The wealth effect describes how changes in an individual's perceived wealth influence their spending behavior, often leading to increased consumption when asset values rise. This psychological impact can significantly affect economic growth by altering demand in various markets. Explore the rest of the article to understand how the wealth effect shapes your financial decisions and the broader economy.

Table of Comparison

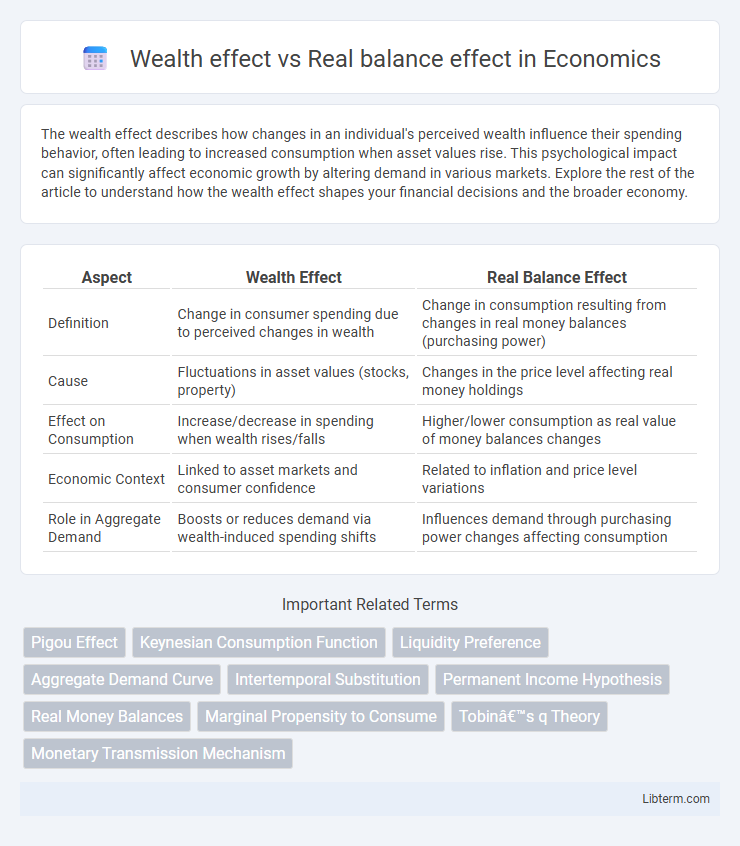

| Aspect | Wealth Effect | Real Balance Effect |

|---|---|---|

| Definition | Change in consumer spending due to perceived changes in wealth | Change in consumption resulting from changes in real money balances (purchasing power) |

| Cause | Fluctuations in asset values (stocks, property) | Changes in the price level affecting real money holdings |

| Effect on Consumption | Increase/decrease in spending when wealth rises/falls | Higher/lower consumption as real value of money balances changes |

| Economic Context | Linked to asset markets and consumer confidence | Related to inflation and price level variations |

| Role in Aggregate Demand | Boosts or reduces demand via wealth-induced spending shifts | Influences demand through purchasing power changes affecting consumption |

Understanding the Wealth Effect

The wealth effect describes how changes in individuals' perceived wealth, such as fluctuations in asset values like stocks or real estate, influence their consumer spending. When asset prices rise, households feel richer and tend to increase consumption, boosting aggregate demand and economic activity. Unlike the real balance effect, which focuses on changes in purchasing power due to price level shifts, the wealth effect centers on psychological and financial perceptions of asset value impacting consumption behavior.

Defining the Real Balance Effect

The Real Balance Effect refers to changes in consumer spending resulting from fluctuations in the real value of money balances due to price level changes. When the price level falls, the purchasing power of fixed nominal balances increases, leading to higher demand for goods and services. This contrasts with the Wealth Effect, which is driven by changes in the value of physical or financial assets rather than the real value of money holdings.

