Cap and trade is an environmental policy tool designed to reduce greenhouse gas emissions by setting a maximum limit, or cap, on emissions and allowing businesses to buy and sell emission allowances within that cap. This system incentivizes companies to innovate and decrease their pollution levels while providing economic flexibility. Explore the rest of the article to understand how cap and trade can impact your industry and the environment.

Table of Comparison

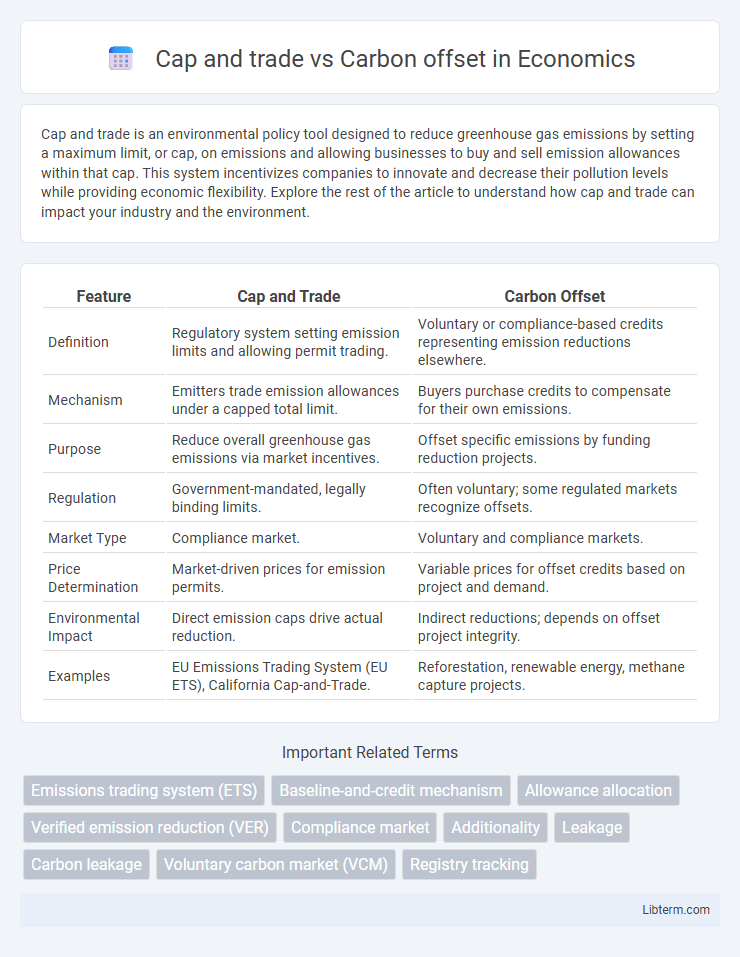

| Feature | Cap and Trade | Carbon Offset |

|---|---|---|

| Definition | Regulatory system setting emission limits and allowing permit trading. | Voluntary or compliance-based credits representing emission reductions elsewhere. |

| Mechanism | Emitters trade emission allowances under a capped total limit. | Buyers purchase credits to compensate for their own emissions. |

| Purpose | Reduce overall greenhouse gas emissions via market incentives. | Offset specific emissions by funding reduction projects. |

| Regulation | Government-mandated, legally binding limits. | Often voluntary; some regulated markets recognize offsets. |

| Market Type | Compliance market. | Voluntary and compliance markets. |

| Price Determination | Market-driven prices for emission permits. | Variable prices for offset credits based on project and demand. |

| Environmental Impact | Direct emission caps drive actual reduction. | Indirect reductions; depends on offset project integrity. |

| Examples | EU Emissions Trading System (EU ETS), California Cap-and-Trade. | Reforestation, renewable energy, methane capture projects. |

Introduction to Carbon Market Mechanisms

Cap and trade systems set a firm limit on total greenhouse gas emissions, allowing companies to buy and sell emission allowances within the established cap, promoting cost-effective pollution reduction. Carbon offsets involve investing in projects that reduce or remove emissions outside the regulatory system, such as reforestation or renewable energy, to compensate for emissions produced elsewhere. Both mechanisms are key components of carbon markets, enabling flexible strategies for achieving emission reduction targets and driving sustainable environmental investments.

