An open economy model analyzes how a country interacts economically with the rest of the world through trade, capital flows, and exchange rates. It examines the impact of international markets on national output, interest rates, and inflation, providing insights into how external factors influence domestic economic policies. Explore the rest of the article to understand how this model applies to Your economy and global financial stability.

Table of Comparison

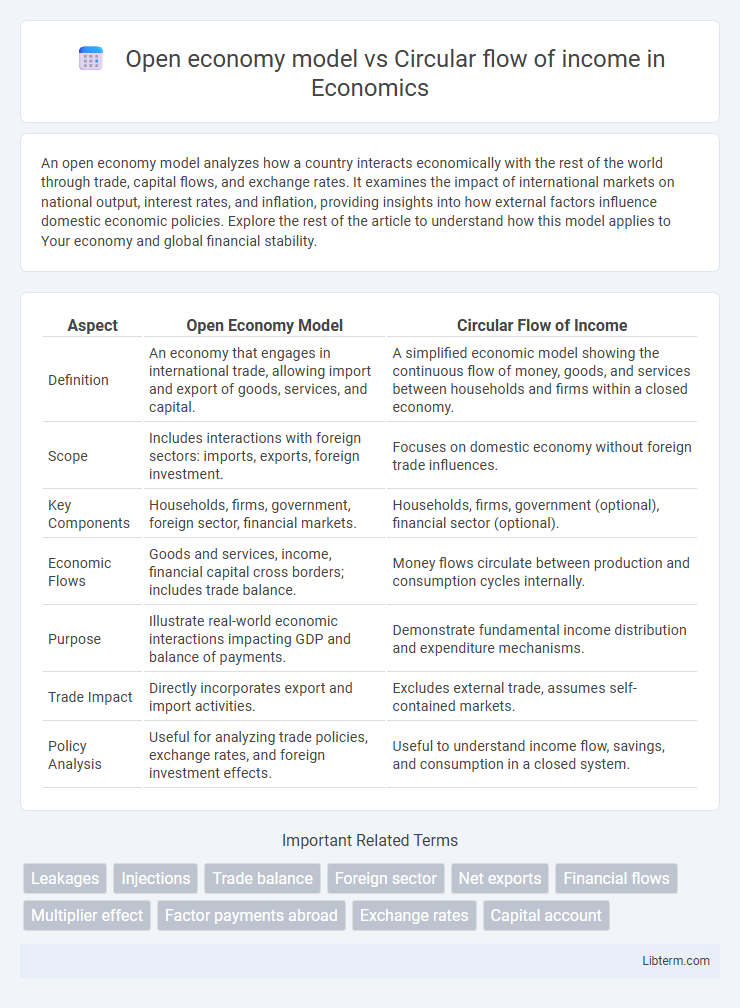

| Aspect | Open Economy Model | Circular Flow of Income |

|---|---|---|

| Definition | An economy that engages in international trade, allowing import and export of goods, services, and capital. | A simplified economic model showing the continuous flow of money, goods, and services between households and firms within a closed economy. |

| Scope | Includes interactions with foreign sectors: imports, exports, foreign investment. | Focuses on domestic economy without foreign trade influences. |

| Key Components | Households, firms, government, foreign sector, financial markets. | Households, firms, government (optional), financial sector (optional). |

| Economic Flows | Goods and services, income, financial capital cross borders; includes trade balance. | Money flows circulate between production and consumption cycles internally. |

| Purpose | Illustrate real-world economic interactions impacting GDP and balance of payments. | Demonstrate fundamental income distribution and expenditure mechanisms. |

| Trade Impact | Directly incorporates export and import activities. | Excludes external trade, assumes self-contained markets. |

| Policy Analysis | Useful for analyzing trade policies, exchange rates, and foreign investment effects. | Useful to understand income flow, savings, and consumption in a closed system. |

Introduction to Economic Models

The Open Economy Model incorporates international trade, capital flows, and exchange rates, reflecting real-world economic interactions beyond domestic boundaries. In contrast, the Circular Flow of Income simplifies economy-wide transactions by illustrating the continuous movement of money, goods, and services between households and firms in a closed system. Understanding these foundational economic models enables deeper analysis of macroeconomic policies and global economic dynamics.

