The relative income hypothesis suggests that an individual's consumption and saving behavior is influenced not just by their absolute income but by their income relative to others in their social group. This concept highlights how social comparisons affect economic decisions, often leading to increased consumption to maintain a certain social status. Explore the rest of the article to understand how this hypothesis impacts your financial choices and economic policy.

Table of Comparison

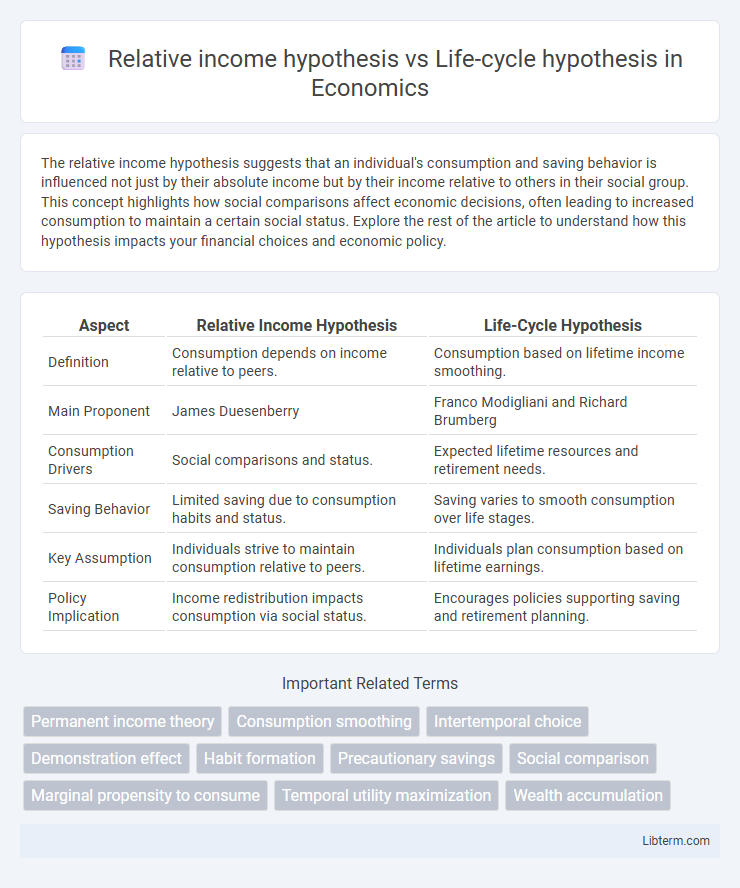

| Aspect | Relative Income Hypothesis | Life-Cycle Hypothesis |

|---|---|---|

| Definition | Consumption depends on income relative to peers. | Consumption based on lifetime income smoothing. |

| Main Proponent | James Duesenberry | Franco Modigliani and Richard Brumberg |

| Consumption Drivers | Social comparisons and status. | Expected lifetime resources and retirement needs. |

| Saving Behavior | Limited saving due to consumption habits and status. | Saving varies to smooth consumption over life stages. |

| Key Assumption | Individuals strive to maintain consumption relative to peers. | Individuals plan consumption based on lifetime earnings. |

| Policy Implication | Income redistribution impacts consumption via social status. | Encourages policies supporting saving and retirement planning. |

Introduction to Income Consumption Theories

The Relative Income Hypothesis suggests that individuals' consumption patterns are influenced by their income relative to others, emphasizing social comparison and the desire to maintain a certain standard of living. In contrast, the Life-Cycle Hypothesis proposes that consumers plan their spending and saving behavior over their lifetime, aiming to smooth consumption despite fluctuations in income at different ages. Both theories offer key insights into consumption behavior, with the former highlighting social factors and the latter focusing on intertemporal optimization of income and expenditure.

Defining the Relative Income Hypothesis

The Relative Income Hypothesis posits that an individual's consumption and savings behavior is influenced primarily by their income relative to others in their social environment, rather than their total lifetime income. This theory emphasizes social comparison and status-driven consumption, suggesting that people strive to maintain a consumption level comparable to that of their peers. It contrasts with the Life-Cycle Hypothesis, which focuses on consumption smoothing over a lifetime based on expected income and wealth accumulation.

