The Black-Litterman model offers a sophisticated approach to portfolio optimization by blending an investor's views with market equilibrium returns, resulting in more balanced and stable asset allocations. This model improves risk-adjusted returns by addressing the limitations of traditional mean-variance optimization, incorporating both subjective insights and objective market data. Discover how the Black-Litterman model can refine your investment strategy by exploring the detailed explanation below.

Table of Comparison

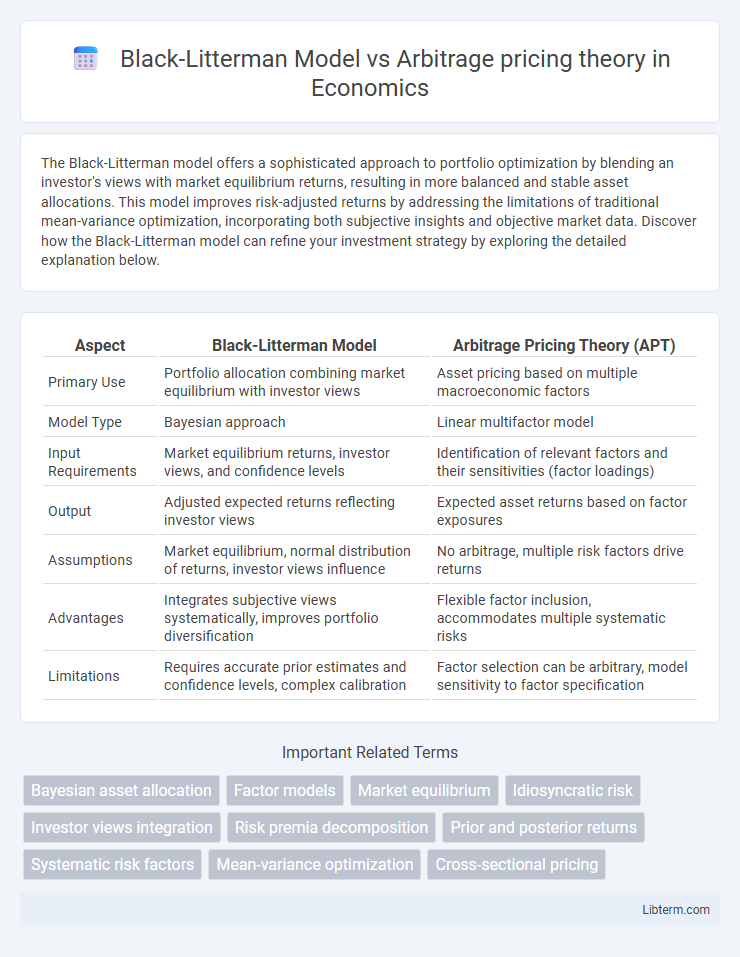

| Aspect | Black-Litterman Model | Arbitrage Pricing Theory (APT) |

|---|---|---|

| Primary Use | Portfolio allocation combining market equilibrium with investor views | Asset pricing based on multiple macroeconomic factors |

| Model Type | Bayesian approach | Linear multifactor model |

| Input Requirements | Market equilibrium returns, investor views, and confidence levels | Identification of relevant factors and their sensitivities (factor loadings) |

| Output | Adjusted expected returns reflecting investor views | Expected asset returns based on factor exposures |

| Assumptions | Market equilibrium, normal distribution of returns, investor views influence | No arbitrage, multiple risk factors drive returns |

| Advantages | Integrates subjective views systematically, improves portfolio diversification | Flexible factor inclusion, accommodates multiple systematic risks |

| Limitations | Requires accurate prior estimates and confidence levels, complex calibration | Factor selection can be arbitrary, model sensitivity to factor specification |

Introduction to Black-Litterman Model and Arbitrage Pricing Theory

The Black-Litterman Model integrates investor views with market equilibrium to generate more stable and diversified portfolio allocations, addressing limitations in traditional mean-variance optimization. Arbitrage Pricing Theory (APT) explains asset returns through multiple macroeconomic factors, offering a multifactor alternative to the Capital Asset Pricing Model by capturing systematic risk influences. Both frameworks enhance portfolio construction but differ fundamentally in their approach to risk modeling and return estimation.

Fundamental Principles of Black-Litterman Model

The Black-Litterman model integrates investor views with equilibrium market returns to generate optimized portfolio allocations, emphasizing the fusion of subjective insights and market consensus. It fundamentally relies on Bayesian statistical methods to combine prior market equilibrium returns with investor-specific views, adjusting expected returns and covariances in a consistent framework. This approach contrasts with Arbitrage Pricing Theory, which models asset returns through multiple macroeconomic factors without directly incorporating investor views or equilibrium conditions.

