Holding money involves an opportunity cost because the funds kept as cash or in non-interest-bearing accounts cannot earn returns elsewhere, such as investments or savings with higher yields. This cost represents the potential income or benefits foregone by not allocating your money into more productive assets. Explore the rest of the article to understand how opportunity cost affects your financial decisions and strategies.

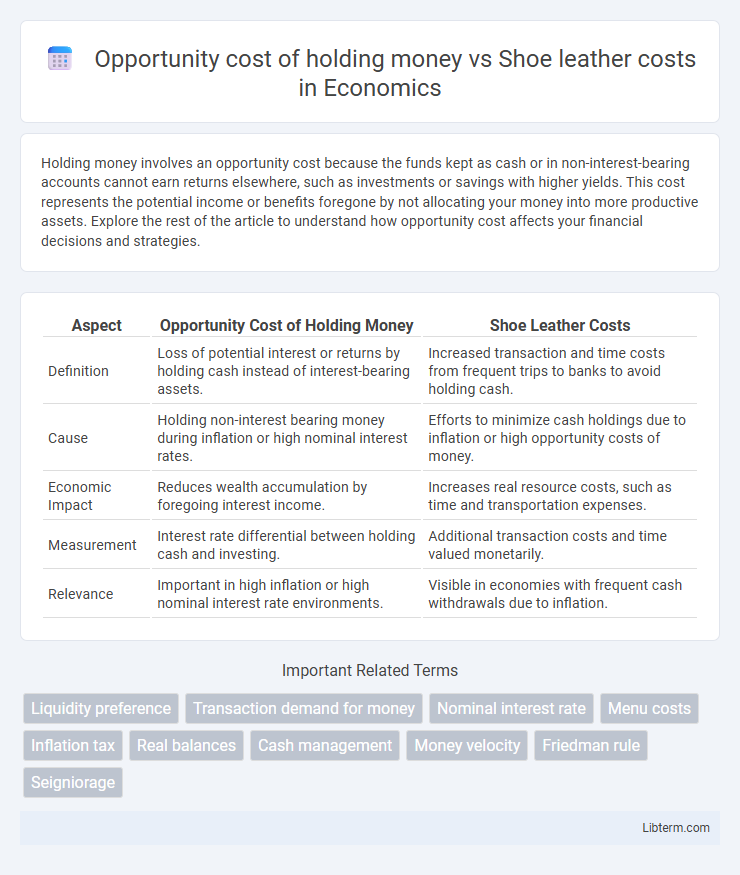

Table of Comparison

| Aspect | Opportunity Cost of Holding Money | Shoe Leather Costs |

|---|---|---|

| Definition | Loss of potential interest or returns by holding cash instead of interest-bearing assets. | Increased transaction and time costs from frequent trips to banks to avoid holding cash. |

| Cause | Holding non-interest bearing money during inflation or high nominal interest rates. | Efforts to minimize cash holdings due to inflation or high opportunity costs of money. |

| Economic Impact | Reduces wealth accumulation by foregoing interest income. | Increases real resource costs, such as time and transportation expenses. |

| Measurement | Interest rate differential between holding cash and investing. | Additional transaction costs and time valued monetarily. |

| Relevance | Important in high inflation or high nominal interest rate environments. | Visible in economies with frequent cash withdrawals due to inflation. |

Introduction to Opportunity Cost and Shoe Leather Costs

Opportunity cost of holding money refers to the potential returns foregone by keeping funds in liquid cash rather than invested in interest-bearing assets, highlighting the trade-off between liquidity and profitability. Shoe leather costs represent the transactions and time expenses incurred when people reduce their money holdings to minimize these opportunity costs, typically through more frequent trips to the bank or ATM. Both concepts are essential in understanding the behavior of consumers and businesses in managing cash balances amidst inflationary pressures.