Understanding Cap and Trade Systems

Cap and trade systems establish a legal limit on total greenhouse gas emissions, distributing allowances that companies can buy or sell to meet their emission targets, driving cost-effective reductions. This market-based approach incentivizes innovation in low-carbon technologies by allowing flexibility in how businesses comply. Unlike carbon offsets, which involve purchasing credits from external projects to compensate for emissions, cap and trade directly regulates and caps emissions within a defined jurisdiction.

Exploring Carbon Offset Programs

Carbon offset programs allow businesses and individuals to compensate for their carbon emissions by investing in projects that reduce or capture greenhouse gases, such as reforestation or renewable energy initiatives. These programs complement cap and trade systems by providing offset credits that can be traded to meet emission reduction targets while supporting sustainable development. Effective carbon offset programs ensure transparency, additionality, and verifiable emissions reductions to maintain the integrity of carbon markets.

Key Differences Between Cap and Trade and Carbon Offsets

Cap and trade systems set a firm limit on total emissions, allowing companies to buy and sell emission allowances within that cap, creating a market-driven approach to reduce greenhouse gases. Carbon offsets involve projects that reduce or remove emissions outside the company's operation, such as reforestation or renewable energy initiatives, which can be purchased to compensate for emissions. The key difference lies in cap and trade's regulatory emission cap and internal trading, versus carbon offsets' external, voluntary reductions that supplement or offset emissions beyond regulated limits.

Environmental Impact Comparison

Cap and trade systems directly limit total greenhouse gas emissions by setting a firm cap on allowable emissions and enabling the trading of emission permits, fostering measurable reductions within regulated sectors. Carbon offsets, while promoting emissions reduction projects such as reforestation or renewable energy, often face challenges in verifying true net environmental benefits due to issues like additionality and permanence. Consequently, cap and trade mechanisms typically offer more quantifiable and enforceable environmental impact reductions compared to the variable effectiveness of carbon offset programs.

Economic Implications for Industries

Cap and trade systems create a market-driven approach where industries receive emission allowances that can be traded, incentivizing cost-effective pollution reduction and fostering innovation. Carbon offsets allow companies to compensate for their emissions by investing in external environmental projects, often providing flexible, lower-cost compliance options but potentially lacking direct emission cuts within industries. Both mechanisms influence corporate financial planning, with cap and trade directly impacting production costs through permit pricing, while offsets offer alternative investment strategies to meet regulatory requirements.

Regulatory and Policy Considerations

Cap and trade systems establish a regulatory limit on total greenhouse gas emissions, allowing companies to buy and sell emission permits within that cap, ensuring compliance with government-mandated reduction targets. Carbon offset programs enable organizations to invest in external projects that reduce or capture emissions, often used to meet voluntary or regulatory requirements, but face scrutiny regarding additionality and verification standards. Policymakers must consider the effectiveness, transparency, and enforcement mechanisms of both approaches to balance environmental goals with economic impacts.

Effectiveness in Reducing Global Emissions

Cap and trade systems set a strict limit on total greenhouse gas emissions, allowing companies to buy and sell emission permits, which creates a financial incentive to reduce emissions directly and efficiently. Carbon offsets involve investing in external projects that reduce or capture emissions, but their effectiveness varies widely due to issues like additionality, verification, and permanence. Studies indicate that cap and trade generally achieves more measurable and enforceable reductions in global emissions compared to carbon offsets, which often serve as supplementary mitigation rather than primary drivers of emission cuts.

Challenges and Criticisms of Each Approach

Cap and trade faces challenges including market volatility, difficulty in setting appropriate emission caps, and risk of allowing companies to buy excessive allowances without reducing overall emissions. Carbon offset programs often face criticisms related to the verification and permanence of offset projects, potential double counting, and the risk of enabling continued emissions instead of promoting direct reductions. Both approaches struggle with ensuring environmental integrity and transparency, which can undermine their effectiveness in meeting climate targets.

Future Outlook: Integrating Cap and Trade and Offsets

Integrating cap and trade with carbon offsets enhances flexibility and cost-effectiveness in achieving emissions reductions by allowing regulated entities to invest in verified offset projects alongside allowance trading. Future outlooks emphasize the development of robust monitoring, reporting, and verification (MRV) systems to ensure environmental integrity and transparency across both mechanisms. Expansion of international linkages and standardized offset credits is expected to create a more cohesive global carbon market, driving deeper decarbonization efforts.

Cap and trade Infographic

libterm.com

libterm.com