Reserve requirement changes directly impact banks' ability to lend money, influencing overall economic activity and liquidity. Adjusting these requirements can either stimulate growth by freeing up capital or tighten credit to curb inflation. Explore the rest of the article to understand how these shifts affect your financial decisions and the broader economy.

Table of Comparison

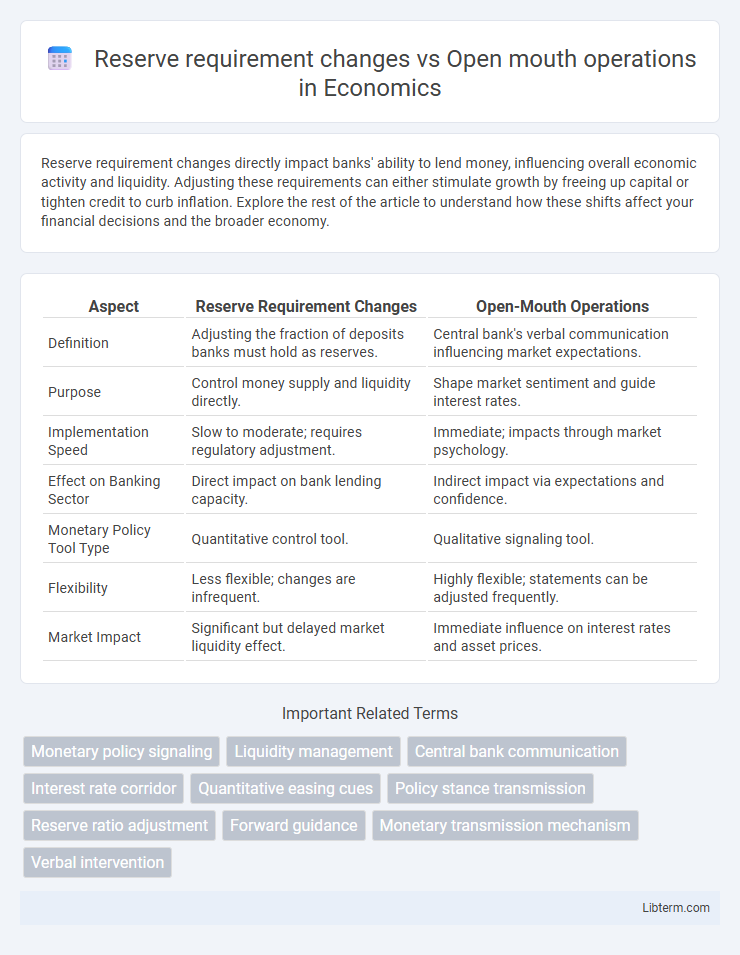

| Aspect | Reserve Requirement Changes | Open-Mouth Operations |

|---|---|---|

| Definition | Adjusting the fraction of deposits banks must hold as reserves. | Central bank's verbal communication influencing market expectations. |

| Purpose | Control money supply and liquidity directly. | Shape market sentiment and guide interest rates. |

| Implementation Speed | Slow to moderate; requires regulatory adjustment. | Immediate; impacts through market psychology. |

| Effect on Banking Sector | Direct impact on bank lending capacity. | Indirect impact via expectations and confidence. |

| Monetary Policy Tool Type | Quantitative control tool. | Qualitative signaling tool. |

| Flexibility | Less flexible; changes are infrequent. | Highly flexible; statements can be adjusted frequently. |

| Market Impact | Significant but delayed market liquidity effect. | Immediate influence on interest rates and asset prices. |

Introduction to Monetary Policy Tools

Reserve requirement changes directly alter the minimum reserves banks must hold, impacting liquidity and credit creation immediately. Open mouth operations involve verbal policy signals from central banks to influence market expectations and guide economic behavior without actual market transactions. Both tools are essential components of monetary policy aimed at managing inflation and stabilizing the economy through liquidity control and expectation management.

Understanding Reserve Requirement Changes

Reserve requirement changes directly alter the minimum reserves banks must hold, impacting liquidity and credit availability in the economy. This monetary policy tool influences banks' lending capacity, thereby affecting money supply and interest rates. Unlike open mouth operations, which rely on central bank communication to guide market expectations, reserve requirement adjustments have immediate quantitative effects on banking behavior and financial conditions.

