Crowding out occurs when increased government spending leads to a reduction in private sector investment by raising interest rates or absorbing available resources. This phenomenon can slow economic growth by limiting the funds businesses need for expansion and innovation. Explore the rest of the article to understand how crowding out impacts your financial decisions and the broader economy.

Table of Comparison

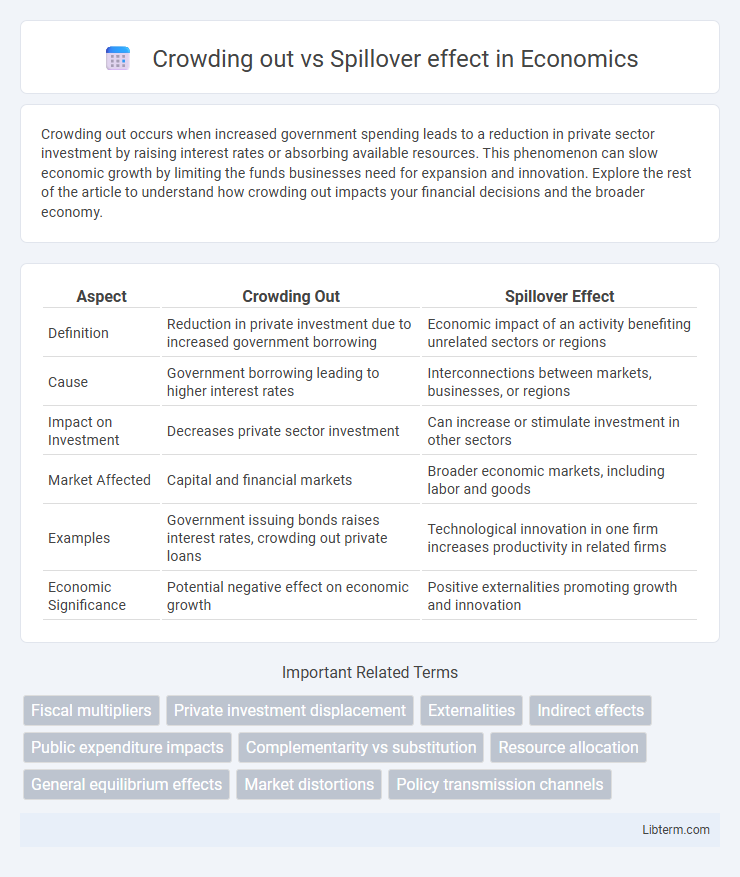

| Aspect | Crowding Out | Spillover Effect |

|---|---|---|

| Definition | Reduction in private investment due to increased government borrowing | Economic impact of an activity benefiting unrelated sectors or regions |

| Cause | Government borrowing leading to higher interest rates | Interconnections between markets, businesses, or regions |

| Impact on Investment | Decreases private sector investment | Can increase or stimulate investment in other sectors |

| Market Affected | Capital and financial markets | Broader economic markets, including labor and goods |

| Examples | Government issuing bonds raises interest rates, crowding out private loans | Technological innovation in one firm increases productivity in related firms |

| Economic Significance | Potential negative effect on economic growth | Positive externalities promoting growth and innovation |

Introduction to Crowding Out and Spillover Effects

Crowding out occurs when increased government spending reduces private sector investment by raising interest rates or competing for resources, limiting the overall economic growth potential. Spillover effects refer to the indirect impacts of an economic activity or policy on unrelated sectors or regions, often enhancing or diminishing economic outcomes beyond the initial target. Understanding the distinction between crowding out and spillover effects is critical for analyzing fiscal policies and their broader implications on economic efficiency and resource allocation.

Defining Crowding Out Effect

The crowding out effect occurs when increased government spending leads to a reduction in private sector investment due to higher interest rates. This phenomenon arises because government borrowing competes with private borrowing, raising the cost of capital and discouraging businesses from financing projects. Understanding the crowding out effect is crucial for evaluating fiscal policy impacts on economic growth and private sector activity.

Understanding Spillover Effect

The spillover effect occurs when economic activities or policies in one sector or region indirectly impact others, creating positive or negative externalities beyond their original scope. Understanding the spillover effect is essential for assessing how investments, technological innovations, or policy changes in one area can drive growth or impose costs in neighboring sectors or communities. This dynamic contrasts with crowding out, where increased government spending reduces private sector investment by raising interest rates, limiting overall economic expansion.

Key Differences between Crowding Out and Spillover

Crowding out refers to the reduction in private sector investment due to increased government spending, often leading to higher interest rates that discourage borrowing. Spillover effect describes the positive or negative impacts of economic activity in one sector or region influencing others, such as technology transfers or environmental damage. Key differences include crowding out's direct competition for financial resources versus spillover's broader, indirect influence on interconnected markets or communities.

Economic Theories Supporting Crowding Out

Economic theories supporting crowding out emphasize how increased government spending leads to higher interest rates, which reduce private investment by making borrowing more expensive. According to classical and neoclassical frameworks, government borrowing competes with the private sector for limited financial resources, causing a decline in capital formation. Keynesian theory distinguishes this effect by suggesting crowding out occurs primarily at full employment, where fiscal expansion cannot increase output without competing against private spending.

Spillover Effects in Different Sectors

Spillover effects occur when economic activities in one sector influence outcomes in other sectors, driving innovation and productivity gains beyond the initial investment area. For instance, technological advancements in the information technology sector often enhance efficiency and create new opportunities in manufacturing, healthcare, and finance industries. These intersectoral impacts foster broad-based economic growth and amplify the benefits of targeted investments.

Real-World Examples of Crowding Out

Government borrowing to finance large infrastructure projects often leads to crowding out by increasing interest rates, which discourages private investment in sectors like technology and manufacturing. For instance, during the 1980s in the United States, increased federal deficit spending raised interest rates, reducing private capital formation and slowing economic growth. Similarly, in emerging markets like India, heavy public sector borrowing sometimes leads to higher borrowing costs for private firms, limiting their expansion and innovation capabilities.

Positive and Negative Spillover Impacts

Positive spillover effects occur when an economic activity generates benefits beyond its immediate scope, such as increased innovation or job creation in related sectors, enhancing overall economic growth. Negative spillover impacts, however, arise when activities cause unintended harm to surrounding entities, like pollution from industrial production adversely affecting community health. Crowding out contrasts these effects by reducing private sector investment due to increased public expenditure, limiting potential economic expansion despite spillover opportunities.

Policymaking Implications: Crowding Out vs Spillover

Crowding out occurs when increased government spending reduces private sector investment, potentially limiting economic growth, while spillover effects represent the positive or negative externalities resulting from policy actions that extend beyond the targeted sector. Policymaking must carefully balance fiscal interventions to avoid crowding out private investment while maximizing beneficial spillovers, such as technology diffusion or workforce skill improvements. Effective policy design incorporates mechanisms that amplify spillover benefits and mitigate crowding out to enhance overall economic welfare.

Conclusion: Balancing Effects for Sustainable Growth

Crowding out occurs when increased government spending reduces private investment, potentially slowing economic growth, while spillover effects generate positive externalities that stimulate broader economic activity. Balancing these effects requires careful fiscal policy design to promote sustainable growth by maximizing beneficial spillovers and minimizing crowding out risks. Policymakers should target investments in innovation and infrastructure to enhance productivity without displacing private sector involvement.

Crowding out Infographic

libterm.com

libterm.com