Understanding the Concept of Holding Money

The opportunity cost of holding money refers to the potential returns forfeited by not investing funds in interest-bearing assets, highlighting the trade-off between liquidity and profitability. Shoe leather costs represent the physical effort and time spent managing cash withdrawals to minimize holding money and reduce lost interest. Understanding these concepts is crucial for balancing liquidity needs against economic efficiency in money management.

What Are Shoe Leather Costs?

Shoe leather costs refer to the time and effort individuals expend to reduce their money holdings due to the opportunity cost of holding cash instead of interest-bearing assets. These costs increase with higher inflation, as people make more frequent trips to banks or ATMs to avoid holding depreciating money. This concept highlights the trade-off between liquidity and the opportunity cost of holding money, where minimizing cash balances leads to additional transaction and transportation expenses.

The Economic Trade-Off: Holding Cash vs Frequent Transactions

The opportunity cost of holding money lies in the foregone interest or investment returns when cash is kept idle rather than invested. Shoe leather costs represent the increased time and effort expended to minimize cash holdings by making frequent trips to the bank. Balancing these economic trade-offs involves managing liquidity needs against transaction costs to optimize overall financial efficiency.

Factors Affecting the Opportunity Cost of Money

The opportunity cost of holding money is primarily influenced by the prevailing interest rates, inflation expectations, and the liquidity preference of individuals and businesses. Higher interest rates increase the cost of holding cash instead of investing in interest-bearing assets, while inflation erodes the purchasing power of money, raising the incentive to minimize cash holdings. Shoe leather costs, representing the resources spent to reduce cash holdings through more frequent transactions, rise when opportunity costs increase, driving individuals to balance the trade-off between liquidity and transaction expenses.

How Inflation Influences Shoe Leather Costs

Inflation increases the opportunity cost of holding money by eroding its purchasing power, prompting individuals to minimize cash holdings. This behavior leads to more frequent trips to the bank, thereby raising shoe leather costs, which represent the time and effort spent managing cash balances. Higher inflation thus intensifies shoe leather costs as people strive to reduce cash holdings and maintain liquidity.

Measuring the True Cost of Cash Holdings

The opportunity cost of holding money is primarily the interest foregone by not investing in interest-bearing assets, directly impacting an individual's or firm's liquidity preferences. Shoe leather costs represent the tangible expenses incurred from frequent trips to the bank or ATM to minimize cash holdings, such as time and effort spent. Measuring the true cost of cash holdings requires balancing the interest lost against these shoe leather costs to determine the optimal cash reserve level.

Opportunity Cost in Low vs High-Interest Environments

In low-interest environments, the opportunity cost of holding money is minimal, reducing the incentive to minimize cash holdings and therefore lowering shoe leather costs. Conversely, high-interest rates increase the opportunity cost of holding money, prompting individuals and businesses to make frequent trips to banks to withdraw smaller amounts, which raises shoe leather costs. The trade-off between holding liquidity and incurring shoe leather costs becomes more pronounced as interest rates rise, influencing money demand behavior significantly.

Reducing Shoe Leather Costs: Strategies and Innovations

Reducing shoe leather costs involves minimizing the frequency and urgency of cash withdrawals by adopting digital payment systems and efficient cash management strategies. Innovations like mobile banking, contactless payments, and online wallets significantly decrease the need for physical cash handling, thereby lowering transaction time and wear-and-tear expenses associated with frequent bank visits. Incorporating automated cash forecasting tools and real-time spending data further optimizes liquidity management, cutting down both opportunity costs and shoe leather costs simultaneously.

Conclusion: Balancing Cash Holdings and Transaction Costs

Balancing cash holdings requires minimizing the opportunity cost of holding money, which represents the foregone interest from not investing funds. Shoe leather costs arise from frequent trips to the bank to withdraw smaller amounts, increasing time and effort spent on managing cash. Optimal cash management seeks to strike a balance where the marginal opportunity cost of holding money equals the marginal shoe leather cost, maximizing overall economic efficiency.

Opportunity cost of holding money Infographic

libterm.com

libterm.com