Absolute advantage refers to the ability of a person, company, or country to produce a good or service more efficiently than others, using fewer resources or less time. Understanding absolute advantage helps you identify where production can be optimized to maximize output and reduce costs. Discover how leveraging absolute advantage can improve economic decisions by reading the rest of the article.

Table of Comparison

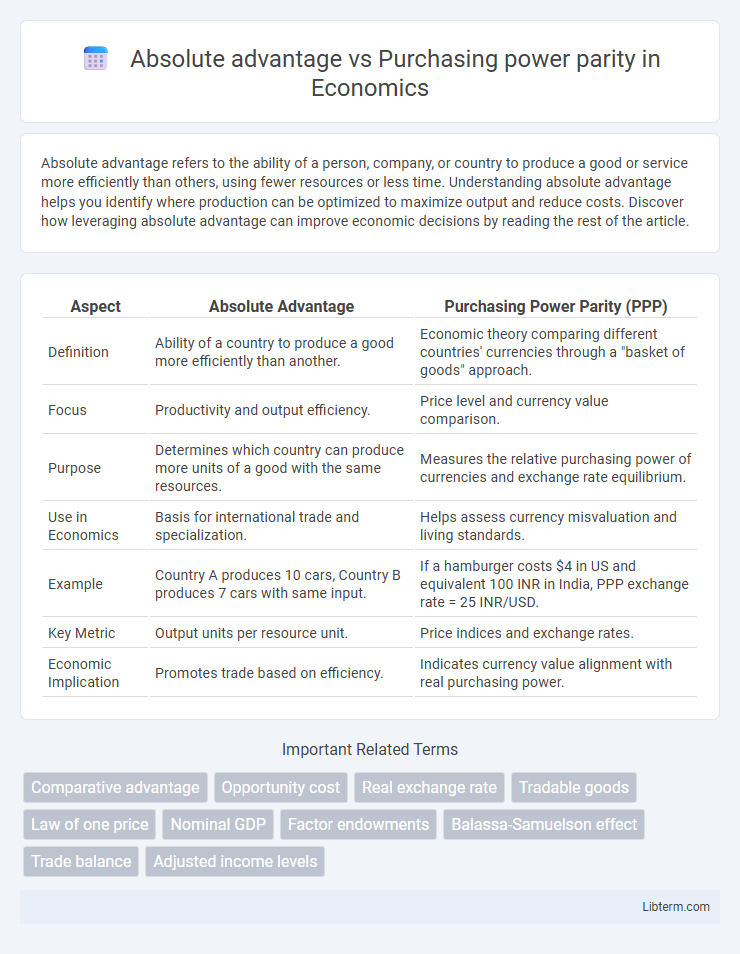

| Aspect | Absolute Advantage | Purchasing Power Parity (PPP) |

|---|---|---|

| Definition | Ability of a country to produce a good more efficiently than another. | Economic theory comparing different countries' currencies through a "basket of goods" approach. |

| Focus | Productivity and output efficiency. | Price level and currency value comparison. |

| Purpose | Determines which country can produce more units of a good with the same resources. | Measures the relative purchasing power of currencies and exchange rate equilibrium. |

| Use in Economics | Basis for international trade and specialization. | Helps assess currency misvaluation and living standards. |

| Example | Country A produces 10 cars, Country B produces 7 cars with same input. | If a hamburger costs $4 in US and equivalent 100 INR in India, PPP exchange rate = 25 INR/USD. |

| Key Metric | Output units per resource unit. | Price indices and exchange rates. |

| Economic Implication | Promotes trade based on efficiency. | Indicates currency value alignment with real purchasing power. |

Understanding Absolute Advantage

Absolute advantage refers to a country's ability to produce a good more efficiently than another nation, using fewer resources or lower costs. This concept is fundamental in international trade theory as it highlights how economies can benefit by specializing in the production of goods where they hold an efficiency edge. Understanding absolute advantage helps explain trade patterns but does not account for price level differences addressed by Purchasing Power Parity (PPP).

