with possible capital market failures |

| Policy Implications | Analyzes effects of savings and capital taxation | Highlights role of pay-as-you-go social security and fiscal policy |

| Equilibrium Concept | Dynamic general equilibrium | Multiple equilibria and potential inefficiencies |

| Use Cases | Long-term growth, capital accumulation studies | Pension systems, demographic transitions, liquidity constraints |

Introduction to Economic Growth Models

The Diamond growth model extends the Solow framework by incorporating an overlapping generations structure, where individuals live for two periods, allowing for detailed analysis of savings and capital accumulation dynamics. Unlike the Overlapping Generations (OLG) model, which primarily focuses on intergenerational transfer and debt sustainability, the Diamond model explicitly links demographic factors with economic growth through optimized household decisions. Both models highlight the role of population structure in economic development but differ in their assumptions about agent behavior and equilibrium outcomes.

Overview of the Diamond Growth Model

The Diamond Growth Model, developed by Peter Diamond in 1965, is a foundational framework in overlapping generations (OLG) economic theory that examines capital accumulation and intergenerational savings behavior. It models an economy with overlapping generations of agents who live for two periods, making consumption and saving decisions that determine the capital stock and economic growth. Unlike simpler infinite-horizon models, the Diamond Model captures the effects of demographic structure, savings, and interest rates on long-term growth and equilibrium dynamics.

Fundamentals of the Overlapping Generations (OLG) Model

The Overlapping Generations (OLG) model fundamentally analyzes intertemporal economic decisions by representing agents born in different periods who live for two periods, allowing distinct consumption and saving behaviors across young and old cohorts. Unlike the Diamond growth model, which incorporates endogenous savings and capital accumulation with a focus on balanced growth, the OLG model emphasizes generational interactions and the role of heterogeneity in savings, pensions, and capital markets. This framework provides key insights into issues like fiscal policy, national debt sustainability, and intergenerational wealth transfers within dynamic general equilibrium settings.

Key Assumptions: Diamond vs OLG

The Diamond growth model assumes a closed economy with a representative agent optimizing consumption over two periods, emphasizing capital accumulation and endogenous savings decisions. The Overlapping Generations (OLG) model features multiple cohorts coexisting at different life stages, allowing for heterogeneity in preferences and intertemporal choices. Unlike the Diamond model's single representative agent, the OLG framework captures complex dynamics such as intergenerational transfers and public debt effects through its overlapping agents.

Capital Accumulation Mechanisms

The Diamond growth model emphasizes capital accumulation through individuals' intertemporal savings decisions across two life periods, resulting in a more detailed depiction of capital formation linked to overlapping generations of agents. In contrast, the Overlapping Generations (OLG) model highlights capital accumulation as an emergent property from the interaction of different cohort lifespans, where savings by the young finance investment that benefits the old, creating dynamic capital stocks over time. Both models incorporate heterogeneous agents and intertemporal trade-offs, but the Diamond model provides a structured framework to analyze steady-state capital levels and transition dynamics in contrast to the broader generational interactions in OLG frameworks.

Intergenerational Dynamics and Savings Behavior

The Diamond growth model emphasizes infinite overlapping generations with explicit lifecycle savings decisions, illustrating how capital accumulation depends on individual intertemporal optimization and demographic shifts. The Overlapping Generations (OLG) model captures intergenerational dynamics by modeling distinct cohorts interacting through savings and consumption, highlighting how population growth and aging affect aggregate capital and economic growth. Both models analyze savings behavior differently: the Diamond model focuses on optimal savings for retirement in a deterministic setting, while the OLG model incorporates heterogeneity in preferences and survival probabilities across generations.

Efficiency and Market Outcomes

The Diamond growth model emphasizes aggregate capital accumulation and its impact on long-term economic efficiency through intertemporal optimization, highlighting potential underinvestment due to overlapping generations' saving behavior. The Overlapping Generations (OLG) model captures market outcomes by modeling multiple cohorts simultaneously, allowing analysis of pension systems, debt sustainability, and capital market imperfections affecting efficiency. Both frameworks offer distinct insights into how demographic structures influence resource allocation, with the Diamond model focusing on steady-state equilibrium efficiency and the OLG model emphasizing dynamic market interactions and generational welfare distributions.

Policy Implications in Each Model

The Diamond growth model emphasizes the role of savings, capital accumulation, and demographic changes, informing policies that target optimal capital taxation and social security reforms to enhance intergenerational welfare. The Overlapping Generations (OLG) model highlights the impact of demographic structure and maturity of capital markets, guiding policies on pensions, public debt management, and resource allocation to prevent dynamic inefficiencies. Both models inform macroeconomic policy design by considering heterogeneous agents across generations, but the OLG model provides richer insights into age-dependent fiscal interventions and the sustainability of social programs.

Comparative Strengths and Weaknesses

The Diamond growth model excels in incorporating capital accumulation and intergenerational savings behavior, providing a clearer framework for analyzing steady-state equilibria and the role of physical capital in economic growth, but it struggles with representing heterogeneous agents and varying population dynamics. The Overlapping Generations (OLG) model offers greater flexibility in modeling demographic changes, intertemporal choices, and fiscal policy effects due to its multi-cohort structure, yet it can be computationally complex and less tractable for closed-form analytical solutions. While Diamond's model simplifies the analysis of long-term growth by focusing on representative agents, the OLG model's strength lies in capturing realistic lifecycle economic behaviors and policy implications across different age groups.

Conclusion: Choosing the Appropriate Model

Selecting between the Diamond growth model and the Overlapping Generations (OLG) model depends on the specific economic context and research objectives. The Diamond model is optimal for analyzing capital accumulation and long-term economic growth with a focus on intertemporal optimization, while the OLG model excels in capturing demographic dynamics and heterogeneous agent behavior across different age cohorts. Researchers should prioritize the Diamond model for macroeconomic growth studies and the OLG model for fiscal policy analysis involving age-structured populations and social security systems.

Diamond growth model Infographic

libterm.com

libterm.com