X-inefficiency occurs when firms operate below their optimal efficiency, often due to lack of competitive pressure, resulting in higher costs and wasted resources. It highlights the gap between actual and potential productivity within organizations. Discover how understanding X-inefficiency can improve Your business performance by reading the full article.

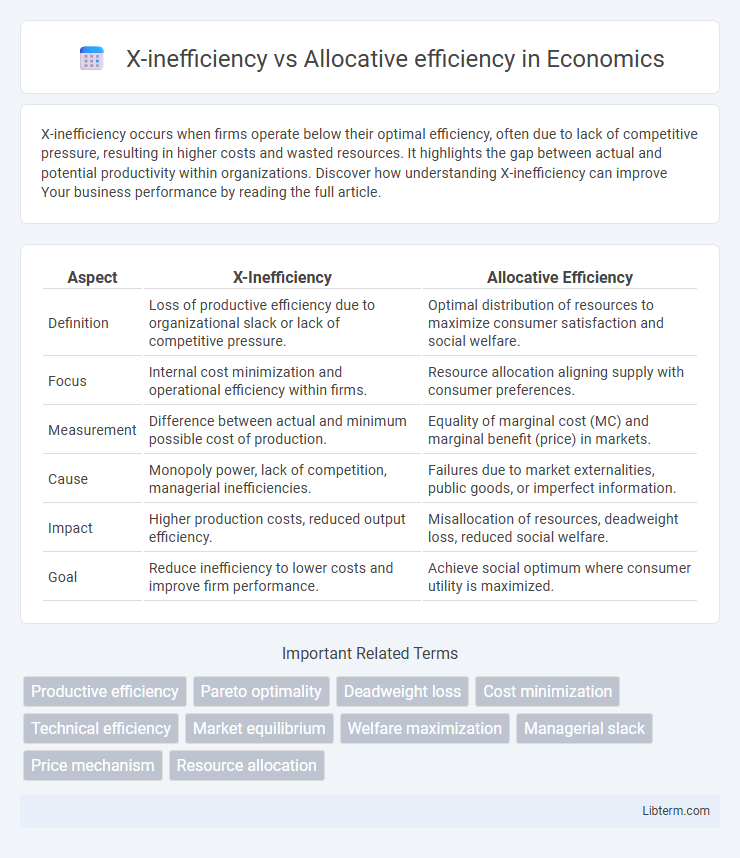

Table of Comparison

| Aspect | X-Inefficiency | Allocative Efficiency |

|---|---|---|

| Definition | Loss of productive efficiency due to organizational slack or lack of competitive pressure. | Optimal distribution of resources to maximize consumer satisfaction and social welfare. |

| Focus | Internal cost minimization and operational efficiency within firms. | Resource allocation aligning supply with consumer preferences. |

| Measurement | Difference between actual and minimum possible cost of production. | Equality of marginal cost (MC) and marginal benefit (price) in markets. |

| Cause | Monopoly power, lack of competition, managerial inefficiencies. | Failures due to market externalities, public goods, or imperfect information. |

| Impact | Higher production costs, reduced output efficiency. | Misallocation of resources, deadweight loss, reduced social welfare. |

| Goal | Reduce inefficiency to lower costs and improve firm performance. | Achieve social optimum where consumer utility is maximized. |

Understanding X-Inefficiency

X-inefficiency occurs when firms fail to minimize costs due to lack of competitive pressure, leading to higher production expenses than necessary. This inefficiency contrasts with allocative efficiency, where resources are distributed to produce the most valued goods and services according to consumer preferences. Understanding X-inefficiency highlights the importance of competition and managerial incentives in driving firms to operate efficiently.

Defining Allocative Efficiency

Allocative efficiency occurs when resources are distributed in a way that maximizes consumer satisfaction and societal welfare, ensuring that goods and services produced match consumer preferences. It is achieved when the price of a good equals the marginal cost of production, reflecting the true opportunity cost. Unlike X-inefficiency, which deals with internal inefficiencies within firms, allocative efficiency focuses on optimal resource allocation across the entire economy.

