A mortgage is a loan specifically designed for purchasing real estate, where the property itself serves as collateral. Understanding key terms such as interest rates, loan types, and repayment schedules can help you make informed decisions that suit your financial goals. Explore the article to learn everything you need to know about securing the right mortgage for your needs.

Table of Comparison

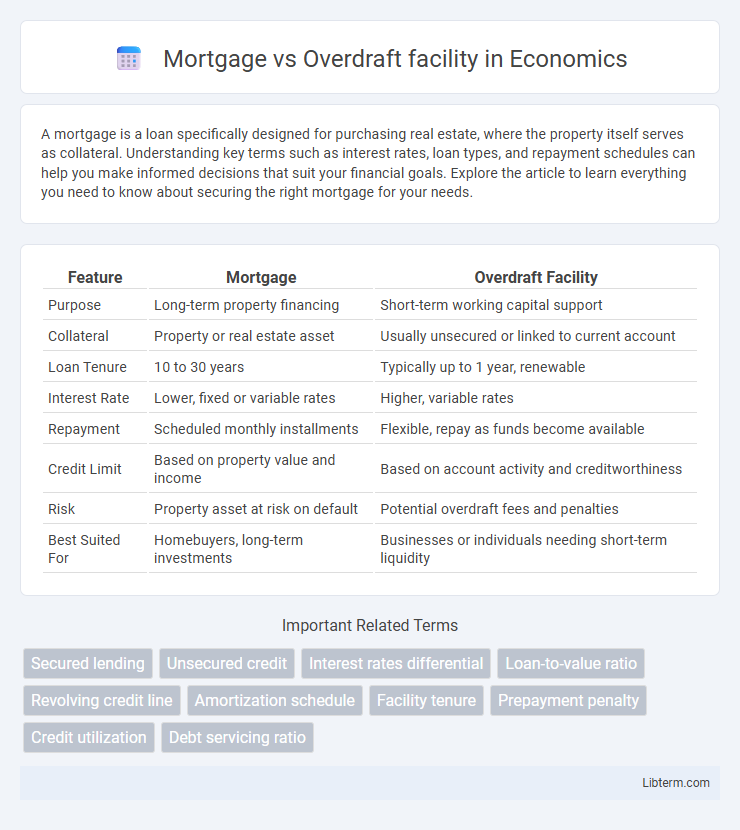

| Feature | Mortgage | Overdraft Facility |

|---|---|---|

| Purpose | Long-term property financing | Short-term working capital support |

| Collateral | Property or real estate asset | Usually unsecured or linked to current account |

| Loan Tenure | 10 to 30 years | Typically up to 1 year, renewable |

| Interest Rate | Lower, fixed or variable rates | Higher, variable rates |

| Repayment | Scheduled monthly installments | Flexible, repay as funds become available |

| Credit Limit | Based on property value and income | Based on account activity and creditworthiness |

| Risk | Property asset at risk on default | Potential overdraft fees and penalties |

| Best Suited For | Homebuyers, long-term investments | Businesses or individuals needing short-term liquidity |

Understanding Mortgage Loans

Mortgage loans are long-term secured loans specifically designed for purchasing real estate, where the property serves as collateral to minimize lender risk. These loans typically feature fixed or variable interest rates, repayment terms ranging from 15 to 30 years, and larger loan amounts compared to overdraft facilities. Understanding mortgage loan structures, including principal, interest, and amortization schedules, is crucial for borrowers aiming to manage debt effectively while financing property acquisition.

What is an Overdraft Facility?

An overdraft facility is a short-term borrowing option that allows account holders to withdraw more money than their available balance up to an approved limit, providing immediate access to funds for cash flow management. This credit arrangement is typically linked to a current or checking account, with interest charged only on the overdrawn amount and fees varying based on the bank's terms. Unlike a mortgage, which is a long-term loan secured against property, an overdraft facility offers flexible, revolving credit aimed at covering temporary shortages rather than financing large purchases.

Key Differences Between Mortgage and Overdraft

A mortgage is a long-term loan specifically secured against property, typically used for purchasing real estate, with fixed or variable interest rates and structured repayment schedules over several years. An overdraft facility allows account holders to withdraw more money than their current balance up to an approved limit, offering short-term, flexible borrowing with interest charged only on the overdrawn amount. Key differences include the purpose and duration--mortgages finance property with long repayment terms, while overdrafts provide immediate liquidity for short-term cash flow needs.

Interest Rates: Mortgage vs Overdraft

Mortgage interest rates typically range from 3% to 7% annually, offering lower and fixed or variable rates due to the secured nature of the loan against property. Overdraft facility interest rates are generally higher, often between 8% and 20%, reflecting the unsecured and short-term borrowing risk. Lenders set mortgage rates based on creditworthiness and loan-to-value ratios, whereas overdraft rates depend on account type and usage frequency.

Eligibility Criteria Compared

Mortgage eligibility typically requires a strong credit score, stable income, low debt-to-income ratio, and proof of property collateral, with lenders often demanding a down payment of 10-20%. Overdraft facility eligibility is generally less stringent, focusing primarily on the borrower's credit history, existing banking relationship, and monthly account turnover, without the need for asset backing. While mortgages cater to long-term financing needs with detailed financial scrutiny, overdrafts serve short-term liquidity with more flexible approval conditions.

Loan Tenure and Repayment Options

Mortgage loans typically offer longer loan tenures ranging from 15 to 30 years, allowing borrowers to make fixed monthly payments that include principal and interest, facilitating structured, long-term repayment. Overdraft facilities provide flexible short-term borrowing, where repayment is often linked to account deposits and can be repaid at any time, with no fixed schedule, but interest accumulates based on the outstanding balance. Mortgages emphasize scheduled amortization over an extended period, while overdrafts prioritize revolving credit with flexible, on-demand repayment options.

Flexibility and Usage Purposes

A mortgage provides long-term financing primarily for purchasing property, with structured repayment schedules and fixed terms, limiting flexibility in modifying loan conditions or usage. An overdraft facility offers short-term credit linked to a current account, allowing flexible withdrawals up to an agreed limit for various expenses, ideal for managing cash flow fluctuations. While mortgages are suited for specific asset acquisition with less adaptable terms, overdrafts enable immediate access to funds for diverse and unpredictable financial needs.

Costs and Fees Involved

Mortgage loans typically involve lower interest rates compared to overdraft facilities, reflecting the secured nature of the loan by real estate collateral. Overdraft facilities often come with higher interest rates and additional fees, such as arrangement fees, renewal fees, and penalties on excess withdrawals, increasing overall costs. Borrowers should carefully compare the total cost of borrowing, including interest rates, fees, and repayment terms, to determine the most cost-effective financing option.

Risk Factors and Security

Mortgage loans involve secured borrowing against real estate, reducing lender risk due to collateral that can be repossessed upon default, but carry the risk of property loss for borrowers if repayments fail. Overdraft facilities are typically unsecured or secured by liquid assets, exposing lenders to higher credit risk and borrowers to fluctuating interest rates and possible account restrictions during financial stress. The security of a mortgage generally results in lower interest rates compared to overdrafts, though overdrafts offer more flexible access to funds without long-term collateral commitments.

Choosing the Right Option for Your Needs

Choosing between a mortgage and an overdraft facility depends on your financial goals and borrowing needs. A mortgage offers long-term financing with fixed or variable interest rates ideal for purchasing property, while an overdraft provides short-term credit flexibility linked to your bank account for managing cash flow. Assess your repayment capacity, interest costs, and purpose to select the most suitable option for effective financial management.

Mortgage Infographic

libterm.com

libterm.com