Historical Background and Economic Theories

The wealth effect, rooted in Keynesian economic theory, emphasizes how changes in perceived wealth from asset price fluctuations influence consumer spending, gaining prominence during the 20th century as financial markets expanded. The real balance effect, originally proposed by economist Alfred Marshall, highlights the inverse relationship between price levels and real money balances, affecting consumption through purchasing power changes. Both concepts have shaped macroeconomic models explaining aggregate demand dynamics, with the wealth effect linking to financial wealth and consumer confidence, while the real balance effect centers on the real value of monetary assets.

Mechanisms Behind the Wealth Effect

The wealth effect mechanism operates through changes in household net worth, causing shifts in consumer spending as asset values appreciate, thus boosting aggregate demand. Increased asset prices elevate perceived wealth, leading to higher consumption even without changes in income, influencing economic output. This contrasts with the real balance effect, which hinges on changes in the purchasing power of money holdings affecting consumption and aggregate demand through real money balances.

How the Real Balance Effect Operates

The Real Balance Effect operates by increasing consumer spending when a decrease in the price level raises the real value of money holdings, effectively boosting purchasing power. As prices fall, individuals feel wealthier because their nominal money balances can buy more goods and services, which stimulates higher aggregate demand. This mechanism contrasts with the Wealth Effect that relies on changes in asset values rather than changes in the real value of money balances.

Key Differences Between Wealth Effect and Real Balance Effect

The wealth effect refers to changes in consumer spending driven by variations in perceived wealth, such as fluctuations in stock market values or real estate prices, which increase or decrease household wealth and influence consumption levels. The real balance effect occurs when changes in the price level alter the real value of money holdings, impacting purchasing power and thereby affecting aggregate demand. Key differences include the wealth effect's reliance on asset value changes while the real balance effect depends on price level adjustments altering real cash balances.

Implications for Aggregate Demand

The wealth effect influences aggregate demand by increasing consumer spending as rising asset values, such as stocks or housing, enhance perceived wealth, boosting consumption. The real balance effect impacts aggregate demand through changes in the purchasing power of money holdings; when the price level falls, real balances rise, encouraging higher consumption and increased demand. Both effects demonstrate how shifts in wealth or real balances directly alter consumer expenditure, thereby affecting equilibrium output and overall economic activity.

Policy Responses and Economic Outcomes

The wealth effect influences consumer spending by altering perceived asset values, prompting policy responses such as adjusting interest rates to stabilize consumption and investment levels. The real balance effect impacts aggregate demand through changes in purchasing power from price-level fluctuations, guiding monetary policy towards controlling inflation and maintaining currency stability. Understanding both effects helps policymakers balance inflation control with economic growth, optimizing fiscal and monetary strategies to achieve sustainable economic outcomes.

Empirical Evidence and Case Studies

Empirical evidence on the wealth effect reveals stronger consumer spending responses to changes in housing and stock market wealth, as demonstrated in studies following the 2008 financial crisis where wealth declines led to reduced consumption. Real balance effect case studies, such as hyperinflation episodes in Zimbabwe and Weimar Germany, show that decreases in real money balances significantly suppressed aggregate demand and consumption. Comparative research indicates the wealth effect operates through perceived wealth changes impacting confidence, while the real balance effect functions via changes in purchasing power and liquidity constraints.

Conclusion: Comparative Insights and Future Perspectives

The wealth effect emphasizes how changes in asset values influence consumer spending and overall economic demand, while the real balance effect highlights the impact of price level fluctuations on consumers' purchasing power. Comparing both, the wealth effect tends to have a stronger and more direct impact on aggregate demand during periods of financial market volatility, whereas the real balance effect plays a crucial role in monetary policy transmission and inflation dynamics. Future perspectives suggest integrating these effects into dynamic macroeconomic models to better capture consumer behavior and improve policy responsiveness under diverse economic conditions.

Wealth effect Infographic

libterm.com

libterm.com