Key Differences Between X-Inefficiency and Allocative Efficiency

X-inefficiency occurs when firms operate with higher costs than necessary, often due to lack of competitive pressure, leading to organizational slack and resource wastage. Allocative efficiency is achieved when resources are distributed to produce goods and services most desired by consumers, maximizing overall welfare. The key difference lies in X-inefficiency focusing on internal cost minimization failures, while allocative efficiency emphasizes optimal resource allocation responding to consumer preferences.

Causes of X-Inefficiency in Markets

X-inefficiency arises in markets primarily due to organizational slack, lack of competitive pressure, and informational asymmetries that prevent firms from minimizing costs. This inefficiency is caused by managers' and employees' reduced incentive to operate efficiently when market competition is weak or absent, leading to excess resource use and suboptimal output levels. Contrastingly, allocative efficiency occurs when resources are distributed to maximize consumer satisfaction, which is often hindered when X-inefficiency distorts production costs and market prices.

Factors Influencing Allocative Efficiency

Allocative efficiency occurs when resources are distributed to produce goods and services most desired by consumers, achieving optimal satisfaction and utility. Factors influencing allocative efficiency include market structure, such as perfect competition promoting efficient resource allocation, consumer preferences that dictate demand patterns, and price mechanisms that signal where resources are most valued. Constraints like information asymmetry, externalities, and government intervention can hinder allocative efficiency by distorting market signals and resource distribution.

Economic Impacts of X-Inefficiency

X-inefficiency results in firms operating with higher costs and lower productivity than theoretically possible, leading to resource wastage and decreased overall economic output. This inefficiency distorts market signals, causing suboptimal allocation of resources that hinder allocative efficiency and reduce consumer welfare. Persistent X-inefficiency in industries can slow economic growth, elevate prices, and diminish competitive pressures necessary for innovation and efficient resource distribution.

Measuring Allocative Efficiency in Practice

Allocative efficiency is measured by comparing the marginal cost of production to the marginal benefit or price consumers are willing to pay, typically assessed through consumer surplus and producer surplus analyses. In practice, economic models use the Lerner Index or the price elasticity of demand to estimate how closely output matches consumer preferences and resource allocation. Unlike X-inefficiency, which focuses on cost minimization within firms, allocative efficiency emphasizes optimal distribution of resources to maximize total welfare in the market.

X-Inefficiency vs Allocative Efficiency: Real-World Examples

X-inefficiency occurs when firms fail to minimize costs due to lack of competitive pressure, often seen in monopolies like utility companies, where complacency leads to higher production costs. Allocative efficiency is achieved when resources are distributed to produce goods and services that match consumer preferences, as observed in competitive markets such as online retail platforms like Amazon. Real-world examples show monopolistic industries suffering from X-inefficiency, while highly competitive sectors demonstrate allocative efficiency by optimizing product variety and pricing based on consumer demand.

Policy Implications and Remedies

X-inefficiency occurs when firms fail to minimize costs due to lack of competitive pressure, resulting in wasted resources and higher prices, contrasting with allocative efficiency where resources are optimally distributed to maximize consumer satisfaction. Policy implications emphasize the need for competition-enhancing reforms, such as deregulation, antitrust enforcement, and promoting market entry to reduce inefficiencies. Remedies include incentivizing innovation, improving managerial accountability, and implementing performance-based regulations that align firm behavior with allocative efficiency goals.

The Importance of Efficiency in Economic Performance

X-inefficiency occurs when firms fail to minimize costs, resulting in higher production expenses without corresponding increases in output, thereby reducing overall economic performance. Allocative efficiency ensures resources are distributed to produce goods and services most desired by consumers, maximizing societal welfare. Enhancing both X-inefficiency and allocative efficiency is crucial for optimizing productivity, lowering prices, and promoting sustainable economic growth.

X-inefficiency Infographic

libterm.com

libterm.com