The leverage ratio measures a company's financial strength by comparing its debt to its equity or assets, highlighting its ability to meet long-term obligations. Understanding this ratio helps you assess the risk level associated with a business's financial structure. Explore the full article to learn how leverage ratios impact investment decisions and corporate strategy.

Table of Comparison

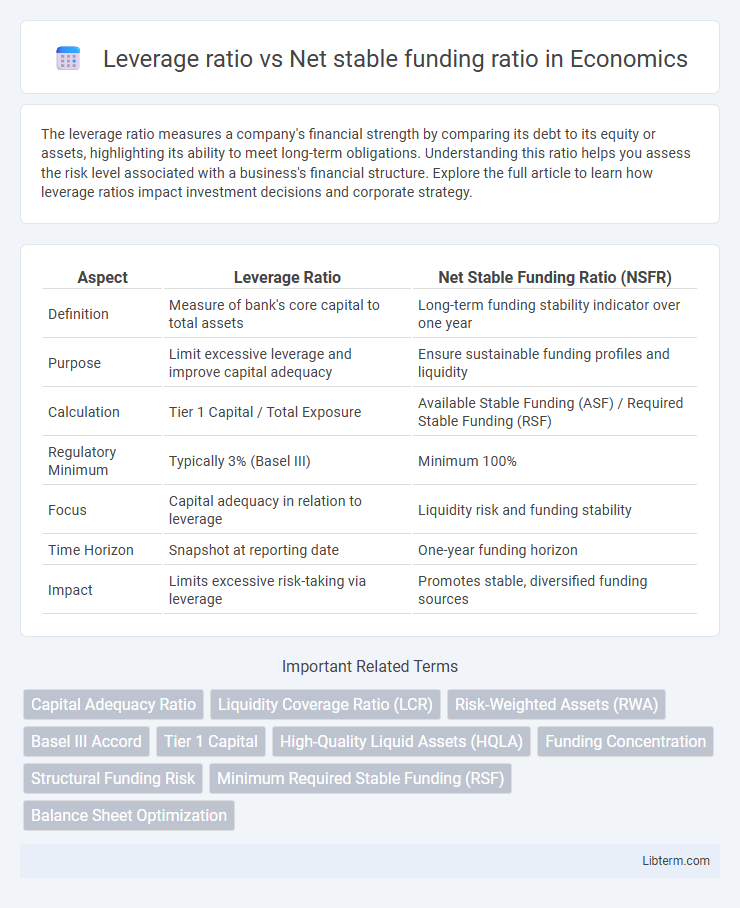

| Aspect | Leverage Ratio | Net Stable Funding Ratio (NSFR) |

|---|---|---|

| Definition | Measure of bank's core capital to total assets | Long-term funding stability indicator over one year |

| Purpose | Limit excessive leverage and improve capital adequacy | Ensure sustainable funding profiles and liquidity |

| Calculation | Tier 1 Capital / Total Exposure | Available Stable Funding (ASF) / Required Stable Funding (RSF) |

| Regulatory Minimum | Typically 3% (Basel III) | Minimum 100% |

| Focus | Capital adequacy in relation to leverage | Liquidity risk and funding stability |

| Time Horizon | Snapshot at reporting date | One-year funding horizon |

| Impact | Limits excessive risk-taking via leverage | Promotes stable, diversified funding sources |

Understanding Leverage Ratio: Definition and Purpose

The leverage ratio measures a bank's core capital relative to its total assets, aiming to limit excessive borrowing and enhance financial stability by ensuring sufficient capital buffers. It is a non-risk-based metric designed to complement risk-weighted capital requirements and reduce the likelihood of insolvency during financial stress. Its primary purpose is to provide a straightforward, transparent assessment of a bank's capital adequacy by focusing on absolute capital levels rather than risk-weighted exposures.

What is Net Stable Funding Ratio (NSFR)?

The Net Stable Funding Ratio (NSFR) is a regulatory liquidity measure designed to ensure that banks maintain a stable funding profile relative to their asset composition over a one-year horizon. It compares available stable funding (ASF) to required stable funding (RSF), promoting long-term resilience by reducing reliance on short-term wholesale funding. Unlike the Leverage Ratio, which focuses on capital adequacy, the NSFR emphasizes liquidity risk management and the sustainability of funding sources.