Understanding the Life-cycle Hypothesis

The Life-cycle Hypothesis explains consumption and saving behavior based on individuals planning their resources to smooth consumption over their lifetime, taking into account expected income during different life stages. This theory contrasts with the Relative Income Hypothesis, which emphasizes consumption decisions driven by comparisons to others' income levels rather than absolute income over time. Life-cycle models are fundamental for understanding long-term savings patterns and the impact of age, retirement, and expected lifetime earnings on consumption choices.

Key Assumptions of Both Hypotheses

The Relative Income Hypothesis assumes that individuals gauge their consumption and savings based on their income relative to others in their social group, emphasizing social comparisons and status preservation as key motivational factors. The Life-Cycle Hypothesis posits that individuals plan their consumption and savings behavior over their lifetime to smooth consumption, assuming predictable income patterns and rational foresight about future financial needs. Both hypotheses highlight different drivers of consumption: social context and relative standing in the former, and intertemporal optimization with income expectations in the latter.

Comparative Analysis: Consumption Patterns

The Relative Income Hypothesis emphasizes consumption patterns driven by individuals' income relative to their social peers, leading to expenditure aimed at signaling social status and maintaining consumption levels consistent with reference groups. The Life-Cycle Hypothesis explains consumption smoothing over an individual's lifetime, with spending and saving decisions influenced by expected lifetime income and retirement planning rather than immediate relative income. Comparative analysis reveals the Relative Income Hypothesis highlights social influences on consumption variance, while the Life-Cycle Hypothesis centers on temporal income allocation and intertemporal choice.

Psychological and Sociological Influences

The Relative Income Hypothesis emphasizes the psychological impact of social comparisons on consumer spending, where individuals adjust their consumption based on perceived income relative to peers, driving consumption patterns by status and social norms. The Life-Cycle Hypothesis incorporates sociological influences by suggesting that individuals plan their consumption and savings behavior over their lifetime, considering expected changes in income and family responsibilities, reflecting social roles and life stages. Both theories highlight the interaction between psychological perceptions of income and sociological factors like social environment and lifecycle events in shaping consumption behavior.

Empirical Evidence and Case Studies

Empirical evidence on the Relative Income Hypothesis reveals that individuals adjust their consumption based on their income compared to peers, with case studies in developed economies showing strong correlations between social comparisons and spending behavior. In contrast, the Life-Cycle Hypothesis is supported by longitudinal data tracking individuals' consumption and savings patterns over their lifetime, such as the Health and Retirement Study in the US, which confirms planned consumption smoothing in response to anticipated income changes. Comparative analyses indicate that while the Life-Cycle Hypothesis explains aggregate consumption trends accurately, the Relative Income Hypothesis better accounts for short-term deviations influenced by social context.

Policy Implications and Economic Planning

The Relative Income Hypothesis suggests that consumption patterns are driven by social comparisons, implying that policies targeting income inequality can influence aggregate demand and economic stability. In contrast, the Life-Cycle Hypothesis emphasizes saving and consumption behaviors based on predictable lifetime income, highlighting the importance of retirement planning and social security policies for long-term economic growth. Policymakers must balance redistribution efforts with incentives for saving to optimize economic planning and foster sustainable consumption patterns.

Strengths and Limitations of Each Hypothesis

The Relative Income Hypothesis emphasizes the impact of social comparison on consumption, highlighting how individuals adjust their spending based on peers, which explains consumption patterns during income changes but often neglects long-term savings behavior. The Life-Cycle Hypothesis underscores consumption smoothing over an individual's lifetime by considering income fluctuations from youth to retirement, providing a comprehensive framework for saving decisions but assuming rational behavior and perfect foresight, which may not hold in reality. Both hypotheses offer valuable insights into consumption theory; however, the Relative Income Hypothesis captures social influences better, while the Life-Cycle Hypothesis excels in modeling lifetime financial planning.

Conclusion: Synthesis and Future Research Directions

The Relative Income Hypothesis and the Life-Cycle Hypothesis both offer valuable insights into consumer saving and spending behavior, highlighting the importance of social context and age-related income patterns. Future research should integrate psychological and behavioral economics factors to better understand the interplay between relative income comparisons and lifetime consumption smoothing. Empirical studies leveraging longitudinal data and cross-cultural analysis will enhance the robustness of these models and inform targeted economic policy interventions.

Relative income hypothesis Infographic

libterm.com

libterm.com