Defining Purchasing Power Parity (PPP)

Purchasing Power Parity (PPP) is an economic theory that compares different countries' currencies through a "basket of goods" approach, ensuring that identical goods have the same price in different countries when expressed in a common currency. Unlike absolute advantage, which focuses on the ability of a country to produce goods more efficiently than others, PPP emphasizes the equilibrium exchange rates based on relative price levels. This measure helps in assessing the true value of currencies and adjusting economic indicators like GDP for international comparisons.

Key Differences Between Absolute Advantage and PPP

Absolute advantage measures a country's ability to produce goods more efficiently than others, based on resource productivity and technology, while purchasing power parity (PPP) compares the relative value of currencies by equating the purchasing power of different countries. Absolute advantage centers on production capacity and efficiency, whereas PPP focuses on price level comparisons and cost of living adjustments between nations. Key differences include their application: absolute advantage guides trade specialization decisions, while PPP is used for economic comparisons and assessing currency valuation.

Historical Context of Both Concepts

Absolute advantage, introduced by Adam Smith in the 18th century, explains how countries benefit from specializing in producing goods they can create more efficiently than others. Purchasing power parity (PPP), developed in the early 20th century, provides a method for comparing economic productivity and living standards by adjusting for price level differences across countries. While absolute advantage focuses on production efficiency, PPP addresses exchange rate equilibria and cost-of-living variations for international economic comparisons.

Absolute Advantage in International Trade

Absolute advantage in international trade occurs when a country can produce a good more efficiently than others, using fewer resources and lower costs. This concept enables nations to specialize in the production of goods where they hold an absolute advantage, maximizing overall efficiency and increasing total global output. Unlike purchasing power parity, which compares relative currency values, absolute advantage emphasizes productivity and resource allocation as drivers of trade benefits.

How PPP Influences Global Economics

Purchasing Power Parity (PPP) influences global economics by providing a more accurate comparison of living standards and economic productivity across countries than absolute advantage, which focuses solely on output efficiency. PPP adjusts for price level differences, enabling economists to evaluate real income and consumption capabilities rather than nominal exchange rates that can be distorted by market fluctuations. This adjustment affects international trade policies, investment decisions, and economic forecasting by highlighting countries' true economic scale and purchasing power.

Measuring Economic Strength: Absolute Advantage vs PPP

Absolute advantage measures economic strength by a country's ability to produce goods more efficiently than others, highlighting productivity and resource utilization. Purchasing Power Parity (PPP) evaluates economic strength through the relative cost of living and inflation rates, reflecting the real purchasing capability of income within a domestic market. Comparing absolute advantage and PPP provides a comprehensive view of economic performance by integrating production efficiency with currency value adjustments for true economic comparison.

Real-World Applications and Case Studies

Absolute advantage highlights a country's ability to produce goods more efficiently than others, impacting trade decisions and resource allocation in real-world economies like China's manufacturing dominance. Purchasing power parity (PPP) adjusts for price level differences, providing a more accurate comparison of living standards and economic productivity, essential for global market analysis and policy-making in cases such as World Bank and IMF assessments. Combining these concepts helps multinational corporations strategize investment by balancing production efficiency with local consumer buying power, illustrated by companies expanding in emerging markets like India and Brazil.

Limitations of Absolute Advantage and PPP

Absolute advantage is limited by its assumption that countries can produce goods more efficiently without considering factors like labor quality or resource availability, which complicates real-world trade dynamics. Purchasing power parity (PPP) faces challenges in accounting for non-tradable goods, differing consumption patterns, and exchange rate volatility, leading to discrepancies in economic comparisons. Both concepts overlook structural economic complexities, making them insufficient as standalone measures for evaluating international trade and economic performance.

Conclusion: Implications for Policymakers and Businesses

Absolute advantage emphasizes the efficiency of producing goods at lower costs while Purchasing Power Parity (PPP) reflects the relative value of currencies based on purchasing capabilities. Policymakers must balance trade policies to leverage production efficiency without neglecting currency valuation impacts on international competitiveness. Businesses should integrate insights from both concepts to optimize supply chains, pricing strategies, and cross-border investment decisions.

Absolute advantage Infographic

libterm.com

libterm.com