The compensation principle ensures fair value exchange by offsetting losses in one area with gains in another, promoting balanced economic outcomes. This principle is fundamental in risk management and contract law, helping to align interests and minimize disputes. Discover how understanding the compensation principle can enhance your decision-making in complex negotiations by reading the rest of the article.

Table of Comparison

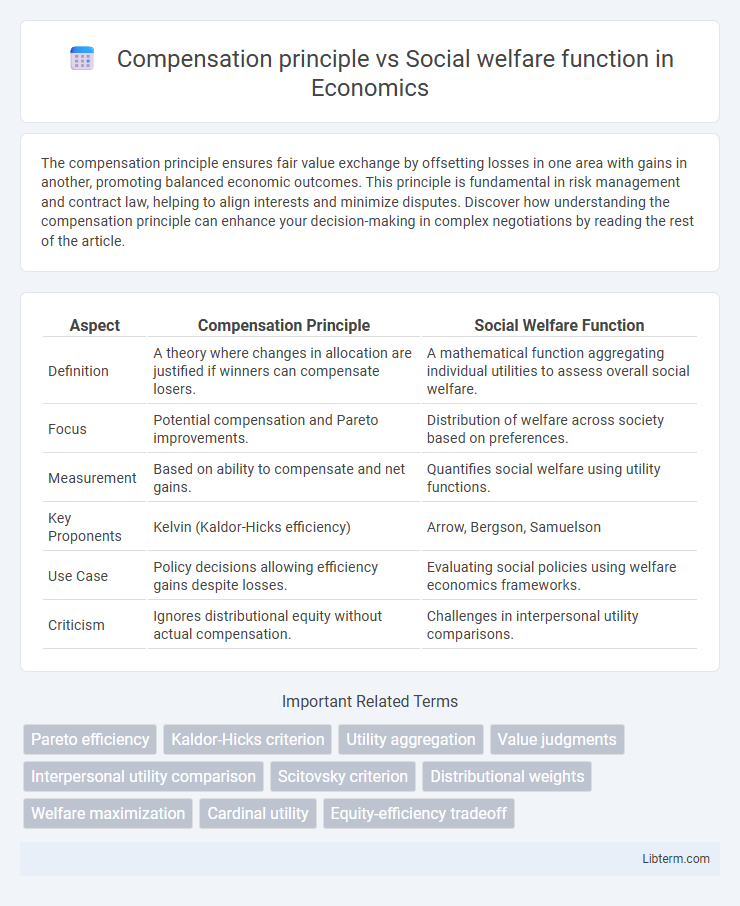

| Aspect | Compensation Principle | Social Welfare Function |

|---|---|---|

| Definition | A theory where changes in allocation are justified if winners can compensate losers. | A mathematical function aggregating individual utilities to assess overall social welfare. |

| Focus | Potential compensation and Pareto improvements. | Distribution of welfare across society based on preferences. |

| Measurement | Based on ability to compensate and net gains. | Quantifies social welfare using utility functions. |

| Key Proponents | Kelvin (Kaldor-Hicks efficiency) | Arrow, Bergson, Samuelson |

| Use Case | Policy decisions allowing efficiency gains despite losses. | Evaluating social policies using welfare economics frameworks. |

| Criticism | Ignores distributional equity without actual compensation. | Challenges in interpersonal utility comparisons. |

Introduction to Compensation Principle and Social Welfare Function

The Compensation Principle evaluates social policies by determining if winners could theoretically compensate losers, ensuring Pareto improvements without actual redistribution. Social Welfare Functions aggregate individual utilities into a collective measure, reflecting societal preferences and ethical considerations for resource allocation. Both concepts underpin welfare economics by guiding decisions that balance efficiency and equity in social outcomes.

Historical Background of Welfare Economics

The Compensation Principle, rooted in Kaldor-Hicks efficiency, emerged in the early 20th century as a criterion for evaluating Pareto improvements without requiring unanimous consent, emphasizing potential compensation to those harmed. In contrast, the Social Welfare Function concept, formalized by Abram Bergson in 1938 and later expanded by Paul Samuelson, provides a comprehensive framework for aggregating individual utilities into a collective welfare measure, reflecting societal preferences and equity considerations. These foundational theories shaped modern welfare economics by addressing the trade-offs between efficiency and equity in policy evaluation.