Key Differences Between Leverage Ratio and NSFR

The leverage ratio measures a bank's core capital relative to its total exposure, emphasizing short-term resilience by limiting excessive borrowing. The Net Stable Funding Ratio (NSFR) assesses the stability of a bank's funding over a one-year horizon by comparing available stable funding to required stable funding, promoting long-term liquidity. Key differences include the leverage ratio's focus on capital adequacy without risk weighting versus NSFR's focus on stable funding sources and liquidity risk management.

Importance of Leverage Ratio in Risk Management

The leverage ratio is a critical metric in risk management as it limits the total amount of debt a financial institution can hold relative to its equity, helping to ensure sufficient capital buffers during periods of financial stress. Unlike the net stable funding ratio (NSFR), which emphasizes funding stability over a one-year horizon, the leverage ratio provides a straightforward, non-risk-based measure that prevents excessive leverage and reduces the risk of insolvency. Regulatory frameworks prioritize the leverage ratio to safeguard against systemic risks and promote the overall resilience of the banking sector.

Role of NSFR in Enhancing Bank Liquidity

The Net Stable Funding Ratio (NSFR) plays a critical role in enhancing bank liquidity by ensuring that institutions maintain a stable funding profile over a one-year horizon, reducing reliance on short-term wholesale funding. Unlike the Leverage Ratio, which primarily measures capital adequacy without consideration of liquidity risk, NSFR emphasizes the structural liquidity resilience by matching available stable funding with the liquidity characteristics of assets. This approach promotes long-term funding stability, mitigating liquidity mismatches and supporting banks' ability to withstand periods of financial stress.

Calculation Methods: Leverage Ratio vs NSFR

The Leverage Ratio is calculated by dividing Tier 1 capital by the bank's total exposure, including on- and off-balance sheet items, without risk weighting, ensuring a straightforward measure of capital adequacy. The Net Stable Funding Ratio (NSFR) calculation involves dividing Available Stable Funding (ASF), which accounts for the bank's reliable funding sources weighted by stability factors, by Required Stable Funding (RSF), reflecting the liquidity risk profile of assets and off-balance exposures under Basel III standards. Unlike the Leverage Ratio's focus on capital relative to total exposure, the NSFR emphasizes liquidity stability by balancing long-term funding against asset maturities and liquidity characteristics.

Regulatory Requirements for Leverage Ratio and NSFR

The leverage ratio requires banks to maintain a minimum level of Tier 1 capital against total exposure, ensuring a non-risk-based capital adequacy measure under Basel III regulations. The Net Stable Funding Ratio (NSFR) mandates a minimum stable funding level relative to the institution's long-term assets to promote liquidity resilience over a one-year horizon. Regulatory requirements for the leverage ratio typically set a minimum of 3%, while the NSFR standard demands a value of at least 100% to ensure sufficient stable funding sources.

Impact on Bank Balance Sheet Strategies

The Leverage Ratio measures a bank's core capital relative to its total assets, influencing balance sheet size by limiting excessive asset growth to maintain capital adequacy. The Net Stable Funding Ratio (NSFR) ensures long-term funding stability by requiring banks to hold sufficient stable funding against illiquid assets, driving strategic shifts toward more stable funding sources and asset quality improvement. Together, these ratios compel banks to optimize capital structure and liquidity risk management, shaping asset-liability composition and funding strategies on the balance sheet.

Challenges in Meeting Leverage and NSFR Standards

Meeting leverage ratio and Net Stable Funding Ratio (NSFR) standards poses significant challenges due to banks' need to maintain sufficient high-quality liquid assets while supporting lending activities. The leverage ratio restricts excessive borrowing by setting a minimum tier 1 capital relative to total exposure, often constraining growth opportunities, while the NSFR requires stable funding to cover long-term assets, pressuring liabilities' structure. Balancing capital adequacy and stable funding composition without compromising profitability demands sophisticated risk management and strategic asset-liability alignment.

Future Trends: Evolution of Leverage and Net Stable Funding Ratios

Future trends in financial regulation indicate a gradual tightening of both Leverage Ratio (LR) and Net Stable Funding Ratio (NSFR) standards to enhance banking sector resilience and stability. The evolution of these ratios is driven by increasing emphasis on sustainable liquidity management, with NSFR focusing on long-term funding stability, while LR limits excessive balance sheet expansion without risk weighting. Advancements in regulatory frameworks, including Basel III updates and integration of stress testing models, are expected to further refine the calibration of LR and NSFR, promoting stronger capital adequacy and liquidity profiles across global banks.

Leverage ratio Infographic

libterm.com

libterm.com