Core Concepts of Arbitrage Pricing Theory

Arbitrage Pricing Theory (APT) is a multifactor asset pricing model that explains returns through multiple systematic risk factors, unlike the Black-Litterman Model, which combines investor views with market equilibrium. Core concepts of APT include the absence of arbitrage opportunities, the linear relationship between asset returns and risk factors, and the identification of various macroeconomic variables or industry indices driving expected returns. APT provides a flexible framework for pricing assets based on factor sensitivities, making it suitable for diversified portfolios and risk management.

Differences in Risk Factor Identification

The Black-Litterman model integrates investor views with a prior market equilibrium to derive expected returns, emphasizing a Bayesian approach to risk factor identification based on market capitalization weights. In contrast, Arbitrage Pricing Theory (APT) identifies risk factors through statistical methods such as factor analysis, allowing multiple macroeconomic variables to explain asset returns without relying on market equilibrium assumptions. The Black-Litterman model's risk factors are implicit and derived from equilibrium conditions, whereas APT explicitly models multiple independent systemic risk factors affecting asset prices.

Portfolio Optimization Approaches Compared

The Black-Litterman model integrates investor views with market equilibrium to produce more stable and diversified portfolio allocations, optimizing expected returns and risks by combining subjective insights with quantitative data. Arbitrage Pricing Theory (APT) relies on multiple systematic risk factors, providing a multifactor framework that estimates expected returns based on economic variables but requires precise factor identification and sensitivity estimation. Portfolio optimization using Black-Litterman tends to offer enhanced stability and adaptability by adjusting prior market equilibrium with investor opinions, whereas APT allows for a flexible, risk-factor-driven optimization but may face challenges in accurately modeling all relevant risk sources.

Handling of Investor Views and Market Data

The Black-Litterman Model incorporates investor views by blending them with equilibrium market returns through a Bayesian approach, allowing for customized adjustments based on confidence levels. Arbitrage Pricing Theory (APT) relies on multiple macroeconomic factors to explain asset returns but does not explicitly integrate subjective investor opinions into the pricing process. While Black-Litterman optimally combines market equilibrium and personal insights to generate refined expected returns, APT focuses on identifying linear relationships between risk factors and returns without direct investor input.

Assumptions and Limitations of Each Model

The Black-Litterman Model assumes investors have subjective views on asset returns that can be combined with market equilibrium to generate optimized portfolios, but it requires accurate estimation of the covariance matrix and reliable views to avoid distorted results. Arbitrage Pricing Theory (APT) assumes asset returns are influenced by multiple macroeconomic factors and relies on the absence of arbitrage opportunities; however, identifying the correct factors is challenging and the model may suffer from misspecification errors. Both models face limitations in real-world applicability due to model complexity, sensitivity to input data, and assumptions that may not hold in volatile or inefficient markets.

Practical Applications in Asset Allocation

The Black-Litterman Model enhances asset allocation by integrating investor views with market equilibrium, producing more stable and intuitive portfolio weights, especially useful in managing diversified portfolios. In contrast, Arbitrage Pricing Theory (APT) provides a multi-factor framework to identify and quantify various macroeconomic risks impacting asset returns, facilitating targeted exposure adjustments. Practical applications of Black-Litterman emphasize blending subjective expectations with market data, while APT excels in risk factor decomposition and constructing portfolios aligned with specific economic scenarios.

Performance and Predictive Accuracy

The Black-Litterman Model enhances portfolio optimization by integrating investor views with market equilibrium, often resulting in improved performance and more stable return estimates compared to Arbitrage Pricing Theory (APT). APT, while useful for identifying multiple risk factors affecting asset returns, may suffer from overfitting and reduced predictive accuracy due to model specification uncertainty. Empirical studies frequently show the Black-Litterman Model delivers superior out-of-sample forecasting and higher Sharpe ratios in diverse market conditions relative to APT-based strategies.

Choosing Between Black-Litterman and Arbitrage Pricing Theory

Choosing between the Black-Litterman model and Arbitrage Pricing Theory (APT) hinges on the investment context and data availability. The Black-Litterman model excels in portfolio optimization by integrating investor views with market equilibrium, making it ideal for scenarios emphasizing subjective insights in asset allocation. APT offers a multi-factor framework based on observable economic variables, suitable for investors seeking to understand systematic risk drivers without relying on market equilibrium assumptions.

Black-Litterman Model Infographic

libterm.com

libterm.com