Understanding the Circular Flow of Income

The circular flow of income in an open economy model illustrates the continuous movement of money, goods, and services between households, firms, government, and foreign markets, highlighting the interactions in both domestic and international trade sectors. This model includes leakages such as savings, taxes, and imports, and injections like investment, government spending, and exports, which affect the overall economic equilibrium and national income. Understanding these flows helps analyze how policies impact economic activity, trade balance, and income distribution within an interconnected global market.

Key Features of the Open Economy Model

The open economy model incorporates international trade, capital flows, and exchange rates, extending the circular flow of income by including exports, imports, and foreign investment to reflect real-world economic interactions. It features multiple sectors such as households, firms, government, and foreign markets, enabling the analysis of trade balances, net exports, and capital account transactions. This model captures the impact of global economic policies, foreign exchange markets, and cross-border financial flows on domestic income and output levels.

Main Differences Between Open and Closed Economy Models

The open economy model incorporates international trade and capital flows, allowing exports, imports, and foreign investment to influence national income, whereas the closed economy model excludes external transactions, focusing solely on domestic production and consumption. In an open economy, the circular flow of income includes injections such as exports and foreign investments, and leakages like imports and savings, while the closed economy's circular flow consists only of consumption, savings, investment, and government spending. These differences highlight the open economy's exposure to global economic factors, contrasting with the closed economy's reliance on internal economic activities.

Components of the Circular Flow of Income Diagram

The Open Economy Model expands the Circular Flow of Income by including components like exports, imports, government spending, and foreign investments, reflecting real-world economic interactions beyond domestic boundaries. Key components in the Circular Flow of Income Diagram comprise households, firms, government, and the foreign sector, which interact through markets for goods, services, and factors of production. This model highlights injections (investment, government expenditure, exports) and leakages (savings, taxes, imports) that influence national income and economic equilibrium.

The Role of International Trade in an Open Economy

International trade in an open economy model introduces exports and imports as key components influencing national income and economic output, contrasting with the circular flow of income that primarily considers a closed economy. Exports inject foreign demand into the domestic economy, increasing aggregate demand and production, while imports represent expenditures on foreign goods, impacting domestic consumption and income. The open economy framework highlights the dynamic interplay between domestic and international markets, foreign exchange rates, and trade balances, demonstrating how international trade shapes income flow and economic equilibrium.

Leakages and Injections in Both Models

Leakages in the open economy model include savings, taxes, and imports, which reduce the flow of income in the economy, while injections consist of investment, government spending, and exports that add to the economic activity. In the circular flow of income model, leakages represent the withdrawal of money from the economy through savings, taxes, and imports, whereas injections are the additions via investment, government expenditure, and exports. Both models emphasize the need for a balance between leakages and injections to maintain economic equilibrium and steady national income.

Advantages and Limitations of the Open Economy Model

The open economy model enables countries to engage in international trade, attracting foreign investment and allowing for specialization based on comparative advantage, which enhances economic growth and resource allocation efficiency. However, it is vulnerable to external shocks such as global financial crises, currency fluctuations, and trade imbalances that can destabilize domestic markets. Unlike the circular flow of income, which primarily illustrates internal economic activity, the open economy model captures complex interactions between domestic and foreign sectors but requires more sophisticated policies to manage trade deficits and capital mobility risks.

Macroeconomic Implications of Each Model

The open economy model incorporates international trade and capital flows, influencing exchange rates, trade balances, and foreign investment, which affect domestic output and employment. The circular flow of income emphasizes the continuous movement of money between households and firms within a closed system, highlighting the relationships between consumption, production, and income without external trade influences. Macroeconomically, the open economy model addresses global interdependencies and policy effects on trade deficits and capital mobility, while the circular flow model focuses on internal equilibrium and aggregate demand within a self-contained economy.

Conclusion: Comparing the Models’ Impact on Economic Analysis

The open economy model extends the circular flow of income by incorporating international trade and capital movements, providing a more comprehensive framework for analyzing real-world economic interactions. It captures the effects of exports, imports, foreign investment, and exchange rates on national income and economic equilibrium, which the circular flow model overlooks. Consequently, the open economy model enhances economic analysis by reflecting globalization's impact on domestic markets and policy decisions more accurately than the closed system of the circular flow of income.

Open economy model Infographic

libterm.com

libterm.com