Defining the Compensation Principle

The Compensation Principle, rooted in welfare economics, asserts that a policy change is considered efficient if those benefiting could hypothetically compensate those harmed, ensuring no overall loss in social welfare. It serves as a criterion for Pareto improvements by emphasizing potential compensation rather than actual redistribution. Unlike the Social Welfare Function, which aggregates individual utilities into a collective measure, the Compensation Principle focuses on hypothetical compensations to assess policy efficiency.

Understanding the Social Welfare Function

The Social Welfare Function (SWF) represents a formal framework aggregating individual preferences into a collective societal welfare measure, guiding policy decisions for equitable resource distribution. It captures trade-offs between efficiency and equity by assigning weights to individual utilities, reflecting societal values and priorities. Understanding SWF involves analyzing its mathematical properties, such as Pareto efficiency and equity criteria, to design optimal interventions promoting overall social well-being.

Key Differences Between Compensation Principle and Social Welfare Function

The Compensation Principle evaluates policies based on hypothetical compensations ensuring no individual is worse off, emphasizing Pareto improvements without requiring actual compensation. In contrast, the Social Welfare Function aggregates individual utilities into a single measure to reflect societal preferences, allowing trade-offs between equity and efficiency. Key differences include the Compensation Principle's reliance on potential compensation to judge improvements versus the Social Welfare Function's explicit prioritization and weighting of social equity and welfare across individuals.

Advantages and Limitations of the Compensation Principle

The Compensation Principle offers a clear criterion for policy efficiency by suggesting that a change is beneficial if those who gain could theoretically compensate those who lose, promoting Pareto improvements. This principle facilitates cost-benefit analysis and helps identify potential winners and losers in economic decisions. However, it faces limitations such as difficulties in actual compensation implementation, ignoring distributional equity, and potential neglect of non-monetary impacts, which limits its effectiveness in addressing social welfare comprehensively compared to Social Welfare Functions.

Strengths and Weaknesses of the Social Welfare Function

The Social Welfare Function (SWF) aggregates individual utilities to evaluate societal well-being, capturing diverse preferences and distributional concerns more comprehensively than the Compensation Principle, which focuses solely on Pareto improvements. SWFs provide a structured framework for policy analysis by incorporating equity and efficiency simultaneously, but their main weakness lies in the arbitrariness of the chosen weighting scheme and the difficulty in cardinally measuring individual utilities accurately. The reliance on subjective ethical judgments in SWFs can lead to contentious policy implications and challenges in achieving consensus among stakeholders.

Practical Applications in Economic Policy

The Compensation Principle guides economic policies by suggesting that social improvements are justified if winners could hypothetically compensate losers, influencing cost-benefit analyses in infrastructure projects and environmental regulations. Social Welfare Functions aggregate individual utilities into a collective measure, helping policymakers design redistributive tax systems and assess income inequality impacts more comprehensively. Both concepts support practical economic policy decisions by balancing efficiency and equity to promote optimal social outcomes.

Criticisms and Debates in Welfare Economics

The Compensation Principle faces criticism for its reliance on hypothetical compensation that may never occur, questioning its practical applicability and fairness in real-world policy decisions. Debates highlight that Social Welfare Functions, which aggregate individual utilities into a single measure of societal well-being, often struggle with issues of interpersonal utility comparability and ethical value judgments. Welfare economics continues to challenge both concepts, emphasizing the complexity of balancing efficiency and equity while addressing distributional concerns.

Conclusion: Balancing Equity and Efficiency

The compensation principle seeks to achieve Pareto efficiency by ensuring that winners could theoretically compensate losers, emphasizing economic efficiency without direct redistribution. Social welfare functions prioritize equity by aggregating individual utilities to reflect societal fairness, often supporting redistributive policies to reduce inequality. Balancing equity and efficiency requires integrating compensation mechanisms with social welfare considerations to design policies that optimize overall social outcomes without sacrificing fairness.

Compensation principle Infographic

libterm.com

libterm.com