What Are Open Mouth Operations?

Open mouth operations refer to central bank communication strategies aimed at influencing market expectations and economic behavior without direct market interventions. Unlike reserve requirement changes, which involve adjusting the amount of funds banks must hold, open mouth operations rely on verbal guidance or public announcements to steer interest rates and inflation. This approach can be a cost-effective tool for managing monetary policy signals and enhancing transparency.

Mechanisms of Reserve Requirement Adjustments

Reserve requirement adjustments modify the mandatory reserve ratio that banks must hold, directly impacting the amount of funds available for lending and influencing liquidity in the banking system. This mechanism operates by altering the base money supply, which in turn affects credit creation and interest rates. Open mouth operations rely on central bank communication to influence market expectations and guide interest rates, whereas reserve requirement changes produce immediate and quantifiable alterations to banks' reserve buffers and lending capacities.

Communication Strategies in Open Mouth Operations

Open Mouth Operations rely on strategic communication to influence market expectations without immediate adjustments to reserve requirements, using verbal cues to steer interest rates and liquidity perceptions effectively. Clear, consistent messaging during these operations enhances central bank credibility, reducing market volatility and guiding financial institutions' behavior preemptively. This contrasts with reserve requirement changes, which directly alter banks' reserve holdings but lack the immediate signaling power inherent in well-executed Open Mouth Operations.

Impact on Money Supply and Banking Sector

Reserve requirement changes directly alter the fraction of deposits banks must hold, immediately influencing the money supply by either constraining or expanding lending capacity; a higher reserve requirement reduces money creation, tightening liquidity, while a lower requirement boosts lending and increases money supply. Open mouth operations, involving central bank communication about future monetary policy, primarily affect market expectations and interest rates, indirectly shaping banking sector behavior and credit availability without immediate changes to reserve levels. Both tools influence the banking sector's liquidity and credit extension, but reserve requirement changes have a more direct and quantifiable impact on money supply, whereas open mouth operations rely on market perception to steer economic activity.

Speed and Flexibility: A Comparative Analysis

Reserve requirement changes involve adjusting the minimum reserves banks must hold, impacting liquidity with a slower implementation speed due to regulatory processes. Open mouth operations, consisting of central bank verbal interventions or policy signaling, enable rapid communication to influence market expectations and interest rates without immediate balance sheet adjustments. In terms of flexibility, open mouth operations allow swift, frequent responses to market conditions, whereas reserve requirement changes are more rigid and infrequent due to their structural impact on the banking system.

Effectiveness in Market Expectation Management

Reserve requirement changes directly alter banks' lending capacity, creating immediate and quantifiable impacts on liquidity but often signaling broad monetary policy shifts that markets may anticipate in advance. Open mouth operations rely on central bank communication to shape market expectations, influencing asset prices and interest rates without direct balance sheet changes, making their effectiveness contingent on credibility and clarity. Market expectation management is more precise with open mouth operations due to real-time signaling, whereas reserve requirement adjustments serve as a stronger, but less flexible, policy tool.

Case Studies: Global Examples and Outcomes

Reserve requirement changes directly impact banks' liquidity by altering the mandatory reserves held, with China frequently adjusting requirements to control credit growth and stabilize economic cycles, resulting in moderated inflation and balanced lending. Open mouth operations, utilized notably by the US Federal Reserve and the European Central Bank, employ forward guidance through public statements to shape market expectations, successfully reducing volatility during financial crises as seen in the 2008 recession and the COVID-19 pandemic. Comparative case studies reveal that reserve requirement adjustments provide immediate liquidity effects, whereas open mouth operations influence longer-term market behavior through signaling, both serving as critical tools in central banks' monetary policy arsenals.

Conclusion: Choosing the Right Policy Lever

Reserve requirement adjustments directly influence banks' lending capacities by altering mandatory reserves, leading to immediate shifts in credit availability and money supply. Open mouth operations shape market expectations through central bank communication, guiding interest rates and economic behavior without changing reserves. Selecting the appropriate policy lever depends on the desired speed, magnitude, and signaling effect of monetary intervention in managing economic conditions.

Reserve requirement changes Infographic

libterm.com

libterm.com